MetLife 2007 Annual Report Download - page 118

Download and view the complete annual report

Please find page 118 of the 2007 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Nos. FAS 115-1 and FAS 124-1, The Meaning of Other-Than-Temporary Impairment and its Application to Certain Investments

(“FSP 115-1”), which nullifies the accounting guidance on the determination of whether an investment is other-than-temporarily impaired

as set forth in EITF 03-1. As required by FSP 115-1, the Company adopted this guidance on a prospective basis, which had no material

impact on the Company’s consolidated financial statements, and has provided the required disclosures.

In December 2004, the FASB issued FSP No. FAS 109-2, Accounting and Disclosure Guidance for the Foreign Earnings Repatriation

Provision within the American Jobs Creation Act of 2004 (“FSP 109-2”). The American Jobs Creation Act of 2004 (“AJCA”) introduced a

one-time dividend received deduction on the repatriation of certain earnings to a U.S. taxpayer. FSP 109-2 provides companies additional

time beyond the financial reporting period of enactment to evaluate the effects of the AJCA on their plans to repatriate foreign earnings for

purposes of applying SFAS No. 109, Accounting for Income Taxes. During 2005, the Company recorded a $27 million income tax benefit

related to the repatriation of foreign earnings pursuant to Internal Revenue Code Section 965 for which a U.S. deferred income tax

provision had previously been recorded. As of January 1, 2006, the repatriation provision of the AJCA no longer applies to the Company.

Future Adoption of New Accounting Pronouncements

Fair Value

In September 2006, the FASB issued SFAS No. 157, Fair Value Measurements (“SFAS 157”). SFAS 157 defines fair value, establishes a

framework for measuring fair value and requires enhanced disclosures about fair value measurements. Effective January 1, 2008, the

Company adopted SFAS 157 and applied the provisions of the statement prospectively to assets and liabilities measured and disclosed at

fair value. In addition to new disclosure requirements, the adoption of SFAS 157 changes the valuation of certain freestanding derivatives

by moving from a mid to bid pricing convention as well as changing the valuation of embedded derivatives associated with annuity

contracts. The change in valuation of embedded derivatives associated with annuity contracts results from the incorporation of risk margins

and the Company’s own credit standing in their valuation. While the Company does not expect such changes in valuation to have a material

impact on the Company’s financial statements at January 1, 2008, the addition of risk margins and the Company’s own credit spread in the

valuation of embedded derivatives associated with annuity contracts may result in significant volatility in the Company’s consolidated net

income.

In February 2007, the FASB issued SFAS No. 159, The Fair Value Option for Financial Assets and Financial Liabilities (“SFAS 159”).

SFAS 159 permits entities the option to measure most financial instruments and certain other items at fair value at specified election dates

and to report related unrealized gains and losses in earnings. The fair value option is generally applied on an instrument-by-instrument

basis and is generally an irrevocable election. Effective January 1, 2008, the Company has elected the fair value option on fixed maturity

securities backing certain pension products sold in Brazil. Previously, these fixed maturity securities were accounted for as availa-

ble-for-sale securities in accordance with FAS 115. The Company’s insurance joint venture in Japan also elected the fair value option for its

single premium deferred annuities and supporting assets. These elections are not expected to have a material impact on the Company’s

retained earnings or equity as of January 1, 2008.

In June 2007, the AICPA issued SOP 07-1, Clarification of the Scope of the Audit and Accounting Guide Investment Companies and

Accounting by Parent Companies and Equity Method Investors for Investments in Investment Companies (“SOP 07-1”) . Upon adoption of

SOP 07-1, the Company must also adopt the provisions of FASB Staff Position No. FSP FIN 46(r)-7, Application of FASB Interpretation

No. 46 to Investment Companies (“FSP FIN 46(r)-7”), which permanently exempts investment companies from applying the provisions of

FIN No. 46(r), Consolidation of Variable Interest Entities — An Interpretation of Accounting Research Bulletin No. 51, and its December

2003 revision (“FIN 46(r)”) to investments carried at fair value. SOP 07-1 provides guidance for determining whether an entity falls within the

scope of the AICPA Audit and Accounting Guide Investment Companies and whether investment company accounting should be retained

by a parent company upon consolidation of an investment company subsidiary or by an equity method investor in an investment company.

In certain circumstances, SOP 07-1 precludes retention of specialized accounting for investment companies (i.e., fair value accounting),

when similar direct investments exist in the consolidated group and are measured on a basis inconsistent with that applied to investment

companies. Additionally, SOP 07-1 precludes retention of specialized accounting for investment companies if the reporting entity does not

distinguish through documented policies the nature and type of investments to be held in the investment companies from those made in

the consolidated group where other accounting guidance is being applied. In February 2008, the FASB issued FSP No. SOP 7-1-1,

Effective Date of AICPA Statement of Position 07-1, which delays indefinitely the effective date of SOP 07-1. The Company is closely

monitoring further FASB developments.

In May 2007, the FASB issued FSP No. FIN 39-1, Amendment of FASB Interpretation No. 39 (“FSP 39-1”). FSP 39-1 amends FIN No. 39,

Offsetting of Amounts Related to Certain Contracts (“FIN 39”), to permit a reporting entity to offset fair value amounts recognized for the

right to reclaim cash collateral (a receivable) or the obligation to return cash collateral (a payable) against fair value amounts recognized for

derivative instruments executed with the same counterparty under the same master netting arrangement that have been offset in

accordance with FIN 39. FSP 39-1 also amends FIN 39 for certain terminology modifications. FSP 39-1 applies to fiscal years beginning

after November 15, 2007. FSP 39-1 will be applied retrospectively, unless it is impracticable to do so. Upon adoption of FSP 39-1, the

Company is permitted to change its accounting policy to offset or not offset fair value amounts recognized for derivative instruments under

master netting arrangements. The adoption of FSP 39-1 will not have an impact on the Company’s financial statements.

Business Combinations

In December 2007, the FASB issued SFAS No. 141 (revised 2007), Business Combinations — A Replacement of FASB Statement

No. 141 (“SFAS 141(r)”) and SFAS No. 160, Noncontrolling Interests in Consolidated Financial Statements — An Amendment of ARB

No. 51 (“SFAS 160”) which are effective for fiscal years beginning after December 15, 2008. Under SFAS 141(r) and SFAS 160:

• All business combinations (whether full, partial, or “step” acquisitions) result in all assets and liabilities of an acquired business being

recorded at fair value, with limited exceptions.

F-22 MetLife, Inc.

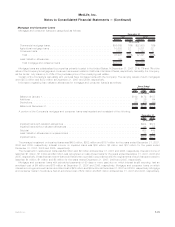

MetLife, Inc.

Notes to Consolidated Financial Statements — (Continued)