MetLife 2007 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2007 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

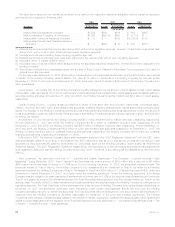

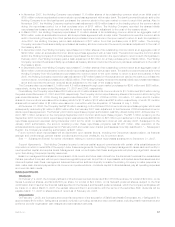

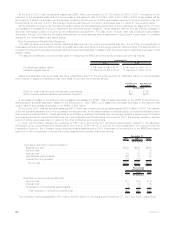

2007 2006 2007 2006

Pension Benefits

Other

Postretirement

Benefits

December 31,

(In millions)

Accumulated other comprehensive (income) loss:

Netactuarial(gains)losses.................................. $ 623 $1,123 $ (112) $ 328

Priorservicecost(credit)................................... 64 41 (193) (230)

Netassetattransition ..................................... — — — 1

687 1,164 (305) 99

Deferredincometaxandminorityinterest......................... (251) (423) 109 (37)

$ 436 $ 741 $ (196) $ 62

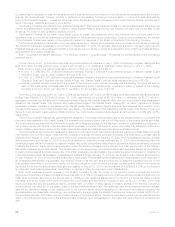

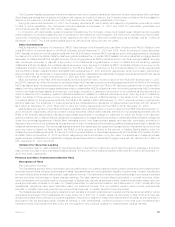

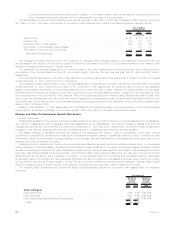

The aggregate projected benefit obligation and aggregate fair value of plan assets for the pension plans were as follows:

2007 2006 2007 2006 2007 2006

Qualified Plans Non-Qualified

Plans Total

December 31,

(In millions)

Aggregate fair value of plan assets (principally Company contracts) . . . . . . $6,550 $6,305 $ — $ — $6,550 $6,305

Aggregate projected benefit obligation . . . . . . . . . . . . . . . . . . . . . . . . . 5,174 5,381 601 578 5,775 5,959

Over (under) funded . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $1,376 $ 924 $(601) $(578) $ 775 $ 346

The accumulated benefit obligation for all defined benefit pension plans was $5,348 million and $5,505 million at December 31, 2007

and 2006, respectively.

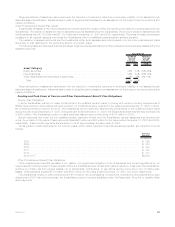

Information for pension plans with an accumulated benefit obligation in excess of plan assets is as follows:

2007 2006

December 31,

(In millions)

Projectedbenefitobligation................................................... $616 $594

Accumulatedbenefitobligation................................................. $533 $501

Fairvalueofplanassets..................................................... $ — $ —

Information for pension and other postretirement plans with a projected benefit obligation in excess of plan assets is as follows:

2007 2006 2007 2006

Pension Benefits

Other

Postretirement

Benefits

December 31,

(In millions)

Projectedbenefitobligation ................................... $ 646 $ 623 $1,610 $2,073

Fairvalueofplanassets ..................................... $ 28 $ 25 $1,183 $1,172

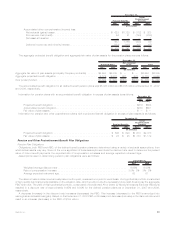

Pension and Other Postretirement Benefit Plan Obligations

Pension Plan Obligations

Obligations, both PBO and ABO, of the defined benefit pension plans are determined using a variety of actuarial assumptions, from

which actual results may vary. Some of the more significant of these assumptions include the discount rate used to determine the present

value of future benefit payments, the expected rate of compensation increases and average expected retirement age.

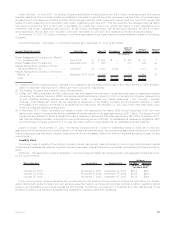

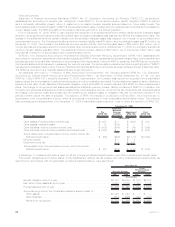

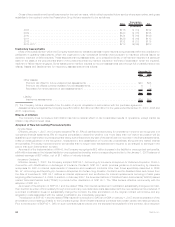

Assumptions used in determining pension plan obligations were as follows:

2007 2006

December 31,

Weightedaveragediscountrate........................................... 6.65% 6.00%

Rateofcompensationincrease ........................................... 3.5%-8% 3%-8%

Averageexpectedretirementage.......................................... 63 61

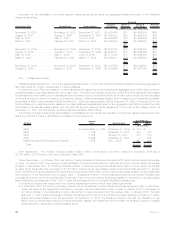

The discount rate is determined annually based on the yield, measured on a yield to worst basis, of a hypothetical portfolio constructed

of high-quality debt instruments available on the valuation date, which would provide the necessary future cash flows to pay the aggregate

PBO when due. The yield of this hypothetical portfolio, constructed of bonds rated AA or better by Moody’s Investors Services (“Moody’s)

resulted in a discount rate of approximately 6.65% and 6.00% for the defined pension plans as of December 31, 2007 and 2006,

respectively.

A decrease (increase) in the discount rate increases (decreases) the PBO. This increase (decrease) to the PBO is amortized into

earnings as an actuarial loss (gain). Based on the December 31, 2007 PBO, a 25 basis point decrease (increase) in the discount rate would

result in an increase (decrease) in the PBO of $159 million.

61MetLife, Inc.