MetLife 2007 Annual Report Download - page 155

Download and view the complete annual report

Please find page 155 of the 2007 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Casualty Insurance Company intends to vigorously defend these matters. However, any adverse rulings could result in an increase in the

Company’s hurricane-related claim exposure and losses. Based on information known by management, it does not believe that additional

claim losses resulting from Hurricane Katrina will have a material adverse impact on the Company’s consolidated financial statements.

Argentina

The Argentinean economic, regulatory and legal environment, including interpretations of laws and regulations by regulators and courts,

is uncertain. Potential legal or governmental actions related to pension reform, fiduciary responsibilities, performance guarantees and tax

rulings could adversely affect the results of the Company. Upon acquisition of Citigroup’s insurance operations in Argentina, the Company

established insurance liabilities, most significantly death and disability policy liabilities, based upon its interpretation of Argentinean law at

the time and the Company’s best estimate of its obligations under such law. In 2006, a decree was issued by the Argentine Government

regarding the taxability of pesification-related gains resulting in the reduction of certain tax liabilities. In 2007, pension reform legislation in

Argentina was enacted which changed the Company’s obligations and resulted in the elimination of the death and disability liabilities and

the establishment of a liability for servicing obligations.

Commitments

Leases

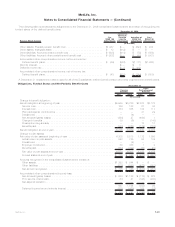

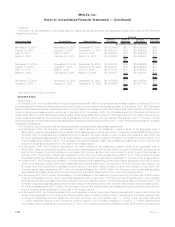

In accordance with industry practice, certain of the Company’s income from lease agreements with retail tenants are contingent upon

the level of the tenants’ sales revenues. Additionally, the Company, as lessee, has entered into various lease and sublease agreements for

office space, data processing and other equipment. Future minimum rental and sublease income, and minimum gross rental payments

relating to these lease agreements are as follows:

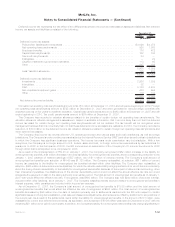

Rental

Income Sublease

Income

Gross

Rental

Payments

(In millions)

2008 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $455 $21 $ 254

2009 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $421 $13 $ 234

2010 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $368 $ 8 $ 208

2011 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $292 $ 8 $ 177

2012 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $217 $ 7 $ 139

Thereafter ....................................................... $766 $ 7 $1,155

Commitments to Fund Partnership Investments

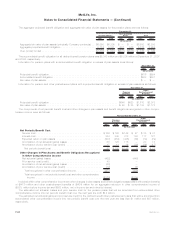

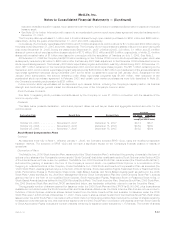

The Company makes commitments to fund partnership investments in the normal course of business. The amounts of these unfunded

commitments were $5.3 billion and $3.0 billion at December 31, 2007 and 2006, respectively. The Company anticipates that these

amounts will be invested in partnerships over the next five years.

Mortgage Loan Commitments

The Company commits to lend funds under mortgage loan commitments. The amounts of these mortgage loan commitments were

$4.0 billion at both December 31, 2007 and 2006.

Commitments to Fund Bank Credit Facilities, Bridge Loans and Private Corporate Bond Investments

The Company commits to lend funds under bank credit facilities, bridge loans and private corporate bond investments. The amounts of

these unfunded commitments were $1.2 billion and $1.9 billion at December 31, 2007 and 2006, respectively.

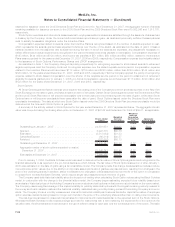

Other Commitments

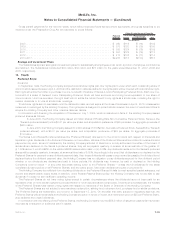

In December 2005, RGA repurchased 1.6 million shares of its outstanding common stock at an aggregate price of $76 million under an

accelerated share repurchase agreement with a major bank. The bank borrowed the stock sold to RGA from third parties and purchased

the shares in the open market over the subsequent few months to return to the lenders. RGA would either pay or receive an amount based

on the actual amount paid by the bank to purchase the shares. These repurchases resulted in an increase in the Company’s ownership

percentage of RGA to approximately 53% at December 31, 2005 from approximately 52% at December 31, 2004. In February 2006, the

final purchase price was determined, resulting in a cash settlement substantially equal to the aggregate cost. RGA recorded the initial

repurchase of shares as treasury stock and recorded the amount received as an adjustment to the cost of the treasury stock. At

December 31, 2007, the Company’s ownership was approximately 52% of RGA.

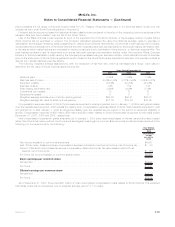

Guarantees

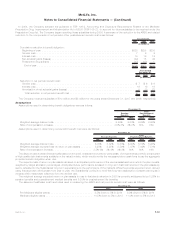

In the normal course of its business, the Company has provided certain indemnities, guarantees and commitments to third parties

pursuant to which it may be required to make payments now or in the future. In the context of acquisition, disposition, investment and other

transactions, the Company has provided indemnities and guarantees, including those related to tax, environmental and other specific

liabilities, and other indemnities and guarantees that are triggered by, among other things, breaches of representations, warranties or

covenants provided by the Company. In addition, in the normal course of business, the Company provides indemnifications to counter-

parties in contracts with triggers similar to the foregoing, as well as for certain other liabilities, such as third party lawsuits. These

obligations are often subject to time limitations that vary in duration, including contractual limitations and those that arise by operation of

law, such as applicable statutes of limitation. In some cases, the maximum potential obligation under the indemnities and guarantees is

subject to a contractual limitation ranging from less than $1 million to $800 million, with a cumulative maximum of $2.3 billion, while in other

cases such limitations are not specified or applicable. Since certain of these obligations are not subject to limitations, the Company does

not believe that it is possible to determine the maximum potential amount that could become due under these guarantees in the future.

F-59MetLife, Inc.

MetLife, Inc.

Notes to Consolidated Financial Statements — (Continued)