MetLife 2007 Annual Report Download - page 30

Download and view the complete annual report

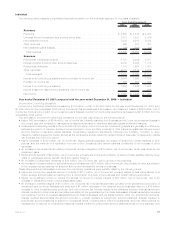

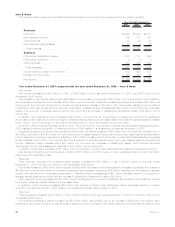

Please find page 30 of the 2007 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.increase. Excluding the impact of the Travelers acquisition, total expenses increased $1,065 million, or 6%, from the comparable 2005

period.

The increase in expenses was attributable to higher interest credited to policyholder account balances of $621 million, policyholder

benefits and claims of $366 million and operating expenses of $79 million.

Management attributes the increase of $621 million in interest credited to policyholder account balances to $433 million from an

increase in average crediting rates, which was largely due to the impact of higher short-term rates in the current year period and

$188 million solely from growth in the average policyholder account balances, primarily resulting from GICs within the retirement & savings

business.

The increases in policyholder benefits and claims of $366 million included a $27 million increase related to net investment gains

(losses). Excluding the increase related to net investment gains (losses), policyholder benefits and claims increased by $339 million. Non-

medical health & other’s policyholder benefits and claims increased by $306 million, predominantly due to the aforementioned growth in

business, as well as unfavorable morbidity in disability and unfavorable claim experience in AD&D. Partially offsetting these increases was

favorable claim and morbidity experience in IDI, as well as the impact of an establishment of a $25 million liability for future losses in the

prior year. In addition, favorable claim experience in the current year reduced dental policyholder benefits and claims. Additionally, disability

business included a $22 million benefit which resulted from reserve refinements in the current year. The year over year variance in disability

also includes the impact of an $18 million loss related to Hurricane Katrina in the prior year. Group life’s policyholder benefits and claims

increased by $238 million, largely due to the aforementioned growth in the business, partially offset by favorable underwriting results,

particularly in the term life business. Term life included a benefit of $16 million due to reserve refinements in the current year. Partially

offsetting the increase was a retirement & savings’ policyholder benefits and claims decrease of $205 million, predominantly due to the

aforementioned decrease in revenues, partially offset by higher FAS 60 interest credits recorded in policyholder benefits and claims due to

growth in structured settlements and MTF.

The increase in other expenses of $79 million was primarily due to an increase in the current year of $60 million in non-deferrable

volume related expenses and corporate support expenses. Non-deferrable volume related expenses include those expenses associated

with information technology, direct departmental spending and commission expenses. Corporate support expenses include advertising,

corporate overhead and consulting fees. Also contributing to the increase was $26 million associated with costs related to the sale of

certain small market recordkeeping businesses, $23 million of non-deferrable LTC commission expense, $24 million related to costs

associated with a previously announced regulatory settlement and $11 million related to stock-based compensation. Partially offsetting

these increases were benefits due to prior year charges of $43 million in Travelers-related integration costs, principally incentive accruals

and $22 million related to an adjustment of DAC for certain LTC products.

26 MetLife, Inc.