MetLife 2007 Annual Report Download - page 167

Download and view the complete annual report

Please find page 167 of the 2007 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

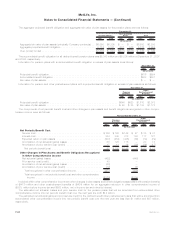

expense related to LTPCP was recognized during the year ended December 31, 2007. Compensation expense of $14 million and

$46 million, related to LTPCP Opportunity Awards was recognized for the years ended December 31, 2006 and 2005, respectively.

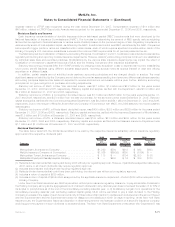

StatutoryEquityandIncome

Each insurance company’s state of domicile imposes minimum risk-based capital (“RBC”) requirements that were developed by the

National Association of Insurance Commissioners (“NAIC”). The formulas for determining the amount of RBC specify various weighting

factors that are applied to financial balances or various levels of activity based on the perceived degree of risk. Regulatory compliance is

determined by a ratio of total adjusted capital, as defined by the NAIC, to authorized control level RBC, as defined by the NAIC. Companies

below specific trigger points or ratios are classified within certain levels, each of which requires specified corrective action. Each of the

Holding Company’s U.S. insurance subsidiaries exceeded the minimum RBC requirements for all periods presented herein.

The NAIC adopted the Codification of Statutory Accounting Principles (“Codification”) in 2001. Codification was intended to standardize

regulatory accounting and reporting to state insurance departments. However, statutory accounting principles continue to be established

by individual state laws and permitted practices. Modifications by the various state insurance departments may impact the effect of

Codification on the statutory capital and surplus of MLIC and the Holding Company’s other insurance subsidiaries.

Statutory accounting principles differ from GAAP primarily by charging policy acquisition costs to expense as incurred, establishing

future policy benefit liabilities using different actuarial assumptions, reporting surplus notes as surplus instead of debt and valuing

securities on a different basis.

In addition, certain assets are not admitted under statutory accounting principles and are charged directly to surplus. The most

significant assets not admitted by the Company are net deferred income tax assets resulting from temporary differences between statutory

accounting principles basis and tax basis not expected to reverse and become recoverable within a year. Further, statutory accounting

principles do not give recognition to purchase accounting adjustments.

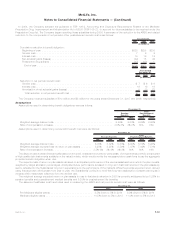

Statutory net income of MLIC, a New York domiciled insurer, was $2.1 billion, $1.0 billion and $2.2 billion for the years ended

December 31, 2007, 2006 and 2005, respectively. Statutory capital and surplus, as filed with the Department, was $13.0 billion and

$9.2 billion at December 31, 2007 and 2006, respectively.

Statutory net income of MICC, a Connecticut domiciled insurer, was $1.1 billion and $856 million for the years ended December 31,

2007 and 2006, respectively, and $470 million from the date of purchase, for the six month period ended December 31, 2005. Statutory

capital and surplus, as filed with the Connecticut Insurance Department, was $4.2 billion and $4.1 billion at December 31, 2007 and 2006,

respectively. Due to the merger of MetLife Life and Annuity Company of Connecticut with MICC, the 2006 statutory net income balance

was adjusted.

Statutory net income of MPC, a Rhode Island domiciled insurer, was $400 million, $385 million and $289 million for the years ended

December 31, 2007, 2006 and 2005, respectively. Statutory capital and surplus, as filed with the Insurance Department of Rhode Island,

was $1.8 billion and $1.9 billion at December 31, 2007 and 2006, respectively.

Statutory net income of MTL, a Delaware domiciled insurer, was $103 million, $2.8 billion and $353 million for the years ended

December 31, 2007, 2006 and 2005, respectively. Statutory capital and surplus, as filed with the Delaware Insurance Department was

$1.1 billion and $1.0 billion as of December 31, 2007 and 2006, respectively.

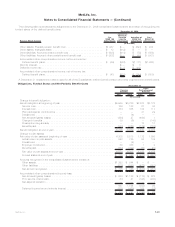

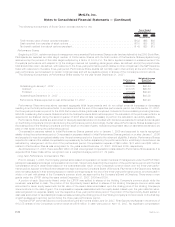

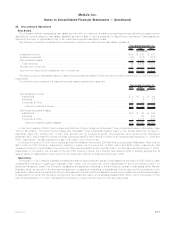

Dividend Restrictions

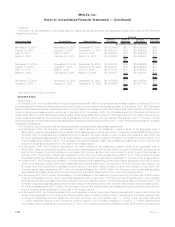

The table below sets forth the dividends permitted to be paid by the respective insurance subsidiary without insurance regulatory

approval and the respective dividends paid:

Company

Permitted

w/o

Approval(1) Paid(2)

Permitted

w/o

Approval(3) Paid(2)

Permitted

w/o

Approval(3)

2008 2007 2006

(In millions)

MetropolitanLifeInsuranceCompany...................... $1,299 $500 $919 $ 863 $863

MetLifeInsuranceCompanyofConnecticut.................. $1,026 $690(5) $690 $ 917(4) $ —

MetropolitanTowerLifeInsuranceCompany ................. $ 113 $ — $104 $2,300 $ 85

Metropolitan Property and CasualtyInsuranceCompany ............... $ — $400 $ 16 $ 300 $178

(1) Reflects dividend amounts that may be paid during 2008 without prior regulatory approval. However, if paid before a specified date during

2008, some or all of such dividends may require regulatory approval.

(2) Includes amounts paid including those requiring regulatory approval.

(3) Reflects dividend amounts that could have been paid during the relevant year without prior regulatory approval.

(4) Includes a return of capital of $259 million.

(5) Includes a return of capital of $404 million as approved by the applicable insurance department, of which $350 million was paid to the

Holding Company.

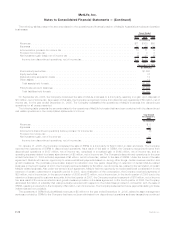

Under New York State Insurance Law, MLIC is permitted, without prior insurance regulatory clearance, to pay stockholder dividends to

the Holding Company as long as the aggregate amount of all such dividends in any calendar year does not exceed the lesser of: (i) 10% of

its surplus to policyholders as of the end of the immediately preceding calendar year; or (ii) its statutory net gain from operations for the

immediately preceding calendar year (excluding realized capital gains). MLIC will be permitted to pay a cash dividend to the Holding

Company in excess of the lesser of such two amounts only if it files notice of its intention to declare such a dividend and the amount thereof

with the Superintendent and the Superintendent does not disapprove the distribution within 30 days of its filing. Under New York State

Insurance Law, the Superintendent has broad discretion in determining whether the financial condition of a stock life insurance company

would support the payment of such dividends to its shareholders. The New York State Department of Insurance (the “Department”) has

F-71MetLife, Inc.

MetLife, Inc.

Notes to Consolidated Financial Statements — (Continued)