MetLife 2007 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2007 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

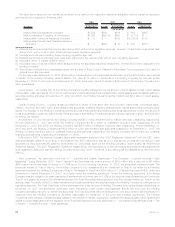

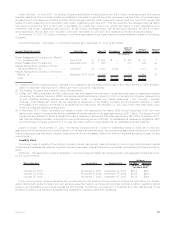

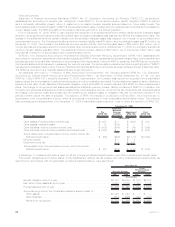

The table below sets forth the dividends permitted to be paid by the respective insurance subsidiary without insurance regulatory

approval and the respective dividends paid:

Company Permitted w/o

Approval(1) Paid(2) Permitted w/o

Approval(3) Paid(2) Permitted w/o

Approval(3)

200 8 2007 200 6

(In millions)

Metropolitan Life Insurance Company . . . . . . . . . . . . $1,299 $500 $919 $ 863 $863

MetLife Insurance Company of Connecticut . . . . . . . . $1,026 $690 (5) $690 $ 917 (4) $ —

MetropolitanTowerLifeInsuranceCompany........ $ 113 $ — $104 $2,300(6) $ 85

Metropolitan Property and Casualty Insurance

Company . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ — $400 $ 16 $ 300 $178

(1) Reflects dividend amounts that may be paid during 2008 without prior regulatory approval. However, if paid before a specified date

during 2008, some or all of such dividends may require regulatory approval.

(2) Includes amounts paid including those requiring regulatory approval.

(3) Reflects dividend amounts that could have been paid during the relevant year without prior regulatory approval.

(4) Includes a return of capital of $259 million.

(5) Includes a return of capital of $404 million as approved by the applicable insurance department, of which $350 million was paid to the

Holding Company.

(6) This dividend reflects the proceeds associated with the sale of Peter Cooper Village and Stuyvesant Town properties to be used for

general corporate purposes.

For the year ended December 31, 2007, $190 million in dividends from other subsidiaries were paid, of which $176 million were returns

of capital, to the Holding Company. MetLife Mexico S.A. paid $116 million in dividends to the Holding Company for the year ended

December 31, 2006. For the year ended December 31, 2006, there were returns of capital of $154 million to the Holding Company from

other subsidiaries.

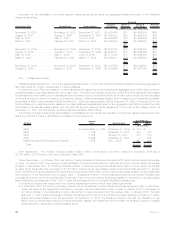

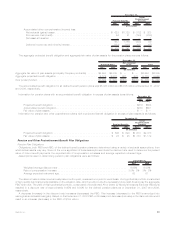

Liquid Assets. An integral part of the Holding Company’s liquidity management is the amount of liquid assets it holds. Liquid assets

include cash, cash equivalents, short-term investments and marketable fixed maturity securities. Liquid assets exclude assets relating to

securities lending activities. At December 31, 2007 and 2006, the Holding Company had $2.3 billion and $3.9 billion in liquid assets,

respectively.

Global Funding Sources. Liquidity is also provided by a variety of both short-term and long-term instruments, commercial paper,

medium- and long-term debt, junior subordinated debt securities, collateral financing arrangements, capital securities and stockholders’

equity. The diversity of the Holding Company’s funding sources enhances funding flexibility and limits dependence on any one source of

funds and generally lowers the cost of funds. Other sources of the Holding Company’s liquidity include programs for short- and long-term

borrowing, as needed.

At December 31, 2007 and 2006, the Holding Company had $310 million and $616 million in short-term debt outstanding, respectively.

At both December 31, 2007 and 2006, the Holding Company had $7.0 billion of unaffiliated long-term debt outstanding. At both

December 31, 2007 and 2006, the Holding Company had $500 million of affiliated long-term debt outstanding. At both December 31,

2007 and 2006, the Holding Company had $3.4 billion of junior subordinated debt securities outstanding. At December 31, 2007, the

Holding Company had $2.4 billion in collateral financing arrangements outstanding. The Holding Company did not have any collateral

financing arrangements outstanding at December 31, 2006.

In November 2007, the Holding Company filed a shelf registration statement (the “2007 Registration Statement”) with the SEC, which

was automatically effective upon filing, in accordance with SEC rules which also allow for pay-as-you-go fees and the ability to add

securities by filing automatically effective amendment for companies, such as the Holding Company, which qualify as “Well-Known

Seasoned Issuers.” The 2007 Registration Statement registered an unlimited amount of debt and equity securities and supersedes the

shelf registration statement that the Holding Company filed in April 2005. The terms of any offering will be established at the time of the

offering.

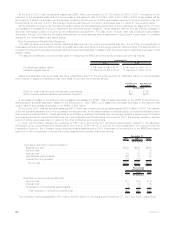

Debt Issuances. As described more fully in “— Liquidity and Capital Resources — The Company — Liquidity Sources — Debt

Issuances”, during December 2007, Trust IV issued Trust Securities with a face amount of $700 million and a discount of $6 million

($694 million) and a fixed rate of interest of 7.875% up to, but not including, December 15, 2037, the scheduled redemption date. The

beneficial interest of Trust IV held by the Holding Company is not represented by an investment in Trust IV but rather by a financing

agreement between the Holding Company and Trust IV. The assets of Trust IV are $700 million of 7.375% surplus notes of MLIC, which are

scheduled to mature December 15, 2037, and rights under the financing agreement. Under the financing agreement, the Holding

Company has the obligation to make payments (i) semiannually at a fixed rate of 0.50% of the surplus notes outstanding and owned by

Trust IV or if greater (ii) equal to the difference between the Trust Securities interest payment and the interest received by Trust IV on the

surplus notes. The ability of MLIC to make interest and principal payments on the surplus notes to the Holding Company is contingent upon

regulatory approval. The Trust Securities, will be exchanged into a like amount of Holding Company junior subordinated debentures on

December 15, 2037, the scheduled redemption date; mandatorily under certain circumstances; and at any time upon the Holding

Company exercising its option to redeem the securities. The Trust Securities will be exchanged for junior subordinated debentures prior to

repayment and the Holding Company is ultimately responsible for repayment of the junior subordinated debentures. The Holding

Company’s other rights and obligations as it relates to the deferral of interest, redemption, replacement capital obligation and replacement

capital covenant associated with the issuance of the Trust Securities are more fully described in “— Liquidity and Capital Resources — The

Company — Liquidity Sources — Debt Issuances.”

52 MetLife, Inc.