MetLife 2007 Annual Report Download - page 3

Download and view the complete annual report

Please find page 3 of the 2007 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Chairman’s Letter

To My Fellow Shareholders:

This year, MetLife will commemorate its 140th anniversary. This is an impressive milestone that we are

proud to celebrate, because it serves as a testament to our strength, commitment, and long-term

perspective. For 140 years, MetLife has helped individuals and institutions build and protect their most

valuable assets. We offer our customers innovative financial solutions through a broad array of products —

life insurance, dental insurance, auto and home protection, annuities, and retirement and savings solutions.

More importantly, we promise to stand behind the guarantees in these products with the full financial

strength of MetLife. To keep the promises we make, we manage our company with discipline and plan for the

long-term.

This long-term approach has been incredibly successful for MetLife. We have grown to become the largest life insurer in the U.S., a

leading provider of employee benefits, and an expert in retirement and savings. Our understanding of customer needs and our ability to

execute on our growth plans have driven strong financial results. This was especially true in 2007.

Driving Growth

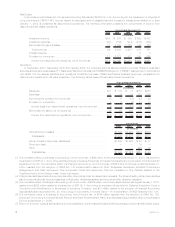

By many counts, MetLife had an outstanding year: premiums, fees and other revenues reached a record $34.8 billion; total assets grew

to $558.6 billion; and net income was strong at $4.3 billion. Across the board, all of our businesses continued to perform extremely well

and helped to make 2007 one of our best years ever.

Institutional Business achieved a record year in 2007 with nearly $14 billion in premiums, fees and other revenues. We retained our

customers through strong service, grew our existing relationships, and introduced new customers to MetLife. Today, we stand alone in the

marketplace with more than 90 of the top 100 FORTUNE 500»companies turning to MetLife for employee benefits. We have supplemented

our organic growth with acquisitions. For example, in early 2008, we completed the acquisition of SafeGuard Health Enterprises, Inc., to

augment our already strong dental offering in the key, growing markets of California, Florida, Texas, and Nevada.

We continue to see a tremendous need for solutions for individuals who are retired or approaching retirement. Our individual variable

annuity business in the U.S. had a very strong year in 2007 with a record $16.5 billion in individual annuity premiums and deposits. We

have increased our market position in this business from 11th in 2000 to 2nd at the end of 2007. Our expanding distribution reach over the

past several years, as well as the introduction of new and innovative variable annuity offerings, has enabled us to achieve this significant

growth.

Our focus on innovative products is also evident in our Auto & Home business. In 2007, we increased sales of our GrandProtect product

offering, which offers our customers complete personal insurance protection in one package. This growth in GrandProtect sales is even

more noteworthy when you consider the very competitive nature of the auto and home insurance market.

I am very pleased with the performance of our International business. This segment experienced a 16% growth in top line results, and

represents approximately 15% of our 2007 net income. International has become — and will continue to be — an important, growing

contributor to MetLife’s bottom line. We are successfully exporting our expertise outside of the U.S., and today we hold leading market

positions in several countries — including Mexico, South Korea, Chile and through our joint venture in Japan. Our efforts to expand

continue as we plant seeds for growth in a number of other countries, including China and India.

In addition to positioning MetLife’s businesses for further success, we are committed to leveraging our time-tested strengths in asset/

liability management. In a rapidly changing investment environment like the one experienced in 2007, our focus on identifying trends,

actively managing our portfolio, and consistently managing risk has been crucial. Our performance has been excellent, as evidenced by the

$19 billion in net investment income we generated during the year. The effective management of our $345 billion portfolio has enabled us to

keep the promises we make to our customers and meet the expectations you have as our shareholders.

At the same time, we continue to focus on the best ways to leverage our strong capital position at MetLife. In 2007, we repurchased

more than $1.7 billion of our common stock, announced a 25% increase in our annual common stock dividend, and grew book value to

$43.47 per share. Collectively, these actions and results demonstrate our commitment to providing value and a strong return to

shareholders.

Strong Leadership

MetLife was recently recognized by Forbes magazine as the “Best Managed Insurance Company” for 2008. I have always been proud of

our management team and the outstanding talent of our organization. Key to our success has been the MetLife Board of Directors. At this

year’s annual shareholders meeting, three members of our Board will retire. Charlie Leighton, Helene Kaplan, and Jamie Houghton have

provided many years of service and made numerous contributions to the company. I am extremely grateful for their service and wish them