MetLife 2007 Annual Report Download - page 123

Download and view the complete annual report

Please find page 123 of the 2007 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

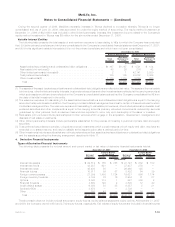

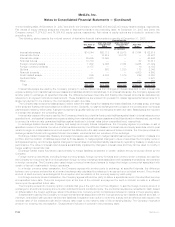

Estimated

Fair

Value

Gross

Unrealized

Loss

Estimated

Fair

Value

Gross

Unrealized

Loss

Estimated

Fair

Value

Gross

Unrealized

Loss

Less than 12 months Equal to or Greater than

12 months Total

December 31, 2006

(In millions, except number of securities)

U.S.corporatesecurities......................... $17,537 $285 $16,780 $ 698 $ 34,317 $ 983

Residential mortgage-backed securities . . . . . . . . . . . . . . . . 15,300 78 13,640 243 28,940 321

Foreign corporate securities . . . . . . . . . . . . . . . . . . . . . . . 6,401 102 7,277 276 13,678 378

U.S. Treasury/agency securities . . . . . . . . . . . . . . . . . . . . . 15,006 157 1,560 91 16,566 248

Commercial mortgage-backed securities . . . . . . . . . . . . . . . 4,960 30 4,029 108 8,989 138

Foreigngovernmentsecurities...................... 1,160 18 507 16 1,667 34

Asset-backedsecurities.......................... 4,519 31 1,077 22 5,596 53

State and political subdivision securities . . . . . . . . . . . . . . . 334 12 532 39 866 51

Otherfixedmaturitysecurities...................... 146 77 4 — 150 77

Total fixed maturity securities . . . . . . . . . . . . . . . . . . . . . $65,363 $790 $45,406 $1,493 $110,769 $2,283

Equitysecurities............................... $ 832 $ 20 $ 567 $ 25 $ 1,399 $ 45

Total number of securities in an unrealized loss position . . . . . 10,529 4,640

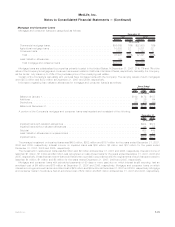

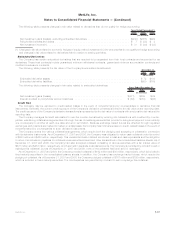

Aging of Gross Unrealized Loss for Fixed Maturity and Equity Securities Available-for-Sale

The following tables present the cost or amortized cost, gross unrealized loss and number of securities for fixed maturity and equity

securities, where the estimated fair value had declined and remained below cost or amortized cost by less than 20%, or 20% or more at:

Less than

20% 20% or

more Less than

20% 20% or

more Less than

20% 20% or

more

Cost or Amortized

Cost Gross Unrealized

Loss Number of

Securities

December 31, 2007

(In millions, except number of securities)

Lessthansixmonths............................ $ 49,463 $1,943 $1,670 $555 6,339 644

Six months or greater but less than nine months . . . . . . . . . . 17,353 23 844 7 1,461 31

Nine months or greater but less than twelve months . . . . . . . . 9,410 7 568 2 791 1

Twelvemonthsorgreater.......................... 31,731 50 1,262 13 3,192 32

Total ..................................... $107,957 $2,023 $4,344 $577

Less than

20% 20% or

more Less than

20% 20% or

more Less than

20% 20% or

more

Cost or Amortized

Cost Gross Unrealized

Loss Number of

Securities

December 31, 2006

(In millions, except number of securities)

Lessthansixmonths............................. $ 52,222 $35 $ 547 $12 9,093 81

Sixmonthsorgreaterbutlessthanninemonths ........... 2,682 3 42 1 415 2

Nine months or greater but less than twelve months . . . . . . . . . 12,049 14 204 4 937 1

Twelvemonthsorgreater .......................... 47,462 29 1,511 7 4,634 6

Total...................................... $114,415 $81 $2,304 $24

At December 31, 2007 and 2006, $4.3 billion and $2.3 billion, respectively, of unrealized losses related to securities with an unrealized

loss position of less than 20% of cost or amortized cost, which represented 4% and 2%, respectively, of the cost or amortized cost of such

securities.

At December 31, 2007, $577 million of unrealized losses related to securities with an unrealized loss position of 20% or more of cost or

amortized cost, which represented 29% of the cost or amortized cost of such securities. Of such unrealized losses of $577 million,

$555 million related to securities that were in an unrealized loss position for a period of less than six months. At December 31, 2006,

$24 million of unrealized losses related to securities with an unrealized loss position of 20% or more of cost or amortized cost, which

represented 30% of the cost or amortized cost of such securities. Of such unrealized losses of $24 million, $12 million related to securities

that were in an unrealized loss position for a period of less than six months.

The Company held 30 fixed maturity and equity securities, each with a gross unrealized loss at December 31, 2007 of greater than

$10 million. These securities represented 9%, or $459 million in the aggregate, of the gross unrealized loss on fixed maturity and equity

securities. The Company held eight fixed maturity and equity securities, each with a gross unrealized loss at December 31, 2006 of greater

than $10 million. These securities represented 7%, or $169 million in the aggregate, of the gross unrealized loss on fixed maturity and

equity securities.

F-27MetLife, Inc.

MetLife, Inc.

Notes to Consolidated Financial Statements — (Continued)