MetLife 2007 Annual Report Download - page 171

Download and view the complete annual report

Please find page 171 of the 2007 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Corporate & Other contains the excess capital not allocated to the business segments, various start-up entities, MetLife Bank and run-

off entities, as well as interest expense related to the majority of the Company’s outstanding debt and expenses associated with certain

legal proceedings and income tax audit issues. Corporate & Other also includes the elimination of all intersegment amounts, which

generally relate to intersegment loans, which bear interest rates commensurate with related borrowings, as well as intersegment

transactions. Additionally, the Company’s asset management business, including amounts reported as discontinued operations, is

included in the results of operations for Corporate & Other. See Note 23 for disclosures regarding discontinued operations, including

real estate.

Economic capital is an internally developed risk capital model, the purpose of which is to measure the risk in the business and to provide

a basis upon which capital is deployed. The economic capital model accounts for the unique and specific nature of the risks inherent in

MetLife’s businesses. As a part of the economic capital process, a portion of net investment income is credited to the segments based on

the level of allocated equity.

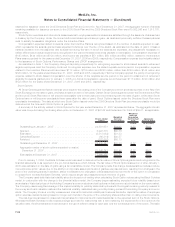

Set forth in the tables below is certain financial information with respect to the Company’s segments, as well as Corporate & Other, for

the years ended December 31, 2007, 2006 and 2005. The accounting policies of the segments are the same as those of the Company,

except for the method of capital allocation and the accounting for gains (losses) from intercompany sales, which are eliminated in

consolidation. The Company allocates equity to each segment based upon the economic capital model that allows the Company to

effectively manage its capital. The Company evaluates the performance of each segment based upon net income excluding net investment

gains (losses), net of income tax, adjustments related to net investment gains (losses), net of income tax, the impact from the cumulative

effect of changes in accounting, net of income tax and discontinued operations, other than discontinued real estate, net of income tax,

less preferred stock dividends. The Company allocates certain non-recurring items, such as expenses associated with certain legal

proceedings, to Corporate & Other.

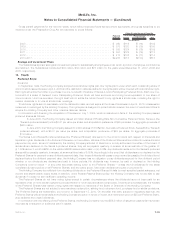

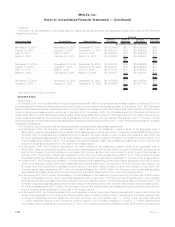

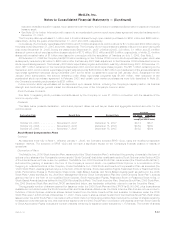

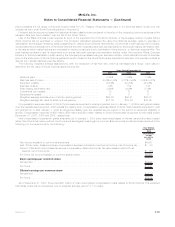

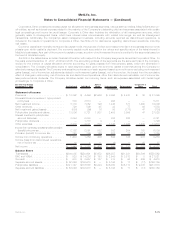

For the Year Ended

December 31, 2007 Institutional Individual Auto &

Home International Reinsurance Corporate &

Other Total

(In millions)

Statement of Income:

Premiums ....................... $ 12,392 $ 4,496 $2,966 $ 3,096 $ 4,910 $ 35 $ 27,895

Universal life and investment- type product

policyfees ..................... 803 3,513 — 995 — — 5,311

Net investment income . . . . . . . . . . . . . . . 8,179 7,052 196 1,248 871 1,460 19,006

Otherrevenues.................... 726 599 45 23 77 63 1,533

Net investment gains (losses) . . . . . . . . . . . (580) (99) 16 55 (177) 47 (738)

Policyholder benefits and claims . . . . . . . . . 13,806 5,721 1,807 2,458 3,989 47 27,828

Interest credited to policyholder

account balances . . . . . . . . . . . . . . . . . 3,094 2,030 — 355 262 — 5,741

Policyholderdividends ............... — 1,718 4 4 — — 1,726

Other expenses. . . . . . . . . . . . . . . . . . . . 2,438 4,031 830 1,748 1,226 1,400 11,673

Income from continuing operations before provision

(benefit) for income tax . . . . . . . . . . . . . . . . 2,182 2,061 582 852 204 158 6,039

Provision (benefit) for income tax. . . . . . . . . 743 705 146 208 71 (114) 1,759

Income from continuing operations . . . . . . . 1,439 1,356 436 644 133 272 4,280

Income (loss) from discontinued operations,

netofincometax ................. 10 1 — (9) — 35 37

Netincome ...................... $ 1,449 $ 1,357 $ 436 $ 635 $ 133 $ 307 $ 4,317

Balance Sheet:

Total assets . . . . . . . . . . . . . . . . . . . . . . $204,005 $250,691 $5,672 $26,357 $21,331 $50,506 $558,562

DAC and VOBA . . . . . . . . . . . . . . . . . . . . $ 923 $ 14,236 $ 193 $ 2,648 $ 3,513 $ 8 $ 21,521

Goodwill ........................ $ 978 $ 2,957 $ 157 $ 313 $ 96 $ 409 $ 4,910

Separate account assets. . . . . . . . . . . . . . $ 52,046 $102,918 $ — $ 5,195 $ 17 $ (17) $160,159

Policyholder liabilities . . . . . . . . . . . . . . . . $121,147 $116,568 $3,324 $16,083 $15,113 $ 9,335 $281,570

Separate account liabilities . . . . . . . . . . . . $ 52,046 $102,918 $ — $ 5,195 $ 17 $ (17) $160,159

F-75MetLife, Inc.

MetLife, Inc.

Notes to Consolidated Financial Statements — (Continued)