MetLife 2007 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2007 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

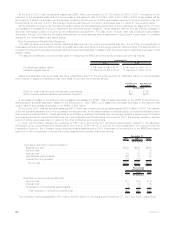

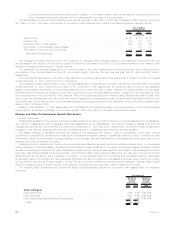

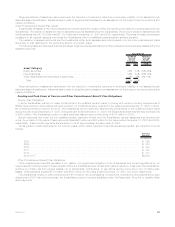

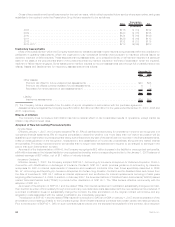

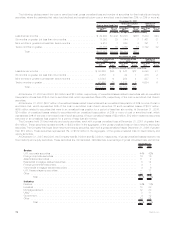

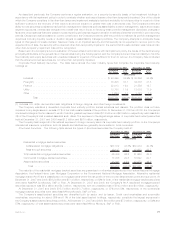

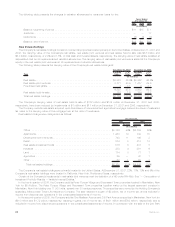

Composition of Investment Portfolio Results

The following table illustrates the net investment income, net investment gains (losses), annualized yields on average ending assets and

ending carrying value for each of the components of the Company’s investment portfolio at:

2007 2006 2005

December 31,

(In millions)

FIXED MATURITY SECURITIES

Yield(1).................................................. 6.34% 6.16% 6.41%

Investmentincome(2)......................................... $ 12,882 $ 11,977 $ 10,351

Investmentgains(losses)...................................... $ (622) $ (1,120) $ (868)

Endingcarryingvalue(2)....................................... $243,021 $242,687 $229,303

MORTGAGE AND CONSUMER LOANS

Yield(1).................................................. 6.55% 6.60% 6.81%

Investmentincome(3)......................................... $ 2,701 $ 2,411 $ 2,236

Investmentgains(losses)...................................... $ 2 $ (8) $ 17

Endingcarryingvalue ........................................ $ 47,030 $ 42,239 $ 37,190

REAL ESTATE AND REAL ESTATE JOINT VENTURES(4)

Yield(1).................................................. 10.28% 11.55% 10.59%

Investmentincome .......................................... $ 607 $ 549 $ 467

Investmentgains(losses)...................................... $ 57 $ 4,898 $ 2,139

Endingcarryingvalue ........................................ $ 6,769 $ 4,986 $ 4,665

POLICY LOANS

Yield(1).................................................. 6.21% 5.99% 6.00%

Investmentincome .......................................... $ 637 $ 603 $ 572

Endingcarryingvalue ........................................ $ 10,419 $ 10,228 $ 9,981

EQUITY SECURITIES AND OTHER LIMITED PARTNERSHIP INTERESTS

Yield(1).................................................. 15.59% 14.90% 12.83%

Investmentincome .......................................... $ 1,567 $ 1,067 $ 798

Investmentgains(losses)...................................... $ 180 $ 85 $ 159

Endingcarryingvalue ........................................ $ 12,205 $ 9,875 $ 7,614

CASH AND SHORT-TERM INVESTMENTS

Yield(1).................................................. 4.74% 5.51% 3.66%

Investmentincome .......................................... $ 437 $ 442 $ 362

Investmentgains(losses)...................................... $ 3 $ (2) $ (2)

Endingcarryingvalue ........................................ $ 13,016 $ 9,816 $ 7,324

OTHER INVESTED ASSETS(5)

Yield(1).................................................. 8.98% 9.60% 8.96%

Investmentincome .......................................... $ 887 $ 821 $ 570

Investmentgains(losses)...................................... $ (627) $ (736) $ 508

Endingcarryingvalue ........................................ $ 12,642 $ 10,428 $ 8,078

TOTAL INVESTMENTS

Grossinvestmentincomeyield(1)................................. 6.81% 6.62% 6.66%

Investmentfeesandexpensesyield............................... (0.15)% (0.15)% (0.15)%

NET INVESTMENT INCOME YIELD ............................. 6.66% 6.47% 6.51%

Grossinvestmentincome...................................... $ 19,718 $ 17,870 $ 15,356

Investmentfeesandexpenses................................... (440) (404) (339)

NET INVESTMENT INCOME .................................. $ 19,278 $ 17,466 $ 15,017

Endingcarryingvalue ........................................ $345,102 $330,259 $304,155

Grossinvestmentgains ....................................... $ 1,440 $ 5,754 $ 3,340

Grossinvestmentlosses ...................................... (1,765) (2,036) (1,578)

Writedowns............................................... (148) (136) (116)

Subtotal................................................. $ (473) $ 3,582 $ 1,646

Derivative and other instruments not qualifying for hedge accounting . . . . . . . . . . (534) (465) 307

INVESTMENT GAINS (LOSSES) ................................ $ (1,007) $ 3,117 $ 1,953

Minorityinterest—investmentgains(losses) ......................... 33 — (9)

Investmentgains(losses)taxbenefit(provision)........................ 326 (1,114) (681)

INVESTMENT GAINS (LOSSES), NET OF INCOME TAX ............... $ (648) $ 2,003 $ 1,263

(1) Yields are based on quarterly average asset carrying values, excluding recognized and unrealized investment gains (losses), and for yield

calculation purposes, average assets exclude collateral associated with the Company’s securities lending program.

(2) Fixed maturity securities include $779 million, $759 million and $825 million in ending carrying value related to trading securities at

December 31, 2007, 2006 and 2005, respectively. Fixed maturity securities include $50 million, $71 million and $14 million of investment

income related to trading securities for the years ended December 31, 2007, 2006 and 2005, respectively.

(3) Investment income from mortgage and consumer loans includes prepayment fees.

72 MetLife, Inc.