MetLife 2007 Annual Report Download - page 163

Download and view the complete annual report

Please find page 163 of the 2007 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

reduction of additional paid-in capital. Upon settlement with the bank, the Company increased additional paid-in capital and reduced

treasury stock.

• See Note 25 for further information with respect to an accelerated common stock repurchase agreement executed subsequent to

December 31, 2007.

The Company also repurchased 3.1 million and 4.6 million shares through open market purchases for $200 million and $268 million,

respectively, during the years ended December 31, 2007 and 2006, respectively.

Cumulatively, the Company repurchased 26.6 million and 8.6 million shares of its common stock for $1.7 billion and $500 million during

the years ended December 31, 2007 and 2006, respectively. The Company did not repurchase any shares of its common stock during the

year ended December 31, 2005. During the years ended December 31, 2007, 2006 and 2005, 3.9 million, 3.1 million and 25.0 million

shares of common stock were issued from treasury stock for $172 million, $102 million and $819 million, respectively, of which 22.4 million

shares with a market value of $1 billion were issued in connection with the acquisition of Travelers on July 1, 2005. See Note 2.

At December 31, 2006 the Company had $216 million remaining on the October 2004 common stock repurchase program which was

subsequently reduced by $8 million to $208 million after the February 2007 cash adjustment to the December 2006 accelerated common

stock repurchase agreement. The February 2007 stock repurchase program authorization was fully utilized during 2007. At December 31,

2007, $511 million remained on the Company’s September 2007 common stock repurchase program. The $511 million remaining on the

September 2007 common stock repurchase program was reduced by $450 million to $61 million upon settlement of the accelerated stock

repurchase agreement executed during December 2007 but for which no settlement occurred until January 2008. Subsequent to the

January 2008 authorization, the amount remaining under these repurchase programs was $1,061 million. After execution of the

accelerated stock repurchase agreement in February 2008 and certain open market purchases as more fully described in Note 25,

the Company’s remaining authorization is $261 million.

Future common stock repurchases will be dependent upon several factors, including the Company’s capital position, its financial

strength and credit ratings, general market conditions and the price of the Company’s common stock.

Stock Purchase Contracts

See Note 13 regarding stock purchase contracts issued by the Company on June 21, 2005 in connection with the issuance of the

common equity units.

Dividends

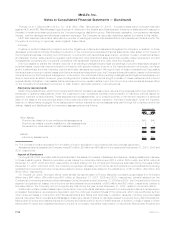

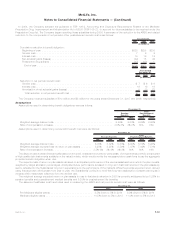

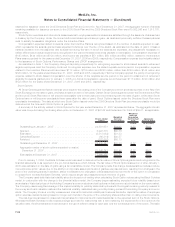

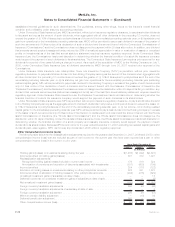

The table below presents declaration, record and payment dates, as well as per share and aggregate dividend amounts, for the

common stock:

Declaration Date Record Date Payment Date Per Share Aggregate

Dividend

(In millions,

except per share data)

October 23, 2007 . . . . . . . . . . November 6, 2007 December 14, 2007 $0.74 $541

October 24, 2006 . . . . . . . . . . November 6, 2006 December 15, 2006 $0.59 $450

October 25, 2005 . . . . . . . . . . November 7, 2005 December 15, 2005 $0.52 $394

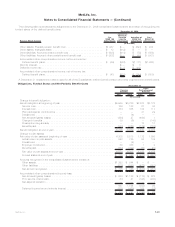

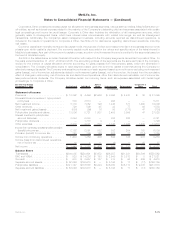

Stock-BasedCompensationPlans

Overview

As described more fully in Note 1, effective January 1, 2006, the Company adopted SFAS 123(r), using the modified prospective

transition method. The adoption of SFAS 123(r) did not have a significant impact on the Company’s financial position or results of

operations.

Description of Plans

The MetLife, Inc. 2000 Stock Incentive Plan, as amended (the “Stock Incentive Plan”), authorized the granting of awards in the form of

options to buy shares of the Company’s common stock (“Stock Options”) that either qualify as incentive Stock Options under Section 422A

of the Internal Revenue Code or are non-qualified. The MetLife, Inc. 2000 Directors Stock Plan, as amended (the “Directors Stock Plan”),

authorized the granting of awards in the form of the Company’s common stock, non-qualified Stock Options, or a combination of the

foregoing to outside Directors of the Company. Under the MetLife, Inc. 2005 Stock and Incentive Compensation Plan, as amended (the

“2005 Stock Plan”), awards granted may be in the form of Stock Options, Stock Appreciation Rights, Restricted Stock or Restricted Stock

Units, Performance Shares or Performance Share Units, Cash-Based Awards, and Stock-Based Awards (each as defined in the 2005

Stock Plan). Under the MetLife, Inc. 2005 Non-Management Director Stock Compensation Plan (the “2005 Directors Stock Plan”), awards

granted may be in the form of non-qualified Stock Options, Stock Appreciation Rights, Restricted Stock or Restricted Stock Units, or

Stock-Based Awards (each as defined in the 2005 Directors Stock Plan). The Stock Incentive Plan, Directors Stock Plan, 2005 Stock Plan,

the 2005 Directors Stock Plan and the LTPCP, as described below, are hereinafter collectively referred to as the “Incentive Plans.”

The aggregate number of shares reserved for issuance under the 2005 Stock Plan and the LTPCP is 68,000,000, plus those shares

available but not utilized under the Stock Incentive Plan and those shares utilized under the Stock Incentive Plan that are recovered due to

forfeiture of Stock Options. Additional shares carried forward from the Stock Incentive Plan and available for issuance under the 2005

Stock Plan were 12,506,003 as of December 31, 2007. There were no shares carried forward from the Directors Stock Plan. Each share

issued under the 2005 Stock Plan in connection with a Stock Option or Stock Appreciation Right reduces the number of shares remaining

for issuance under that plan by one, and each share issued under the 2005 Stock Plan in connection with awards other than Stock Options

or Stock Appreciation Rights reduces the number of shares remaining for issuance under that plan by 1.179 shares. The number of shares

F-67MetLife, Inc.

MetLife, Inc.

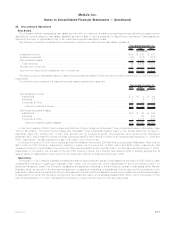

Notes to Consolidated Financial Statements — (Continued)