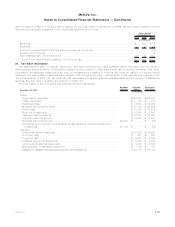

MetLife 2007 Annual Report Download - page 165

Download and view the complete annual report

Please find page 165 of the 2007 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

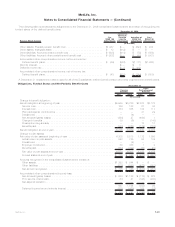

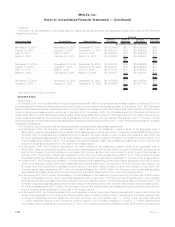

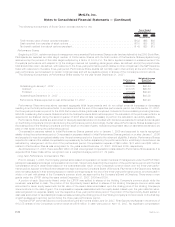

below presents the full range of imputed forward rates for U.S. Treasury Strips that was used in the binomial lattice model over the

contractual term of all Stock Options granted in the period.

Dividend yield is determined based on historical dividend distributions compared to the price of the underlying common stock as of the

valuation date and held constant over the life of the Stock Option.

Use of the Black-Scholes model requires an input of the expected life of the Stock Options, or the average number of years before

Stock Options will be exercised or expired. The Company estimated expected life using the historical average years to exercise or

cancellation and average remaining years outstanding for vested Stock Options. Alternatively, the binomial model used by the Company

incorporates the contractual term of the Stock Options and then considers expected exercise behavior and a post-vesting termination rate,

or the rate at which vested options are exercised or expire prematurely due to termination of employment, to derive an expected life. The

post-vesting termination rate is determined from actual historical exercise and expiration activity under the Incentive Plans. Exercise

behavior in the binomial lattice model used by the Company is expressed using an exercise multiple, which reflects the ratio of exercise

price to the strike price of Stock Options granted at which holders of the Stock Options are expected to exercise. The exercise multiple is

derived from actual historical exercise activity.

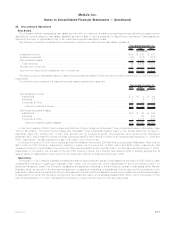

The following weighted average assumptions, with the exception of risk-free rate, which is expressed as a range, were used to

determine the fair value of Stock Options issued during the:

2007 2006 2005

Years Ended December 31,

Dividendyield ....................................... 0.94% 1.04% 1.19%

Risk-freerateofreturn.................................. 4.30%-5.32% 4.17%-4.96% 3.34%-5.41%

Expectedvolatility..................................... 19.54% 22.00% 23.24%

Exercisemultiple ..................................... 1.66 1.52 1.48

Post-vestingterminationrate.............................. 3.66% 4.09% 5.19%

Contractualterm(years)................................. 10 10 10

Expectedlife(years) ................................... 6 6 6

Weighted average exercise price of stock options granted. . . . . . . . . . . $62.86 $50.21 $38.70

Weighted average fair value of stock options granted . . . . . . . . . . . . . . $17.76 $13.84 $10.09

Compensation expense related to Stock Option awards expected to vest and granted prior to January 1, 2006 is recognized ratably

over the requisite service period, which equals the vesting term. Compensation expense related to Stock Option awards expected to vest

and granted on or after January 1, 2006 is recognized ratably over the requisite service period or the period to retirement eligibility, if

shorter. Compensation expense of $55 million, $56 million and $50 million related to Stock Options was recognized for the years ended

December 31, 2007, 2006 and 2005, respectively.

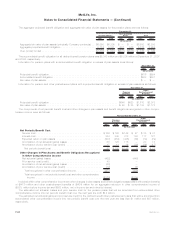

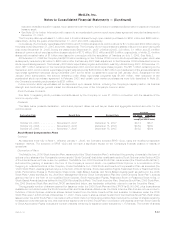

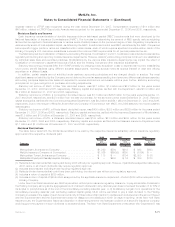

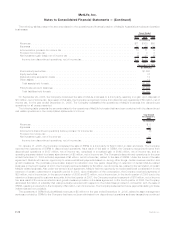

Had compensation expense for grants awarded prior to January 1, 2003 been determined based on the fair value at the date of grant

rather than the intrinsic value method, the Company’s earnings and earnings per common share amounts would have been reduced to the

following pro forma amounts for the following:

Year Ended

December 31,

2005

(In millions,

except

per share

data)

Netincomeavailabletocommonshareholders ............................................ $4,651

Add: Stock option-based employee compensation expense included in reported net income, net of income tax . . $ 33

Deduct: Total stock option-based employee compensation determined under fair value based method for all

awards,netofincometax........................................................ $ (35)

Proformanetincomeavailabletocommonshareholders...................................... $4,649

Basic earnings per common share

Asreported................................................................... $ 6.21

Proforma.................................................................... $ 6.21

Diluted earnings per common share

Asreported................................................................... $ 6.16

Proforma.................................................................... $ 6.15

As of December 31, 2007, there were $41 million of total unrecognized compensation costs related to Stock Options. It is expected

that these costs will be recognized over a weighted average period of 1.70 years.

F-69MetLife, Inc.

MetLife, Inc.

Notes to Consolidated Financial Statements — (Continued)