MetLife 2007 Annual Report Download - page 149

Download and view the complete annual report

Please find page 149 of the 2007 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

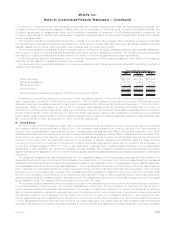

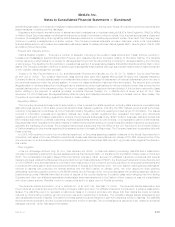

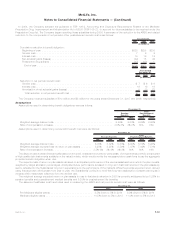

Deferred income tax represents the tax effect of the differences between the book and tax basis of assets and liabilities. Net deferred

income tax assets and liabilities consisted of the following:

2007 2006

December 31,

(In millions)

Deferred income tax assets:

Policyholderliabilitiesandreceivables............................................ $4,026 $4,078

Netoperatinglosscarryforwards ............................................... 920 1,368

Employeebenefits......................................................... 176 472

Capitallosscarryforwards.................................................... 162 156

Taxcreditcarryforwards..................................................... 24 —

Intangibles.............................................................. — 22

Litigation-relatedandgovernmentmandated........................................ 113 65

Other................................................................. 247 198

5,668 6,359

Less:Valuationallowance.................................................... 135 239

5,533 6,120

Deferred income tax liabilities:

Investments............................................................. 2,266 1,839

Intangibles.............................................................. 32 —

DAC.................................................................. 5,153 5,433

Netunrealizedinvestmentgains................................................ 423 994

Other................................................................. 116 132

7,990 8,398

Netdeferredincometaxliability.................................................. $(2,457) $(2,278)

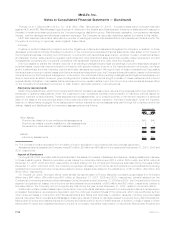

Domestic net operating loss carryforwards amount to $2,057 million at December 31, 2007 and will expire beginning in 2019. Foreign

net operating loss carryforwards amount to $725 million at December 31, 2007 and were generated in various foreign countries with

expiration periods of five years to indefinite expiration. Capital loss carryforwards amount to $463 million at December 31, 2007 and will

expire beginning in 2010. Tax credit carryforwards amount to $24 million at December 31, 2007.

The Company has recorded a valuation allowance related to tax benefits of certain foreign net operating loss carryforwards. The

valuation allowance reflects management’s assessment, based on available information, that it is more likely than not that the deferred

income tax asset for certain foreign net operating loss carryforwards will not be realized. The tax benefit will be recognized when

management believes that it is more likely than not that these deferred income tax assets are realizable. In 2007, the Company recorded a

reduction of $104 million to the deferred income tax valuation allowance related to certain foreign net operating loss carryforwards and

other deferred tax assets.

The Company files income tax returns with the U.S. federal government and various state and local jurisdictions, as well as foreign

jurisdictions. The Company is under continuous examination by the Internal Revenue Service (“IRS”) and other tax authorities in jurisdictions

in which the Company has significant business operations. The income tax years under examination vary by jurisdiction. With a few

exceptions, the Company is no longer subject to U.S. federal, state and local, or foreign income tax examinations by tax authorities for

years prior to 2000. In the first quarter of 2005, the IRS commenced an examination of the Company’s U.S. income tax returns for 2000

through 2002 that is anticipated to be completed in 2008.

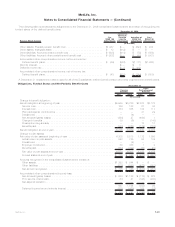

As a result of the implementation of FIN 48 on January 1, 2007, the Company recognized a $52 million increase in the liability for

unrecognized tax benefits, a $4 million decrease in the interest liability for unrecognized tax benefits, and a corresponding reduction to the

January 1, 2007 balance of retained earnings of $37 million, net of $11 million of minority interest. The Company’s total amount of

unrecognized tax benefits upon adoption of FIN 48 was $1,128 million. The Company reclassified, at adoption, $611 million of current

income tax payables to the liability for unrecognized tax benefits included within other liabilities. The Company also reclassified, at

adoption, $465 million of deferred income tax liabilities, for which the ultimate deductibility is highly certain but for which there is uncertainty

about the timing of such deductibility, to the liability for unrecognized tax benefits. Because of the impact of deferred tax accounting, other

than interest and penalties, the disallowance of the shorter deductibility period would not affect the annual effective tax rate but would

accelerate the payment of cash to the taxing authority to an earlier period. The total amount of unrecognized tax benefits as of January 1,

2007 that would affect the effective tax rate, if recognized, was $680 million. The Company also had $240 million of accrued interest,

included within other liabilities, as of January 1, 2007. The Company classifies interest accrued related to unrecognized tax benefits in

interest expense, while penalties are included within income tax expense.

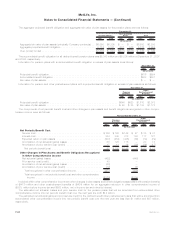

As of December 31, 2007, the Company’s total amount of unrecognized tax benefits is $1,038 million and the total amount of

unrecognized tax benefits that would affect the effective tax rate, if recognized, is $593 million. The total amount of unrecognized tax

benefits decreased by $90 million from the date of adoption primarily due to settlements reached with the IRS with respect to certain

significant issues involving demutualization, post-sale purchase price adjustments, and reinsurance offset by additions for tax positions of

the current year. As a result of the settlements, items within the liability for unrecognized tax benefits, in the amount of $177 million, were

reclassified to current and deferred income taxes, as applicable, and a payment of $156 million was made in December of 2007 with the

remaining $21 million to be paid in future years. In addition, the Company’s liability for unrecognized tax benefits may change significantly in

F-53MetLife, Inc.

MetLife, Inc.

Notes to Consolidated Financial Statements — (Continued)