MetLife 2007 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2007 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Credit Facilities. In June 2007, the Holding Company and MetLife Funding entered into a $3.0 billion credit agreement with various

financial institutions, the proceeds of which are available to be used for general corporate purposes, to support their commercial paper

programs and for the issuance of letters of credit. All borrowings under the credit agreement must be repaid by June 2012, except that

letters of credit outstanding upon termination may remain outstanding until June 2013. The borrowers and the lenders under this facility

may agree to extend the term of all or part of the facility to no later than June 2014, except that letters of credit outstanding upon

termination may remain outstanding until June 2015. The $1.5 billion credit agreement, with an April 2009 expiration, and the $1.5 billion

credit agreement, with an April 2010 expiration, were both terminated in June 2007 and replaced by the aforementioned facility.

At December 31, 2007, $1.5 billion of letters of credit have been issued under these unsecured credit facilities on behalf of the Holding

Company.

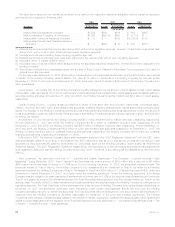

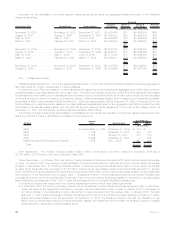

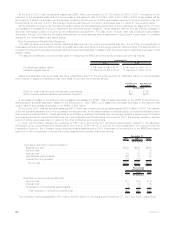

Committed Facilities. Information on committed facilities as of December 31, 2007 is as follows:

Account Party/Borrower(s) Expiration Capacity Drawdowns

Letter of

Credit

Issuances Unused

Commitments Maturity

(Years)

(In millions)

Exeter Reassurance Company Ltd., MetLife,

Inc., & Missouri Re . . . . . . . . . . . . . . . . . . June 2016 (1) $ 500 $ — $ 490 $ 10 8

Exeter Reassurance Company Ltd. . . . . . . . . . December 2027 (2) 650 — 410 240 20

MetLife Reinsurance Company of South

Carolina & MetLife, Inc. . . . . . . . . . . . . . . . June 2037 (3) 3,500 2,382 — 1,118 30

MetLife Reinsurance Company of Vermont &

MetLife, Inc. . . . . . . . . . . . . . . . . . . . . . . December 2037 (2),(4) 2,896 — 1,235 1,661 30

Total............................ $7,546 $2,382 $2,135 $3,029

(1) Letters of credit and replacements or renewals thereof issued under this facility of $280 million, $10 million and $200 million are set to

expire no later than December 2015, March 2016 and June 2016, respectively.

(2) The Holding Company is a guarantor under this agreement.

(3) In May 2007, MRSC terminated the $2.0 billion amended and restated five-year letter of credit and reimbursement agreement entered

into among the Holding Company, MRSC and various institutional lenders on April 25, 2005. In its place the Company entered into a

30-year collateral financing arrangement as described under “— Liquidity and Capital Resources — The Company — Liquidity

Sources — Debt Issuances”, which may be extended by agreement of the Holding Company and the financial institution on each

anniversary of the closing of the facility for an additional one-year period. At December 31, 2007, $2.4 billion had been drawn upon

under the collateral financing arrangement.

(4) In December 2007, Exeter terminated four letters of credit, with expirations from March 2025 through December 2026, that were

issued under a letter of credit facility with an unaffiliated financial institution in an aggregate amount of $1.7 billion. The letters of credit

had served as collateral for Exeter’s obligations under a reinsurance agreement that was recaptured by MLI-USA in December 2007.

MLI-USA immediately thereafter entered into a new reinsurance agreement with MRV. To collateralize its reinsurance obligations, MRV

and the Holding Company entered into a 30-year, $2.9 billion letter of credit facility with an unaffiliated financial institution.

Letters of Credit. At December 31, 2007, the Holding Company had $1.5 billion in outstanding letters of credit, all of which are

associated with the aforementioned credit facilities, from various financial institutions. As commitments associated with letters of credit and

financing arrangements may expire unused, these amounts do not necessarily reflect the Holding Company’s actual future cash funding

requirements.

Liquidity Uses

The primary uses of liquidity of the Holding Company include debt service, cash dividends on common and preferred stock, capital

contributions to subsidiaries, payment of general operating expenses, acquisitions and the repurchase of the Holding Company’s common

stock.

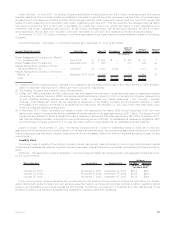

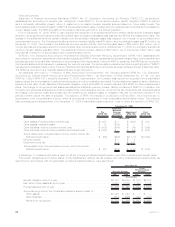

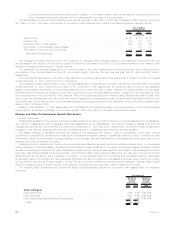

Dividends. The table below presents declaration, record and payment dates, as well as per share and aggregate dividend amounts,

for the common stock:

Declaration Date Record Date Payment Date Per Share Aggregate

Dividend

(In millions, except

per share data)

October 23, 2007 . . . . . . . . . . . . . . . . . . . . . . . November 6, 2007 December 14, 2007 $0.74 $541

October 24, 2006 . . . . . . . . . . . . . . . . . . . . . . . November 6, 2006 December 15, 2006 $0.59 $450

October 25, 2005 . . . . . . . . . . . . . . . . . . . . . . . November 7, 2005 December 15, 2005 $0.52 $394

Future common stock dividend decisions will be determined by the Holding Company’s Board of Directors after taking into consid-

eration factors such as the Company’s current earnings, expected medium- and long-term earnings, financial condition, regulatory capital

position, and applicable governmental regulations and policies. Furthermore, the payment of dividends and other distributions to the

Holding Company by its insurance subsidiaries is regulated by insurance laws and regulations.

55MetLife, Inc.