MetLife 2007 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2007 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

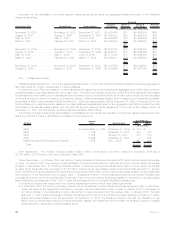

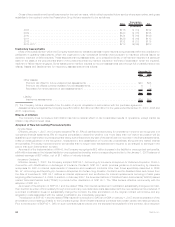

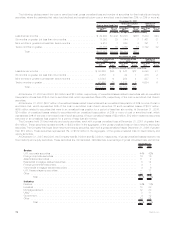

Gross other postretirement benefit payments for the next ten years, which reflect expected future service where appropriate, and gross

subsidies to be received under the Prescription Drug Act are expected to be as follows:

Gross Prescription

Drug Subsidies Net

(In millions)

2008 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $116 $ (14) $102

2009 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $120 $ (15) $105

2010 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $124 $ (16) $109

2011 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $129 $ (16) $113

2012 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $132 $ (17) $115

2013-2017 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $713 $(100) $613

Insolvency Assessments

Most of the jurisdictions in which the Company is admitted to transact business require insurers doing business within the jurisdiction to

participate in guaranty associations, which are organized to pay contractual benefits owed pursuant to insurance policies issued by

impaired, insolvent or failed insurers. These associations levy assessments, up to prescribed limits, on all member insurers in a particular

state on the basis of the proportionate share of the premiums written by member insurers in the lines of business in which the impaired,

insolvent or failed insurer engaged. Some states permit member insurers to recover assessments paid through full or partial premium tax

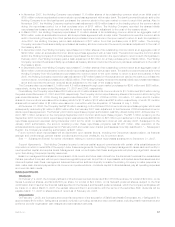

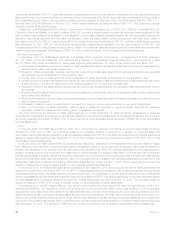

offsets. Assets and liabilities held for insolvency assessments are as follows:

2007 2006

December 31,

(In millions)

Other Assets:

Premiumtaxoffsetforfutureundiscountedassessments ............................... $40 $45

Premiumtaxoffsetscurrentlyavailableforpaidassessments............................. 6 7

Receivableforreimbursementofpaidassessments(1) ................................. 7 10

$53 $62

Liability:

Insolvencyassessments .................................................... $74 $90

(1) The Company holds a receivable from the seller of a prior acquisition in accordance with the purchase agreement.

Assessments levied against the Company were ($1) million, $2 million and $4 million for the years ended December 31, 2007, 2006 and

2005, respectively.

Effects of Inflation

The Company does not believe that inflation has had a material effect on its consolidated results of operations, except insofar as

inflation may affect interest rates.

Adoption of New Accounting Pronouncements

Income Taxes

Effective January 1, 2007, the Company adopted FIN 48. FIN 48 clarifies the accounting for uncertainty in income tax recognized in a

company’s financial statements. FIN 48 requires companies to determine whether it is “more likely than not” that a tax position will be

sustained upon examination by the appropriate taxing authorities before any part of the benefit can be recorded in the financial statements.

It also provides guidance on the recognition, measurement, and classification of income tax uncertainties, along with any related interest

and penalties. Previously recorded income tax benefits that no longer meet this standard are required to be charged to earnings in the

period that such determination is made.

As a result of the implementation of FIN 48, the Company recognized a $52 million increase in the liability for unrecognized tax benefits,

a $4 million decrease in the interest liability for unrecognized tax benefits, and a corresponding reduction to the January 1, 2007 balance of

retained earnings of $37 million, net of $11 million of minority interest.

Insurance Contracts

Effective January 1, 2007, the Company adopted SOP 05-1, Accounting by Insurance Enterprises for Deferred Acquisition Costs in

Connection with Modifications or Exchanges of Insurance Contracts. SOP 05-1 which provides guidance on accounting by insurance

enterprises for DAC on internal replacements of insurance and investment contracts other than those specifically described in SFAS

No. 97, Accounting and Reporting by Insurance Enterprises for Certain Long-Duration Contracts and for Realized Gains and Losses from

the Sale of Investments. SOP 05-1 defines an internal replacement and is effective for internal replacements occurring in fiscal years

beginning after December 15, 2006. In addition, in February 2007, the American Institute of Certified Public Accountants (“AICPA”) issued

related Technical Practice Aids (“TPAs”) to provide further clarification of SOP 05-1. The TPAs became effective concurrently with the

adoption of SOP 05-1.

As a result of the adoption of SOP 05-1 and the related TPAs, if an internal replacement modification substantially changes a contract,

then the DAC is written off immediately through income and any new deferrable costs associated with the new replacement are deferred. If

a contract modification does not substantially change the contract, the DAC amortization on the original contract will continue and any

acquisition costs associated with the related modification are immediately expensed.

The adoption of SOP 05-1 and the related TPAs resulted in a reduction to DAC and VOBA on January 1, 2007 and an acceleration of the

amortization period relating primarily to the Company’s group life and health insurance contracts that contain certain rate reset provisions.

PriortotheadoptionofSOP05-1,DAConsuchcontractswasamortized over the expected renewable life of the contract. Upon adoption

66 MetLife, Inc.