MetLife 2007 Annual Report Download - page 141

Download and view the complete annual report

Please find page 141 of the 2007 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

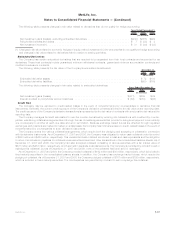

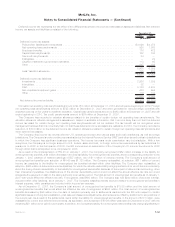

Information regarding the closed block revenues and expenses is as follows:

2007 2006 2005

Years Ended December 31,

(In millions)

Revenues

Premiums.......................................................... $2,870 $2,959 $3,062

Netinvestmentincomeandotherrevenues.................................... 2,350 2,355 2,382

Netinvestmentgains(losses)............................................. 28 (130) 10

Totalrevenues ..................................................... 5,248 5,184 5,454

Expenses

Policyholderbenefitsandclaims........................................... 3,457 3,474 3,478

Policyholderdividends.................................................. 1,492 1,479 1,465

Changeinpolicyholderdividendobligation .................................... — (114) (9)

Otherexpenses...................................................... 231 247 263

Totalexpenses..................................................... 5,180 5,086 5,197

Revenues,netofexpensesbeforeincometax.................................. 68 98 257

Incometax......................................................... 21 34 90

Revenues,netofexpensesandincometaxfromcontinuingoperations.................. 47 64 167

Revenues,netofexpensesandincometaxfromdiscontinuedoperations ................ — 1 —

Revenues,netofexpenses,incometaxesanddiscontinuedoperations.................. $ 47 $ 65 $ 167

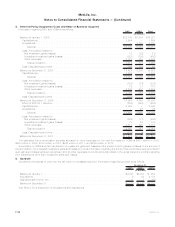

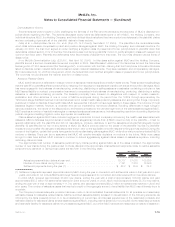

The change in the maximum future earnings of the closed block is as follows:

2007 2006 2005

Years Ended December 31,

(In millions)

BalanceatDecember31, ............................................... $4,429 $4,480 $4,545

Less:

Cumulativeeffectofachangeinaccountingprinciple,netofincometax................ (4) — —

BalanceatJanuary1,.................................................. 4,480 4,545 4,712

Changeduringyear ................................................... $ (47) $ (65) $ (167)

MLIC charges the closed block with federal income taxes, state and local premium taxes, and other additive state or local taxes, as well

as investment management expenses relating to the closed block as provided in the Plan. MLIC also charges the closed block for

expenses of maintaining the policies included in the closed block.

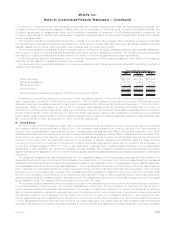

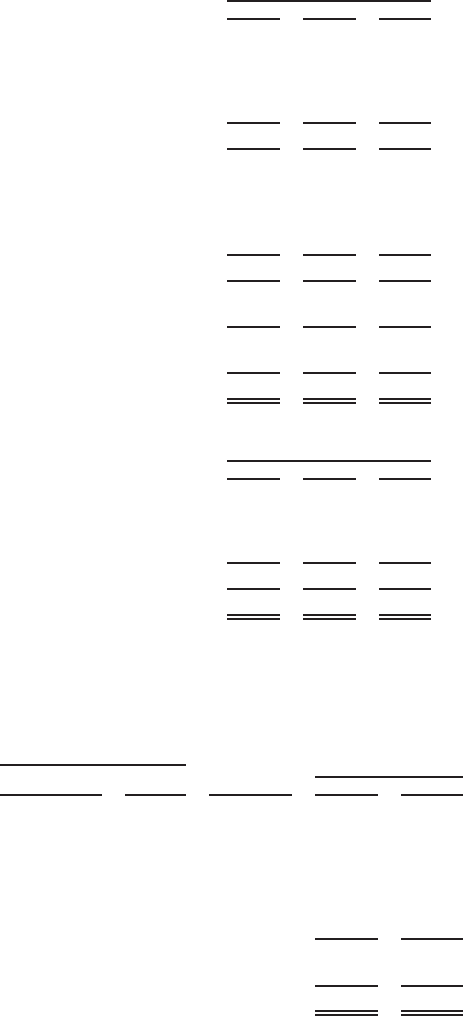

10. Long-term and Short-term Debt

Long-term and short-term debt outstanding is as follows:

Range Weighted

Average Maturity 2007 2006

December 31,

Interest Rates

(In millions)

Senior notes . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5.00%-6.75% 5.60% 2011-2035 $ 7,515 $ 7,196

Repurchase agreements . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2.83%-5.65% 4.49% 2008-2013 1,213 998

Surplus notes . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7.63%-7.88% 7.76% 2015-2025 697 697

Fixed rate notes . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5.50%-7.25% 6.68% 2008 73 107

Other notes with varying interest rates . . . . . . . . . . . . . . . . . . . . . . 3.44%-6.10% 4.99% 2009-2012 75 68

Capitalleaseobligations............................... 55 63

Totallong-termdebt.................................. 9,628 9,129

Totalshort-termdebt ................................. 667 1,449

Total........................................... $10,295 $10,578

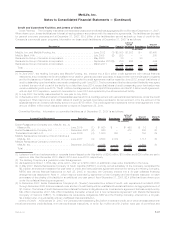

The aggregate maturities of long-term debt as of December 31, 2007 for the next five years are $458 million in 2008, $536 million in

2009, $285 million in 2010, $966 million in 2011, $471 million in 2012 and $6,912 million thereafter.

Repurchase agreements and capital lease obligations are collateralized and rank highest in priority, followed by unsecured senior debt

which consists of senior notes, fixed rate notes and other notes with varying interest rates, followed by subordinated debt which consists

of junior subordinated debentures. Payments of interest and principal on the Company’s surplus notes, which are subordinate to all other

obligations at the operating company level and senior to obligations at the Holding Company, may be made only with the prior approval of

the insurance department of the state of domicile. Collateral financing arrangements are supported by either surplus notes of subsidiaries

or financing arrangements with the Holding Company and accordingly have priority consistent with other such obligations.

F-45MetLife, Inc.

MetLife, Inc.

Notes to Consolidated Financial Statements — (Continued)