MetLife 2007 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2007 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

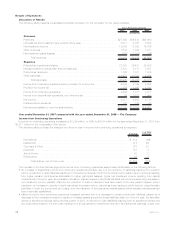

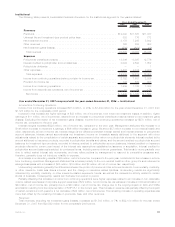

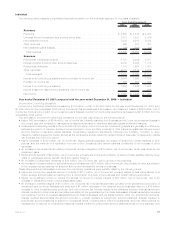

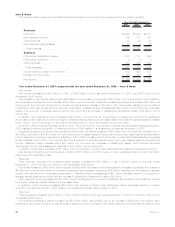

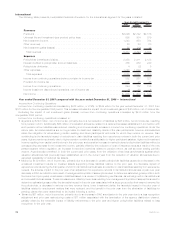

Institutional

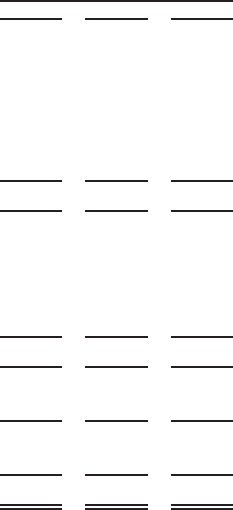

The following table presents consolidated financial information for the Institutional segment for the years indicated:

2007 2006 2005

Years Ended December 31,

(In millions)

Revenues

Premiums................................................... $12,392 $11,867 $11,387

Universallifeandinvestment-typeproductpolicyfees...................... 803 775 772

Netinvestmentincome.......................................... 8,179 7,265 5,942

Otherrevenues............................................... 726 685 653

Netinvestmentgains(losses)...................................... (580) (631) (10)

Totalrevenues .............................................. 21,520 19,961 18,744

Expenses

Policyholderbenefitsandclaims.................................... 13,806 13,367 12,776

Interestcreditedtopolicyholderaccountbalances ........................ 3,094 2,593 1,652

Policyholderdividends .......................................... — — 1

Otherexpenses............................................... 2,438 2,314 2,229

Totalexpenses.............................................. 19,338 18,274 16,658

Incomefromcontinuingoperationsbeforeprovisionforincometax.............. 2,182 1,687 2,086

Provisionforincometax ......................................... 743 562 698

Incomefromcontinuingoperations .................................. 1,439 1,125 1,388

Incomefromdiscontinuedoperations,netofincometax .................... 10 42 174

Netincome ................................................ $ 1,449 $ 1,167 $ 1,562

Year ended December 31, 2007 compared with the year ended December 31, 2006 — Institutional

Income from Continuing Operations

Income from continuing operations increased $314 million, or 28%, to $1,439 million for the year ended December 31, 2007 from

$1,125 million for the comparable 2006 period.

Included in this increase are higher earnings of $33 million, net of income tax, from lower net investment losses. In addition, higher

earnings of $11 million, net of income tax, resulted from an increase in policyholder benefits and claims related to net investment gains

(losses). Excluding the impact of net investment gains (losses), income from continuing operations increased by $270 million, net of

income tax, compared to the prior year.

Interest margins increased $229 million, net of income tax, compared to the prior year. Management attributes this increase to a

$146 million increase in retirement & savings, a $46 million increase in group life and a $37 million increase in non-medical health and

other, respectively, all net of income tax. Interest margin is the difference between interest earned and interest credited to policyholder

account balances. Interest earned approximates net investment income on investable assets attributed to the segment with minor

adjustments related to the consolidation of certain separate accounts and other minor non-policyholder elements. Interest credited is the

amount attributed to insurance products, recorded in policyholder benefits and claims, and the amount credited to policyholder account

balances for investment-type products, recorded in interest credited to policyholder account balances. Interest credited on insurance

products reflects the current year impact of the interest rate assumptions established at issuance or acquisition. Interest credited to

policyholder account balances is subject to contractual terms, including some minimum guarantees. This tends to move gradually over

time to reflect market interest rate movements, and may reflect actions by management to respond to competitive pressures and,

therefore, generally does not introduce volatility in expense.

An increase in underwriting results of $89 million, net of income tax, compared to the prior year, contributed to the increase in income

from continuing operations. Management attributes this increase primarily to the non-medical health & other, group life and retirement &

savings businesses with increases of $65 million, $16 million and $8 million, all net of income tax, respectively.

Underwriting results are generally the difference between the portion of premium and fee income intended to cover mortality, morbidity,

or other insurance costs less claims incurred, and the change in insurance-related liabilities. Underwriting results are significantly

influenced by mortality, morbidity, or other insurance-related experience trends, as well as the reinsurance activity related to certain

blocks of business. Consequently, results can fluctuate from period to period.

Partially offsetting this increase in income from continuing operations were higher expenses related to an increase in non-deferrable

volume-related expenses and corporate support expenses of $72 million, net of income tax, as well as an increase in DAC amortization of

$44 million, net of income tax, primarily due to a $40 million, net of income tax, charge due to the ongoing impact on DAC and VOBA

amortization resulting from the implementation of SOP 05-1 in the current year. This increase in expense was partially offset by the impact

of certain revisions in both years for a net decrease of $34 million, net of income tax. The remaining increase in operating expenses was

more than offset by the remaining increase in premiums, fees, and other revenues.

Revenues

Total revenues, excluding net investment gains (losses), increased by $1,508 million, or 7%, to $22,100 million for the year ended

December 31, 2007 from $20,592 million for the comparable 2006 period.

23MetLife, Inc.