MetLife 2007 Annual Report Download - page 177

Download and view the complete annual report

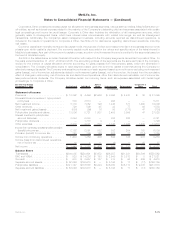

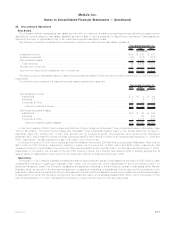

Please find page 177 of the 2007 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Derivative Financial Instruments

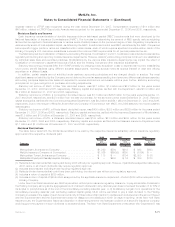

The fair value of derivative financial instruments, including financial futures, financial forwards, interest rate, credit default and foreign

currency swaps, foreign currency forwards, caps, floors, and options are based upon quotations obtained from dealers or other reliable

sources. See Note 4 for derivative fair value disclosures.

25. Subsequent Events

Dividends

On February 19, 2008, the Holding Company’s Board of Directors announced dividends of $0.3785745 per share, for a total of

$9 million, on its Series A preferred shares, and $0.4062500 per share, for a total of $24 million, on its Series B preferred shares, subject to

the final confirmation that it has met the financial tests specified in the Series A and Series B preferred shares, which the Holding Company

anticipates will be made on or about March 5, 2008, the earliest date permitted in accordance with the terms of the securities. Both

dividends will be payable March 17, 2008 to shareholders of record as of February 29, 2008.

Acquisitions

On February 1, 2008, the Company announced its completion of the acquisition of SafeGuard Health Enterprises, Inc. (“Safeguard”) for

approximately $190 million. Safeguard is primarily involved in providing dental and vision benefit plans, including health maintenance and

preferred provider organization plan designs and administrative services.

On January 2, 2008, the Company completed the acquisition of Afore Actinver, S.A. de C.V. (“Actinver”) for approximately $125 million.

Actinver manages retirement accounts for approximately 1.1 million individuals in Mexico.

Stock Repurchases

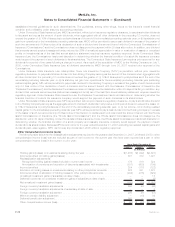

On January 15, 2008, the Company’s Board of Directors authorized a $1 billion common stock repurchase program, which began after

the completion of an earlier $1 billion authorization that was announced in September 2007. See Note 18 for further information.

As previously discussed, in December 2007, the Company entered into an accelerated common stock repurchase agreement with a

major bank. Under the terms of the agreement, the Company paid the bank $450 million in cash in January 2008 in exchange for 6.6 million

shares of the Company’s outstanding common stock that the bank borrowed from third parties. Also, in January 2008, the bank delivered

1.1 million additional shares of the Company’s common stock to the Company resulting in a total of 7.7 million shares being repurchased

under the agreement. Upon settlement with the bank, the Company increased additional paid-in capital and reduced treasury stock. See

Note 18 for further information.

In February 2008, the Company entered into an accelerated common stock repurchase agreement with a major bank. Under the

agreement, the Company paid the bank $711 million in cash and the bank delivered an initial amount of 11.2 million shares of the

Company’s outstanding common stock that the bank borrowed from third parties. Final settlement of the agreement is scheduled to take

place during the first half of 2008. The final number of shares the Company is repurchasing under the terms of the agreement and the

timing of the final settlement will depend on, among other things, prevailing market conditions and the market prices of the common stock

during the repurchase period. The Company recorded the consideration paid as a reduction to stockholders’ equity.

From January 1, 2008 to February 25, 2008, the Company also repurchased 1.6 million of its shares through open market purchases

for $89 million.

F-81MetLife, Inc.

MetLife, Inc.

Notes to Consolidated Financial Statements — (Continued)