MetLife 2007 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 2007 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

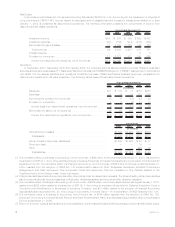

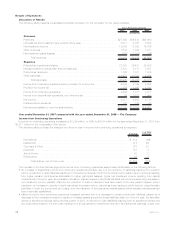

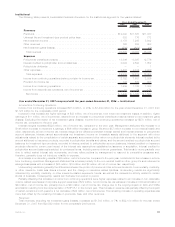

Results of Operations

Discussion of Results

The following table presents consolidated financial information for the Company for the years indicated:

2007 2006 2005

Years Ended December 31,

(In millions)

Revenues

Premiums................................................... $27,895 $26,412 $24,860

Universallifeandinvestment-typeproductpolicyfees...................... 5,311 4,780 3,828

Netinvestmentincome.......................................... 19,006 17,082 14,756

Otherrevenues............................................... 1,533 1,362 1,271

Netinvestmentgains(losses)...................................... (738) (1,382) (86)

Totalrevenues ........................................... 53,007 48,254 44,629

Expenses

Policyholderbenefitsandclaims.................................... 27,828 26,431 25,506

Interestcreditedtopolicyholderaccountbalances ........................ 5,741 5,171 3,887

Policyholderdividends .......................................... 1,726 1,701 1,679

Otherexpenses............................................... 11,673 10,783 9,264

Totalexpenses........................................... 46,968 44,086 40,336

Incomefromcontinuingoperationsbeforeprovisionforincometax.............. 6,039 4,168 4,293

Provisionforincometax ......................................... 1,759 1,097 1,222

Incomefromcontinuingoperations .................................. 4,280 3,071 3,071

Incomefromdiscontinuedoperations,netofincometax .................... 37 3,222 1,643

Netincome.................................................. 4,317 6,293 4,714

Preferredstockdividends ........................................ 137 134 63

Netincomeavailabletocommonshareholders........................... $ 4,180 $ 6,159 $ 4,651

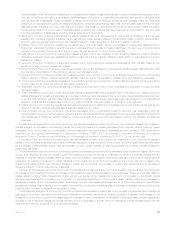

Year ended December 31, 2007 compared with the year ended December 31, 2006 — The Company

Income from Continuing Operations

Income from continuing operations increased by $1,209 million, or 39%, to $4,280 million for the year ended December 31, 2007 from

$3,071 million for the comparable 2006 period.

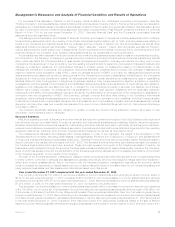

The following table provides the change from the prior year in income from continuing operations by segment:

$ Change %ofTotal

$ Change

(In millions)

International ....................................................... $ 472 39%

Institutional........................................................ 314 26

Corporate&Other ................................................... 278 23

Individual ......................................................... 110 9

Auto&Home....................................................... 20 2

Reinsurance....................................................... 15 1

Totalchange,netofincometax ...................................... $1,209 100%

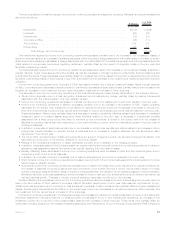

The increase in the International segment’s income from continuing operations was primarily attributable to the following factors:

• An increase in Argentina’s income from continuing operations primarily due to a net reduction of liabilities resulting from pension

reform, a reduction in claim liabilities resulting from experience reviews in both the current and prior years, higher premiums resulting

from higher pension contributions attributable to higher participant salaries, higher net investment income resulting from capital

contributions in the prior year, and a smaller increase in market indexed policyholder liabilities without a corresponding decrease in

net investment income, partially offset by the reduction of cost of insurance fees as a result of the new pension system reform

regulation, an increase in retention incentives related to pension reform, as well as lower trading portfolio income. Argentina also

benefited, in both the current and prior years, from the utilization of tax loss carryforwards against which valuation allowances had

been previously established.

• Mexico’s income from continuing operations increased primarily due to a decrease in certain policyholder liabilities caused by a

decrease in the unrealized investment results on invested assets supporting those liabilities relative to the prior year, the favorable

impact of experience refunds during the first quarter of 2007, a reduction in claim liabilities resulting from an experience review and

the unfavorable impact in the prior year resulting from an adjustment to experience refunds in its institutional business, a year over

14 MetLife, Inc.