MetLife 2007 Annual Report Download - page 140

Download and view the complete annual report

Please find page 140 of the 2007 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

earnings of the closed block is greater than the expected cumulative earnings of the closed block, the Company will pay the excess of the

actual cumulative earnings of the closed block over the expected cumulative earnings to closed block policyholders as additional

policyholder dividends unless offset by future unfavorable experience of the closed block and, accordingly, will recognize only the

expected cumulative earnings in income with the excess recorded as a policyholder dividend obligation. If over such period, the actual

cumulative earnings of the closed block is less than the expected cumulative earnings of the closed block, the Company will recognize only

the actual earnings in income. However, the Company may change policyholder dividend scales in the future, which would be intended to

increase future actual earnings until the actual cumulative earnings equal the expected cumulative earnings.

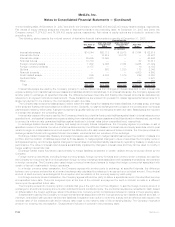

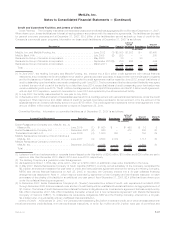

Information regarding the closed block liabilities and assets designated to the closed block is as follows:

2007 2006

December 31,

(In millions)

Closed Block Liabilities

Futurepolicybenefits............................................................. $43,362 $43,089

Otherpolicyholderfunds........................................................... 323 282

Policyholderdividendspayable....................................................... 709 701

Policyholderdividendobligation ...................................................... 789 1,063

Payablesforcollateralundersecuritiesloanedandothertransactions.............................. 5,610 6,483

Otherliabilities ................................................................. 290 192

Totalclosedblockliabilities........................................................ 51,083 51,810

Assets Designated to the Closed Block

Investments:

Fixed maturity securities available-for-sale, at estimated fair value (amortized cost: $29,631 and $30,286,

respectively)................................................................ 30,481 31,255

Equity securities available-for-sale, at estimated fair value (cost: $1,555 and $1,184, respectively) . . . . . . . . . 1,875 1,484

Mortgageloansonrealestate...................................................... 7,472 7,848

Policyloans.................................................................. 4,290 4,212

Realestateandrealestatejointventuresheld-for-investment.................................. 297 242

Short-terminvestments .......................................................... 14 62

Otherinvestedassets ........................................................... 829 644

Totalinvestments............................................................. 45,258 45,747

Cashandcashequivalents ......................................................... 333 255

Accruedinvestmentincome......................................................... 485 517

Deferredincometaxassets......................................................... 640 754

Premiumsandotherreceivables...................................................... 151 156

Totalassetsdesignatedtotheclosedblock............................................. 46,867 47,429

Excessofclosedblockliabilitiesoverassetsdesignatedtotheclosedblock......................... 4,216 4,381

Amounts included in accumulated other comprehensive income (loss):

Unrealized investment gains (losses), net of income tax of $424 and $457, respectively . . . . . . . . . . . . . . . . 751 812

Unrealized gains (losses) on derivative instruments, net of income tax of ($19) and ($18), respectively . . . . . . . (33) (32)

Allocated to policyholder dividend obligation, net of income tax of ($284) and ($381), respectively . . . . . . . . . . (505) (681)

Totalamountsincludedinaccumulatedothercomprehensiveincome(loss)......................... 213 99

Maximumfutureearningstoberecognizedfromclosedblockassetsandliabilities ..................... $ 4,429 $ 4,480

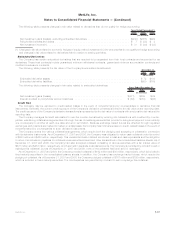

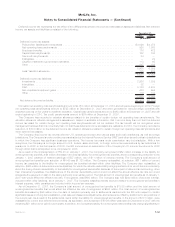

Information regarding the closed block policyholder dividend obligation is as follows:

2007 2006 2005

Years Ended December 31,

(In millions)

BalanceatJanuary1,.................................................. $1,063 $1,607 $2,243

Impactonrevenues,netofexpensesandincometax ............................. — (114) (9)

Changeinunrealizedinvestmentandderivativegains(losses)........................ (274) (430) (627)

BalanceatDecember31, ............................................... $ 789 $1,063 $1,607

F-44 MetLife, Inc.

MetLife, Inc.

Notes to Consolidated Financial Statements — (Continued)