MetLife 2007 Annual Report Download - page 10

Download and view the complete annual report

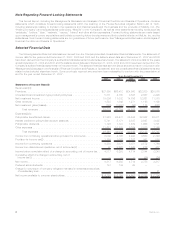

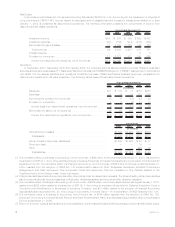

Please find page 10 of the 2007 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.discontinued operations related to the sale of SSRM Holdings, Inc. (“SSRM”) resulting from a reduction in additional proceeds from the sale

received during the year ended December 31, 2007 as compared to the year December 31, 2006.

An increase in other expenses of $579 million, net of income tax, decreased net income available to common shareholders. The

increase in other expenses was primarily due to higher DAC amortization resulting from business growth, lower net investment losses in the

current year and the net impact of revisions to management’s assumption used to determine estimated gross profits and margins in both

years. In addition, other expenses increased due to higher compensation, higher interest expense on debt and interest on tax contin-

gencies, higher minority interest expense, the net impact of revisions to certain liabilities in both periods, asset write-offs, higher general

spending and expenses related to growth initiatives, partially offset by lower legal costs and integration costs incurred in the prior year.

An increase in interest credited to policyholder account balances associated with an increase in the average policyholder account

balance decreased net income available to common shareholders by $371 million, net of income tax.

Partially offsetting the decrease in net income available to common shareholders was an increase in net investment income of

$1,251million,netofincometax,primarilyduetoanincreaseintheaverageassetbaseandanincreaseinyields.Growthintheaverage

asset base was primarily within fixed maturity securities, mortgage loans, real estate joint ventures, and other limited partnership interests.

Higher yields was primarily due to higher returns on fixed maturity securities, other limited partnership interests excluding hedge funds,

equity securities and improved securities lending results, partially offset by lower returns on real estate joint ventures, cash, cash

equivalents and short-term investments, hedge funds and mortgage loans. Management anticipates that investment income and the

related yields on other limited partnership interests may decline during 2008 due to increased volatility in the equity and credit markets

during 2007.

Additionally, there was a decrease in net investment losses of $419 million, net of income tax, primarily due to a reduction of losses on

fixed maturity securities resulting principally from the 2006 portfolio repositioning in a rising interest rate environment, increased gains from

asset-based foreign currency transactions due to a decline in the U.S. dollar year over year against several major currencies and increased

gains on equity securities, partially offset by increased losses from the mark-to-market on derivatives and reduced gains on real estate and

real estate joint ventures.

The net effect of increases in premiums, fees and other revenues of $1,420 million, net of income tax, across all of the Company’s

operating segments and increases in policyholder benefit and claims and policyholder dividends of $924 million, net of income tax, was

attributable to overall business growth and increased net income available to common shareholders.

The remainder of the variance is due to the change in effective tax rates between periods.

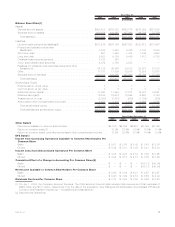

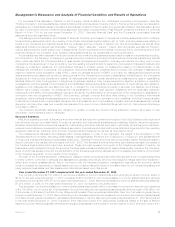

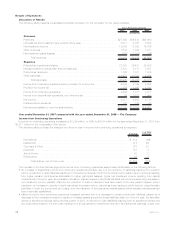

Year ended December 31, 2006 compared with the year ended December 31, 2005

The Company reported $6,159 million in net income available to common shareholders and diluted earnings per common share of

$7.99 for the year ended December 31, 2006 compared to $4,651 million in net income available to common shareholders and diluted

earnings per common share of $6.16 for the year ended December 31, 2005. Excluding the acquisition of Travelers, which contributed

$317 million during the first six months of 2006 to the year over year increase, net income available to common shareholders increased by

$1,191 million for the year ended December 31, 2006 compared to the 2005 period.

Income from discontinued operations consisted of net investment income and net investment gains related to real estate properties that

the Company had classified as available-for-sale or had sold and, for the years ended December 31, 2006 and 2005, the operations and

gain upon disposal from the sale of SSRM on January 31, 2005 and for the year ended December 31, 2005, the operations of P.T. Sejahtera

(“MetLife Indonesia”) which was sold on September 29, 2005. Income from discontinued operations, net of income tax, increased by

$1,579 million, or 96%, to $3,222 million for the year ended December 31, 2006 from $1,643 million for the comparable 2005 period. This

increase was primarily due to a gain of $3 billion, net of income tax, on the sale of the Peter Cooper Village and Stuyvesant Town properties

in Manhattan, New York, as well as a gain of $32 million, net of income tax, related to the sale of SSRM during the year ended December 31,

2006. This increase was partially offset by gains during the year ended December 31, 2005 including $1,193 million, net of income tax, on

the sales of the One Madison Avenue and 200 Park Avenue properties in Manhattan, New York, as well as gains on the sales of SSRM and

MetLife Indonesia of $177 million and $10 million, respectively, both net of income tax. In addition, there was lower net investment income

and net investment gains from discontinued operations related to other real estate properties sold or held-for-sale during the year ended

December 31, 2006 compared to the year ended December 31, 2005.

Net investment losses increased by $842 million, net of income tax, to a loss of $898 million, net of income tax, for the year ended

December 31, 2006 from a loss of $56 million, net of income tax, for the comparable 2005 period. Excluding the impact of the acquisition

of Travelers, which contributed a loss of $191 million, net of income tax, during the first six months of 2006 to the year over year increase,

net investment losses increased by $651 million. The increase in net investment losses was due to a combination of losses from the mark-

to-market on derivatives and foreign currency transaction losses during 2006, largely driven by increases in U.S. interest rates and the

weakening of the dollar against the major currencies the Company hedges, notably the euro and pound sterling.

Dividends on the Holding Company’s Series A preferred shares and Series B preferred shares (“Preferred Shares”) issued in connection

with financing the acquisition of Travelers increased by $71 million, to $134 million for the year ended December 31, 2006, from $63 million

for the comparable 2005 period, as the preferred stock was issued in June 2005.

The remainder of the increase of $334 million in net income available to common shareholders for the year ended December 31, 2006

compared to the 2005 period was primarily due to an increase in premiums, fees and other revenues attributable to continued business

growth across all of the Company’s operating segments. Also contributing to the increase was higher net investment income primarily due

to an overall increase in the asset base, an increase in fixed maturity security yields, improved results on real estate and real estate joint

ventures, mortgage loans, and other limited partnership interests, as well as higher short-term interest rates on cash equivalents and short-

term investments. These increases were partially offset by a decline in net investment income from securities lending results, and bond and

commercial mortgage prepayment fees. Favorable underwriting results for the year ended December 31, 2006 were partially offset by a

decrease in net interest margins. These increases were partially offset by an increase in expenses primarily due to higher interest expense

on debt, increased general spending, higher compensation and commission costs and higher expenses related to growth initiatives and

information technology projects, partially offset by a reduction in Travelers’ integration expenses, principally corporate incentives.

6MetLife, Inc.