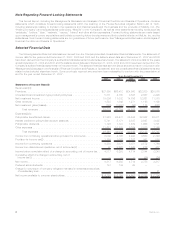

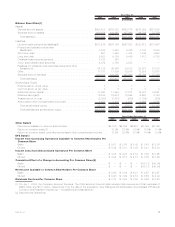

MetLife 2007 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 2007 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Acquisitions and Dispositions

On August 31, 2007, MetLife Australia completed the sale of its annuities and pension businesses to a third party for $25 million in cash

consideration, resulting in a gain upon disposal of $41 million, net of income tax, which was adjusted in the fourth quarter of 2007 for

additional transaction costs. The Company reclassified the assets and liabilities of the annuities and pension businesses within MetLife

Australia, which is reported in the International segment, to assets and liabilities of subsidiaries held-for-sale and the operations of the

business to discontinued operations for all periods presented. Included within the assets to be sold were certain fixed maturity securities in

a loss position for which the Company recognized a net investment loss on a consolidated basis of $59 million, net of income tax, for the

year ended December 31, 2007, because the Company no longer had the intent to hold such securities.

On June 28, 2007, the Company acquired the remaining 50% interest in a joint venture in Hong Kong, MetLife Fubon Limited (“MetLife

Fubon”),for$56millionincash,resultinginMetLifeFubonbecoming a consolidated subsidiary of the Company. The transaction was

treated as a step acquisition, and at June 30, 2007, total assets and liabilities of MetLife Fubon of $839 million and $735 million,

respectively, were included in the Company’s consolidated balance sheet. The Company’s investment for the initial 50% interest in MetLife

Fubon was $48 million. The Company used the equity method of accounting for such investment in MetLife Fubon. The Company’s share

of the joint venture’s results for the six months ended June 30, 2007, was a loss of $3 million. The fair value of the assets acquired and the

liabilities assumed in the step acquisition at June 30, 2007, was $427 million and $371 million, respectively. No additional goodwill was

recorded as a part of the step acquisition. As a result of this acquisition, additional VOBA and value of distribution agreements of $45 million

and $5 million, respectively, were recorded and both have a weighted average amortization period of 16 years.

On June 1, 2007, the Company completed the sale of its Bermuda insurance subsidiary, MetLife International Insurance, Ltd. (“MLII”), to

athirdpartyfor$33millionincashconsideration,resultinginagainupondisposalof$3million,netofincometax.ThenetassetsofMLIIat

disposal were $27 million. A liability of $1 million was recorded with respect to a guarantee provided in connection with this disposition.

On September 29, 2005, the Company completed the sale of MetLife Indonesia to a third party, resulting in a gain upon disposal of

$10 million, net of income tax. As a result of this sale, the Company recognized income (loss) from discontinued operations of $5 million,

net of income tax, for the year ended December 31, 2005. The Company reclassified the operations of MetLife Indonesia into discontinued

operations for all years presented.

On September 1, 2005, the Company completed the acquisition of CitiStreet Associates, a division of CitiStreet LLC, which is primarily

involved in the distribution of annuity products and retirement plans to the education, healthcare, and not-for-profit markets, for $56 million,

of which $2 million was allocated to goodwill and $54 million to other identifiable intangibles, specifically the value of customer relationships

acquired, which have a weighted average amortization period of 16 years. CitiStreet Associates was integrated with MetLife Resources, a

focused distribution channel of MetLife, which is dedicated to provide retirement plans and financial services to the same markets.

On July 1, 2005, the Company completed the acquisition of Travelers for $12.1 billion. The results of Travelers’ operations were

included in the Company’s financial statements beginning July 1, 2005. As a result of the acquisition, management of the Company

increased significantly the size and scale of the Company’s core insurance and annuity products and expanded the Company’s presence in

both the retirement & savings’ domestic and international markets. The distribution agreements executed with Citigroup as part of the

acquisition provide the Company with one of the broadest distribution networks in the industry.

The initial consideration paid in 2005 by the Company for the acquisition consisted of $10.9 billion in cash and 22,436,617 shares of

the Holding Company’s common stock with a market value of $1.0 billion to Citigroup and $100 million in other transaction costs.

Additional consideration of $115 million was paid by the Holding Company to Citigroup in 2006 as a result of the finalization by both parties

of their review of the June 30, 2005 financial statements and final resolution as to the interpretation of the provisions of the acquisition

agreement. In addition to cash on-hand, the purchase price was financed through the issuance of common stock, debt securities,

common equity units and preferred stock. See “— Liquidity and Capital Resources — The Holding Company — Liquidity Sources.”

On January 31, 2005, the Company completed the sale of SSRM to a third party for $328 million in cash and stock. The Company

reported the operations of SSRM in discontinued operations. Under the terms of the sale agreement, MetLife will have an opportunity to

receive additional payments based on, among other things, certain revenue retention and growth measures. The purchase price is also

subject to reduction over five years, depending on retention of certain MetLife-related business. Also under the terms of such agreement,

MetLife had the opportunity to receive additional consideration for the retention of certain customers for a specific period in 2005. Upon

finalization of the computation, the Company received payments of $30 million, net of income tax, in the second quarter of 2006 and

$12 million, net of income tax, in the fourth quarter of 2005 due to the retention of these specific customer accounts. In the first quarter of

2007, the Company received a payment of $16 million, net of income tax, as a result of the revenue retention and growth measure

provision in the sales agreement. In the fourth quarter of 2007, the Company accrued a liability for $2 million, net of income tax, related to

the termination of certain MetLife-related business. In the fourth quarter of 2006, the Company eliminated $4 million of a liability that was

previously recorded with respect to the indemnities provided in connection with the sale of SSRM, resulting in a benefit to the Company of

$2 million, net of income tax. The Company believes that future payments relating to these indemnities are not probable.

See “— Subsequent Events” for information on the Company’s acquisitions subsequent to December 31, 2007.

Industry Trends

The Company’s segments continue to be influenced by a variety of trends that affect the industry.

Financial and Economic Environment. During 2007, the global capital markets reassessed the credit risk inherent in sub-prime

mortgages. This reassessment led to a fairly broad repricing of all credit risk assets and strained market liquidity. Global central banks

intervened to stabilize market conditions and protect against downside risks to economic growth. Still, market and economic conditions

continued to deteriorate. The economic community’s consensus outlook of global economic growth is lower for calendar year 2008, with a

sizable minority of economists forecasting a recessionary environment. The global capital markets have adjusted towards this consensus

outlook, with interest rates and equity prices falling and risk spreads widening. Slow growth and recessionary periods are often associated

with declining asset prices, lower interest rates, credit rating agency downgrades and increasing default losses. The global capital markets

are also less liquid now than in more normal environments. Liquidity conditions impact the cost of purchasing and selling assets and, at

times, the ability to purchase or sell assets. These adjustments in the global capital markets have also resulted in higher realized and

expected volatility.

7MetLife, Inc.