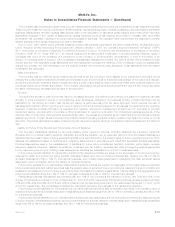

MetLife 2007 Annual Report Download - page 102

Download and view the complete annual report

Please find page 102 of the 2007 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

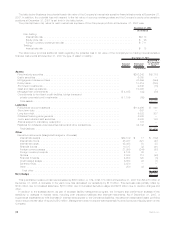

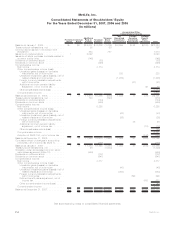

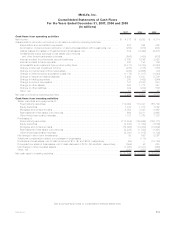

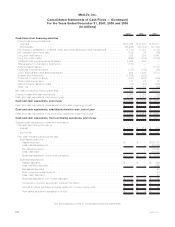

2007 2006 2005

Cash flows from financing activities

Policyholder account balances:

Deposits......................................................... $58,026 $53,947 $ 52,077

Withdrawals....................................................... (55,256) (50,574) (47,827)

Net change in payables for collateral under securities loaned and other transactions . . . . . . . . . (1,710) 11,331 4,138

Netchangeinshort-termdebt ............................................ (782) 35 (56)

Long-termdebtissued ................................................. 726 284 3,541

Long-termdebtrepaid.................................................. (286) (732) (1,430)

Collateralfinancingarrangementsissued...................................... 4,882 850 —

Sharessubjecttomandatoryredemption...................................... (131) — —

Preferredstockissued ................................................. — — 2,100

Dividendsonpreferredstock ............................................. (137) (134) (63)

Juniorsubordinateddebtsecuritiesissued .................................... 694 1,248 2,533

Treasurystockacquired................................................. (1,705) (500) —

Dividendsoncommonstock.............................................. (541) (450) (394)

Stockoptionsexercised ................................................ 110 83 72

Debtandequityissuancecosts............................................ (14) (25) (128)

Other,net.......................................................... 67 12 (53)

Netcashprovidedbyfinancingactivities ....................................... 3,943 15,375 14,510

Changeincashandcashequivalents......................................... 3,261 3,089 (88)

Cashandcashequivalents,beginningofyear.................................... 7,107 4,018 4,106

Cash and cash equivalents, end of year ..................................... $10,368 $ 7,107 $ 4,018

Cashandcashequivalents,subsidiariesheld-for-sale,beginningofyear .................. $ — $ — $ 58

Cash and cash equivalents, subsidiaries held-for-sale, end of year ................. $ — $ — $ —

Cashandcashequivalents,fromcontinuingoperations,beginningofyear ................. $ 7,107 $ 4,018 $ 4,048

Cash and cash equivalents, from continuing operations, end of year................ $10,368 $ 7,107 $ 4,018

Supplemental disclosures of cash flow information:

Net cash paid during the year for:

Interest.......................................................... $ 1,011 $ 819 $ 579

Incometax........................................................ $ 2,128 $ 409 $ 1,391

Non-cash transactions during the year:

Business acquisitions:

Assetsacquired................................................... $ — $ — $102,112

Less:liabilitiesassumed.............................................. — — 90,090

Netassetsacquired ................................................ — — 12,022

Less:cashpaid................................................... — — 11,012

Businessacquisition,commonstockissued................................. $ — $ — $ 1,010

Business dispositions:

Assetsdisposed................................................... $ — $ — $ 366

Less:liabilitiesdisposed ............................................. — — 269

Netassetsdisposed................................................ — — 97

Plus:equitysecuritiesreceived......................................... — — 43

Less:cashdisposed................................................ — — 43

Businessdisposition,netofcashdisposed ................................. $ — $ — $ 97

ContributionofequitysecuritiestoMetLifeFoundation.......................... $ 12 $ — $ 1

Accrualforstockpurchasecontractsrelatedtocommonequityunits ................ $ — $ — $ 97

Realestateacquiredinsatisfactionofdebt ................................. $ 1 $ 6 $ 1

See accompanying notes to consolidated financial statements.

F-6 MetLife, Inc.

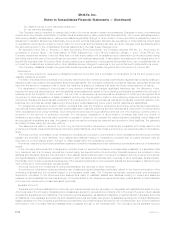

MetLife, Inc.

Consolidated Statements of Cash Flows — (Continued)

For the Years Ended December 31, 2007, 2006 and 2005

(In millions)