MetLife 2007 Annual Report Download - page 124

Download and view the complete annual report

Please find page 124 of the 2007 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

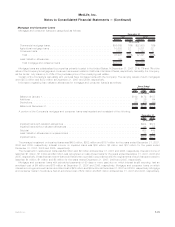

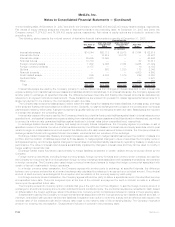

At December 31, 2007 and 2006, the Company had $4.9 billion and $2.3 billion, respectively, of gross unrealized losses related to its

fixed maturity and equity securities. These securities are concentrated, calculated as a percentage of gross unrealized loss, as follows:

2007 2006

December 31,

Sector:

U.S.corporatesecurities.......................................................... 44% 42%

Foreigncorporatesecurities........................................................ 16 16

Asset-backedsecurities .......................................................... 11 2

Residentialmortgage-backedsecurities ................................................ 8 14

Foreigngovernmentsecurities....................................................... 4 1

Commercialmortgage-backedsecurities................................................ 4 6

U.S.Treasury/agencysecurities ..................................................... — 11

Other....................................................................... 13 8

Total...................................................................... 100% 100%

Industry:

Finance ..................................................................... 34% 10%

Industrial .................................................................... 18 23

Mortgage-backed............................................................... 12 20

Utility....................................................................... 8 11

Government .................................................................. 4 12

Other....................................................................... 24 24

Total...................................................................... 100% 100%

As described more fully in Note 1, the Company performs a regular evaluation, on a security-by-security basis, of its investment

holdings in accordance with its impairment policy in order to evaluate whether such securities are other-than-temporarily impaired. One of

the criteria which the Company considers in its other-than-temporary impairment analysis is its intent and ability to hold securities for a

period of time sufficient to allow for the recovery of their value to an amount equal to or greater than cost or amortized cost. The Company’s

intent and ability to hold securities considers broad portfolio management objectives such as asset/liability duration management, issuer

and industry segment exposures, interest rate views and the overall total return focus. In following these portfolio management objectives,

changes in facts and circumstances that were present in past reporting periods may trigger a decision to sell securities that were held in

prior reporting periods. Decisions to sell are based on current conditions or the Company’s need to shift the portfolio to maintain its

portfolio management objectives including liquidity needs or duration targets on asset/liability managed portfolios. The Company attempts

to anticipate these types of changes and if a sale decision has been made on an impaired security and that security is not expected to

recover prior to the expected time of sale, the security will be deemed other-than-temporarily impaired in the period that the sale decision

was made and an other-than-temporary impairment loss will be recognized.

Based upon the Company’s current evaluation of the securities in accordance with its impairment policy, the cause of the decline being

principally attributable to the general rise in interest rates during the holding period, and the Company’s current intent and ability to hold the

fixed maturity and equity securities with unrealized losses for a period of time sufficient for them to recover, the Company has concluded

that the aforementioned securities are not other-than-temporarily impaired.

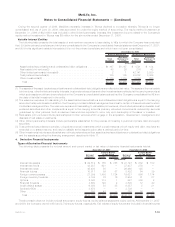

Securities Lending

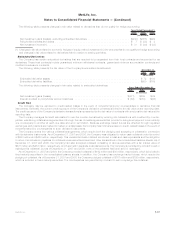

The Company participates in a securities lending program whereby blocks of securities, which are included in fixed maturity and equity

securities, are loaned to third parties, primarily major brokerage firms. The Company requires a minimum of 102% of the fair value of the

loaned securities to be separately maintained as collateral for the loans. Securities with a cost or amortized cost of $41.1 billion and

$43.3 billion and an estimated fair value of $42.1 billion and $44.1 billion were on loan under the program at December 31, 2007 and 2006,

respectively. Securities loaned under such transactions may be sold or repledged by the transferee. The Company was liable for cash

collateral under its control of $43.3 billion and $45.4 billion at December 31, 2007 and 2006, respectively. Security collateral of $40 million

and $100 million on deposit from customers in connection with the securities lending transactions at December 31, 2007 and 2006,

respectively, may not be sold or repledged and is not reflected in the consolidated financial statements.

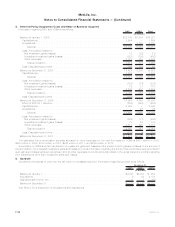

Assets on Deposit and Held in Trust and Assets Pledged as Collateral

The Company had investment assets on deposit with regulatory agencies with a fair market value of $1.8 billion and $1.3 billion at

December 31, 2007 and 2006, respectively, consisting primarily of fixed maturity and equity securities. Company securities held in trust to

satisfy collateral requirements had a cost or amortized cost of $7.1 billion and $3.0 billion at December 31, 2007 and 2006, respectively,

consisting primarily of fixed maturity and equity securities.

Certain of the Company’s fixed maturity securities are pledged as collateral for various derivative transactions as described in Note 4.

Additionally, the Company has pledged certain of its fixed maturity securities in support of its debt and funding agreements as described in

Notes 10 and 7, respectively.

F-28 MetLife, Inc.

MetLife, Inc.

Notes to Consolidated Financial Statements — (Continued)