MetLife 2007 Annual Report Download - page 174

Download and view the complete annual report

Please find page 174 of the 2007 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

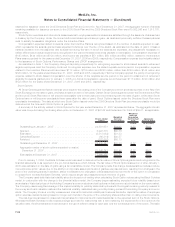

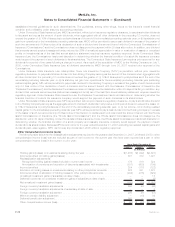

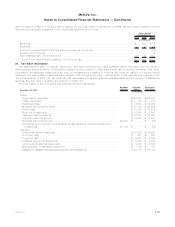

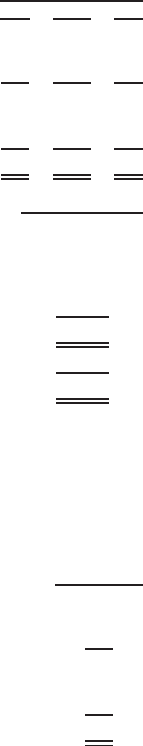

The following tables present the amounts related to the operations and financial position of MetLife Australia’s annuities and pension

businesses:

2007 2006 2005

Years Ended

December 31,

(In millions)

Revenues............................................................... $71 $100 $50

Expenses ............................................................... 58 89 41

Incomebeforeprovisionforincometax............................................ 13 11 9

Provisionforincometax...................................................... 4 3 3

Netinvestmentgain(loss),netofincometax ........................................ (4) 20 (5)

Incomefromdiscontinuedoperations,netofincometax................................ $ 5 $ 28 $ 1

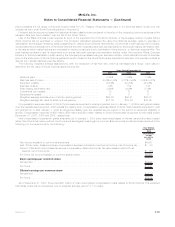

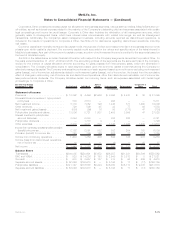

December 31, 2006

(In millions)

Fixedmaturitysecurities........................................................ $1,500

Equitysecurities............................................................. 37

Deferredpolicyacquisitioncosts.................................................. 13

Otherassets............................................................... 13

Totalassetsheld-for-sale...................................................... $1,563

Policyholderaccountbalances ................................................... $1,595

Totalliabilitiesheld-for-sale .................................................... $1,595

On September 29, 2005, the Company completed the sale of MetLife Indonesia to a third party, resulting in a gain upon disposal of

$10 million, net of income tax. As a result of this sale, the Company recognized income from discontinued operations of $5 million, net of

income tax, for the year ended December 31, 2005. The Company reclassified the operations of MetLife Indonesia into discontinued

operations for all years presented.

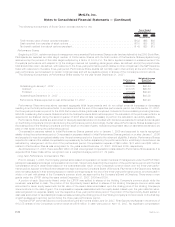

The following table presents the amounts related to the operations of MetLife Indonesia that have been combined with the discontinued

real estate operations in the consolidated statements of income:

Year Ended

December 31,

2005

(In millions)

Revenues.................................................................... $ 5

Expenses.................................................................... 10

Incomefromdiscontinuedoperationsbeforeprovisionforincometax ............................. (5)

Provisionforincometax........................................................... —

Netinvestmentgain,netofincometax ................................................. 10

Incomefromdiscontinuedoperations,netofincometax .................................... $ 5

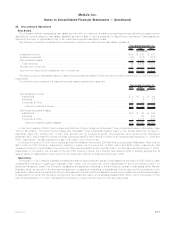

On January 31, 2005, the Company completed the sale of SSRM to a third party for $328 million in cash and stock. The Company

reported the operations of SSRM in discontinued operations. As a result of the sale of SSRM, the Company recognized income from

discontinued operations of $157 million, net of income tax, comprised of a realized gain of $165 million, net of income tax, and an

operating expense related to a lease abandonment of $8 million, net of income tax. The Company’s discontinued operations for the year

ended December 31, 2005 included expenses of $6 million, net of income tax, related to the sale of SSRM. Under the terms of the sale

agreement, MetLife will have an opportunity to receive additional payments based on, among other things, certain revenue retention and

growth measures. The purchase price is also subject to reduction over five years, depending on retention of certain MetLife-related

business. In the fourth quarter of 2007, the Company accrued a liability for $2 million, net of income tax, related to the termination of certain

MetLife-related business. Also under the terms of such agreement, MetLife had the opportunity to receive additional consideration for the

retention of certain customers for a specific period in 2005. Upon finalization of the computation, the Company received payments of

$30 million, net of income tax, in the second quarter of 2006 and $12 million, net of income tax, in the fourth quarter of 2005 due to the

retention of these specific customer accounts. In the first quarter of 2007, the Company received a payment of $16 million, net of income

tax, as a result of the revenue retention and growth measure provision in the sales agreement. In the fourth quarter of 2006, the Company

eliminated $4 million of a liability that was previously recorded with respect to the indemnities provided in connection with the sale of

SSRM, resulting in a benefit to the Company of $2 million, net of income tax. The Company believes that future payments relating to these

indemnities are not probable.

The operations of SSRM include affiliated revenues of $5 million for the year ended December 31, 2005, related to asset management

services provided by SSRM to the Company that have not been eliminated from discontinued operations as these transactions continued

F-78 MetLife, Inc.

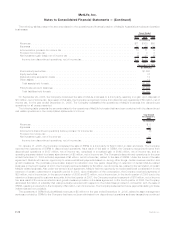

MetLife, Inc.

Notes to Consolidated Financial Statements — (Continued)