MetLife 2007 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2007 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Liquidity Uses

Debt Repayments. On October 31, 2007, the Company redeemed $125 million of 8.525% GenAmerica Capital I Capital Securities

which were due to mature on June 30, 2027. As a result of this repayment, the Company recognized additional interest expense of

$10 million.

During the year ended December 31, 2007, RGA repaid $50 million of long-term debt using the proceeds from its March 2007 10-year

senior notes offering. See “— Liquidity and Capital Resources — The Company — Liquidity Sources — Debt Issuances” for further

information.

During the years ended December 31, 2007, 2006 and 2005, MetLife Bank made repayments of $175 million, $117 million and

$25 million, respectively, to the FHLB of NY. See “— Liquidity and Capital Resources — The Company — Liquidity Sources — Debt

Issuances” for further information.

The Holding Company repaid a $500 million 5.25% senior note which matured in December 2006 and a $1,006 million 3.911% senior

note which matured in May 2005.RGA repaid a $100 million 7.25% senior note which matured in April 2006.

MLIC repaid a $250 million 7% surplus note which matured on November 1, 2005.

Insurance Liabilities. The Company’s principal cash outflows primarily relate to the liabilities associated with its various life insurance,

property and casualty, annuity and group pension products, operating expenses and income tax, as well as principal and interest on its

outstanding debt obligations. Liabilities arising from its insurance activities primarily relate to benefit payments under the aforementioned

products, as well as payments for policy surrenders, withdrawals and loans.

Investment and Other. Additional cash outflows include those related to obligations of securities lending activities, investments in real

estate, limited partnerships and joint ventures, as well as litigation-related liabilities.

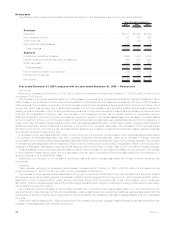

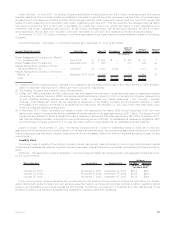

The following table summarizes the Company’s major contractual obligations as of December 31, 2007:

Contractual Obligations Total Less Than

One Year

More Than

One Year and

Less Than

Three Years

More Than

Three Years

and Less

Than Five

Years More Than

Five Years

(In millions)

Future policy benefits . . . . . . . . . . . . . . . . . . . (1) $288,837 $ 6,823 $ 9,471 $ 9,742 $262,801

Policyholder account balances . . . . . . . . . . . . . (2) 212,049 25,640 29,028 28,278 129,103

Other policyholder liabilities . . . . . . . . . . . . . . . (3) 10,592 8,322 93 112 2,065

Short-termdebt ...................... (4) 667 667 — — —

Long-term debt. . . . . . . . . . . . . . . . . . . . . . . (4) 16,832 975 1,797 2,330 11,730

Collateral financing arrangements . . . . . . . . . . . (4) 12,800 301 603 660 11,236

Junior subordinated debt securities. . . . . . . . . . (4) 8,758 1,314 1,398 324 5,722

Shares subject to mandatory redemption . . . . . . (4) 785 13 26 26 720

Payables for collateral under securities loaned

andothertransactions................. (5) 44,136 44,136 — — —

Commitments to lend funds . . . . . . . . . . . . . . . (6) 10,559 8,063 1,141 639 716

Operatingleases...................... (7) 2,167 254 442 316 1,155

Other ............................. (8) 8,278 7,711 6 6 555

Total ............................ $616,460 $104,219 $44,005 $42,433 $425,803

(1) Future policyholder benefits include liabilities related to traditional whole life policies, term life policies, closeout and other group annuity

contracts, structured settlements, MTF agreements, single premium immediate annuities, long-term disability policies, individual

disability income policies, LTC policies and property and casualty contracts.

Included within future policyholder benefits are contracts where the Company is currently making payments and will continue to do so

until the occurrence of a specific event such as death as well as those where the timing of a portion of the payments has been

determined by the contract. Also included are contracts where the Company is not currently making payments and will not make

payments until the occurrence of an insurable event, such as death or illness, or where the occurrence of the payment triggering event,

such as a surrender of a policy or contract, is outside the control of the Company. The Company has estimated the timing of the cash

flows related to these contracts based on historical experience as well as its expectation of future payment patterns.

Liabilities related to accounting conventions, or which are not contractually due, such as shadow liabilities, excess interest reserves

and property and casualty loss adjustment expenses, of $1.1 billionhavebeenexcludedfromamountspresentedinthetableabove.

Amounts presented in the table above, excluding those related to property and casualty contracts, represent the estimated cash

payments for benefits under such contracts including assumptions related to the receipt of future premiums and assumptions related to

mortality, morbidity, policy lapse, renewal, retirement, inflation, disability incidence, disability terminations, policy loans and other

contingent events as appropriate to the respective product type. Payments for case reserve liabilities and incurred but not reported

liabilities associated with property and casualty contracts of $1.6 billion have been included using an estimate of the ultimate amount to

be settled under the policies based upon historical payment patterns. The ultimate amount to be paid under property and casualty

contracts is not determined until the Company reaches a settlement with the claimant, which may vary significantly from the liability or

contractual obligation presented above especially as it relates to incurred but not reported liabilities. All estimated cash payments

presented in the table above are undiscounted as to interest, net of estimated future premiums on policies currently in-force and gross

of any reinsurance recoverable. The more than five years category displays estimated payments due for periods extending for more

than 100 years from the present date.

The sum of the estimated cash flows shown for all years in the table of $288.8 billion exceeds the liability amount of $132.3 billion

included on the consolidated balance sheet principally due to the time value of money, which accounts for at least 80% of the

47MetLife, Inc.