MetLife 2007 Annual Report Download - page 150

Download and view the complete annual report

Please find page 150 of the 2007 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

the next 12 months pending the outcome of remaining issues associated with the current IRS audit including demutualization, leasing, tax-

exempt income, transfer pricing and tax credits. Management is working to resolve the remaining audit items directly with IRS auditors as

well as through available accelerated IRS resolution programs and may protest any unresolved issues through the IRS appeals process

and, possibly, litigation, the timing and extent of which is uncertain. Therefore, a reasonable estimate of the range of a payment or change

in the liability cannot be made at this time; however, the Company continues to believe that the ultimate resolution of the issues will not

result in a material effect on its consolidated financial statements, although the resolution of income tax matters could impact the

Company’s effective tax rate for a particular future period.

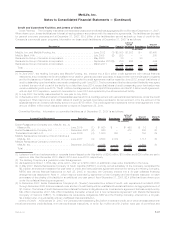

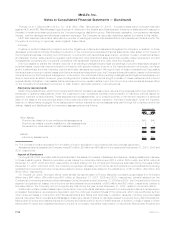

A reconciliation of the beginning and ending amount of unrecognized tax benefits for the year ended December 31, 2007, is as follows:

Total Unrecognized

Tax Benefits

(In millions)

Balance at January 1, 2007 (date of adoption) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $1,128

Additionsfortaxpositionsofprioryears ............................................. 73

Reductionsfortaxpositionsofprioryears............................................ (59)

Additionsfortaxpositionsofcurrentyear ............................................ 85

Reductionsfortaxpositionsofcurrentyear........................................... (8)

Settlementswithtaxauthorities................................................... (177)

Lapsesofstatutesoflimitations................................................... (4)

Balance at December 31, 2007 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $1,038

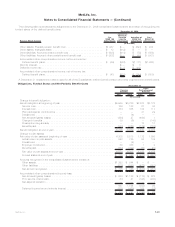

During the year ended December 31, 2007, the Company recognized $98 million in interest expense associated with the liability for

unrecognized tax benefits. As of December 31, 2007, the Company had $252 million of accrued interest associated with the liability for

unrecognized tax benefits. The $12 million increase, from the date of adoption, in accrued interest associated with the liability for

unrecognized tax benefits resulted from an increase of $98 million of interest expense and an $86 million decrease primarily resulting from

the aforementioned IRS settlements. During 2007, $73 million of the $86 million, resulting from IRS settlements, has been reclassified to

current income tax payable and the remaining $13 million reduced interest expense.

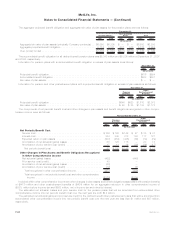

On September 25, 2007, the IRS issued Revenue Ruling 2007-61, which announced its intention to issue regulations with respect to

certain computational aspects of the Dividends Received Deduction (“DRD”) on separate account assets held in connection with variable

annuity contracts. Revenue Ruling 2007-61 suspended a revenue ruling issued in August 2007 that would have changed accepted

industry and IRS interpretations of the statutes governing these computational questions. Any regulations that the IRS ultimately proposes

for issuance in this area will be subject to public notice and comment, at which time insurance companies and other interested parties will

have the opportunity to raise legal and practical questions about the content, scope and application of such regulations. As a result, the

ultimate timing and substance of any such regulations are unknown at this time. For the year ended December 31, 2007, the Company

recognized an income tax benefit of $188 million related to the separate account DRD.

16. Contingencies, Commitments and Guarantees

Contingencies

Litigation

The Company is a defendant in a large number of litigation matters. In some of the matters, very large and/or indeterminate amounts,

including punitive and treble damages, are sought. Modern pleading practice in the United States permits considerable variation in the

assertion of monetary damages or other relief. Jurisdictions may permit claimants not to specify the monetary damages sought or may

permit claimants to state only that the amount sought is sufficient to invoke the jurisdiction of the trial court. In addition, jurisdictions may

permit plaintiffs to allege monetary damages in amounts well exceeding reasonably possible verdicts in the jurisdiction for similar matters.

This variability in pleadings, together with the actual experience of the Company in litigating or resolving through settlement numerous

claims over an extended period of time, demonstrate to management that the monetary relief which may be specified in a lawsuit or claim

bears little relevance to its merits or disposition value. Thus, unless stated below, the specific monetary relief sought is not noted.

Due to the vagaries of litigation, the outcome of a litigation matter and the amount or range of potential loss at particular points in time

may normally be inherently impossible to ascertain with any degree of certainty. Inherent uncertainties can include how fact finders will view

individually and in their totality documentary evidence, the credibility and effectiveness of witnesses’ testimony, and how trial and appellate

courts will apply the law in the context of the pleadings or evidence presented, whether by motion practice, or at trial or on appeal.

Disposition valuations are also subject to the uncertainty of how opposing parties and their counsel will themselves view the relevant

evidence and applicable law.

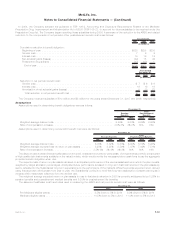

On a quarterly and annual basis, the Company reviews relevant information with respect to litigation and contingencies to be reflected in

the Company’s consolidated financial statements. The review includes senior legal and financial personnel. In 2007, the Company received

$39 million upon the resolution of an indemnification claim associated with the 2000 acquisition of General American Life Insurance

Company (“GALIC”), and the Company reduced legal liabilities by $38 million after the settlement of certain cases. Unless stated below,

estimatesofpossiblelossesorrangesoflossforparticularmatterscannotintheordinarycoursebemadewithareasonabledegreeof

certainty. Liabilities are established when it is probable that a loss has been incurred and the amount of the loss can be reasonably

estimated. Liabilities have been established for a number of the matters noted below; in 2007 the Company increased legal liabilities for

pending sales practices, employment, property and casualty and intellectual property litigation matters against the Company. It is possible

that some of the matters could require the Company to pay damages or make other expenditures or establish accruals in amounts that

could not be estimated as of December 31, 2007.

F-54 MetLife, Inc.

MetLife, Inc.

Notes to Consolidated Financial Statements — (Continued)