MetLife 2007 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2007 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.treatment under these accounting standards. If it was determined that hedge accounting designations were not appropriately applied,

reported net income could be materially affected. Differences in judgment as to the availability and application of hedge accounting

designations and the appropriate accounting treatment may result in a differing impact on the consolidated financial statements of the

Company from that previously reported.

Under a fair value hedge, changes in the fair value of the hedging derivative, including amounts measured as ineffectiveness, and

changes in the fair value of the hedged item related to the designated risk being hedged, are reported within net investment gains (losses).

The fair values of the hedging derivatives are exclusive of any accruals that are separately reported in the consolidated statement of income

within interest income or interest expense to match the location of the hedged item.

Under a cash flow hedge, changes in the fair value of the hedging derivative measured as effective are reported within other

comprehensive income (loss), a separate component of stockholders’ equity, and the deferred gains or losses on the derivative are

reclassified into the consolidated statement of income when the Company’s earnings are affected by the variability in cash flows of the

hedged item. Changes in the fair value of the hedging instrument measured as ineffectiveness are reported within net investment gains

(losses). The fair values of the hedging derivatives are exclusive of any accruals that are separately reported in the consolidated statement

of income within interest income or interest expense to match the location of the hedged item.

In a hedge of a net investment in a foreign operation, changes in the fair value of the hedging derivative that are measured as effective

are reported within other comprehensive income (loss) consistent with the translation adjustment for the hedged net investment in the

foreign operation. Changes in the fair value of the hedging instrument measured as ineffectiveness are reported within net investment gains

(losses).

The Company discontinues hedge accounting prospectively when: (i) it is determined that the derivative is no longer highly effective in

offsetting changes in the fair value or cash flows of a hedged item; (ii) the derivative expires, is sold, terminated, or exercised; (iii) it is no

longer probable that the hedged forecasted transaction will occur; (iv) a hedged firm commitment no longermeetsthedefinitionofafirm

commitment; or (v) the derivative is de-designated as a hedging instrument.

When hedge accounting is discontinued because it is determined that the derivative is not highly effective in offsetting changes in the

fair value or cash flows of a hedged item, the derivative continues to be carried on the consolidated balance sheet at its fair value, with

changes in fair value recognized currently in net investment gains (losses). The carrying value of the hedged recognized asset or liability

under a fair value hedge is no longer adjusted for changes in its fair value due to the hedged risk, and the cumulative adjustment to its

carrying value is amortized into income over the remaining life of the hedged item. Provided the hedged forecasted transaction is still

probable of occurrence, the changes in fair value of derivatives recorded in other comprehensive income (loss) related to discontinued

cash flow hedges are released into the consolidated statement of income when the Company’s earnings are affected by the variability in

cash flows of the hedged item.

When hedge accounting is discontinued because it is no longer probable that the forecasted transactions will occur by the end of the

specified time period or the hedged item no longer meets the definition of a firm commitment, the derivative continues to be carried on the

consolidated balance sheet at its fair value, with changes in fair value recognized currently in net investment gains (losses). Any asset or

liability associated with a recognized firm commitment is derecognized from the consolidated balance sheet, and recorded currently in net

investment gains (losses). Deferred gains and losses of a derivative recorded in other comprehensive income (loss) pursuant to the cash

flow hedge of a forecasted transaction are recognized immediately in net investment gains (losses).

In all other situations in which hedge accounting is discontinued, the derivative is carried at its fair value on the consolidated balance

sheet, with changes in its fair value recognized in the current period as net investment gains (losses).

The Company is also a party to financial instruments that contain terms which are deemed to be embedded derivatives. The Company

assesses each identified embedded derivative to determine whether it is required to be bifurcated. If the instrument would not be

accounted for in its entirety at fair value and it is determined that the terms of the embedded derivative are not clearly and closely related to

the economic characteristics of the host contract, and that a separate instrument with the same terms would qualify as a derivative

instrument, the embedded derivative is bifurcated from the host contract and accounted for as a freestanding derivative. Such embedded

derivatives are carried on the consolidated balance sheet at fair value with the host contract and changes in their fair value are reported

currently in net investment gains (losses). If the Company is unable to properly identify and measure an embedded derivative for separation

from its host contract, the entire contract is carried on the balance sheet at fair value, with changes in fair value recognized in the current

period in net investment gains (losses). Additionally, the Company may elect to carry an entire contract on the balance sheet at fair value,

with changes in fair value recognized in the current period in net investment gains (losses) if that contract contains an embedded derivative

that requires bifurcation. There is a risk that embedded derivatives requiring bifurcation may not be identified and reported at fair value in

the consolidated financial statements and that their related changes in fair value could materially affect reported net income.

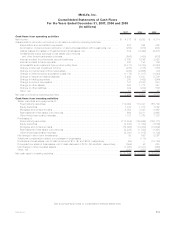

Cash and Cash Equivalents

The Company considers all highly liquid investments purchased with an original or remaining maturity of three months or less at the date

of purchase to be cash equivalents.

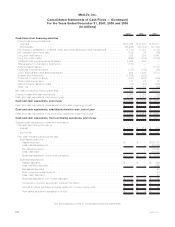

Property, Equipment, Leasehold Improvements and Computer Software

Property, equipment and leasehold improvements, which are included in other assets, are stated at cost, less accumulated depre-

ciation and amortization. Depreciation is determined using either the straight-line or sum-of-the-years-digits method over the estimated

useful lives of the assets, as appropriate. The estimated life for company occupied real estate property is generally 40 years. Estimated

lives generally range from five to ten years for leasehold improvements and three to seven years for all other property and equipment. The

cost basis of the property, equipment and leasehold improvements was $1.6 billion and $1.5 billion at December 31, 2007 and 2006,

respectively. Accumulated depreciation and amortization of property, equipment and leasehold improvements was $828 million and

F-11MetLife, Inc.

MetLife, Inc.

Notes to Consolidated Financial Statements — (Continued)