MetLife 2007 Annual Report Download

Download and view the complete annual report

Please find the complete 2007 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ANNUAL REPORT

MetLife, Inc. 2007

Table of contents

-

Page 1

ANNUAL REPORT MetLife, Inc. 2007 -

Page 2

-

Page 3

... years, MetLife has helped individuals and institutions build and protect their most valuable assets. We offer our customers innovative financial solutions through a broad array of products - life insurance, dental insurance, auto and home protection, annuities, and retirement and savings solutions... -

Page 4

...the world. We are committed to leveraging our 140 years of experience to generate further growth and managing MetLife for the long-term. Thank you for your continued support. Sincerely, C. Robert Henrikson Chairman of the Board, President and Chief Executive Officer MetLife, Inc. February 28, 2008 -

Page 5

...'s Annual Report on Internal Control Over Financial Reporting ...Attestation Report of the Company's Registered Public Accounting Firm ...Financial Statements ...Board of Directors ...Executive Officers ...Contact Information ...Corporate Information ...2 2 5 85 89 89 89 91 92 92 93 93 MetLife... -

Page 6

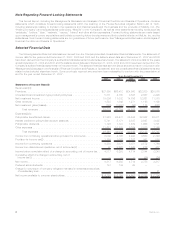

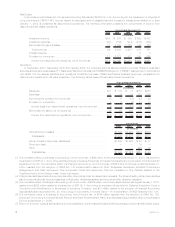

...(2)(3): Premiums ...Universal life and investment-type product policy fees ...Net investment income ...Other revenues ...Net investment gains (losses) ...Total revenues ...Expenses(2)(3): Policyholder benefits and claims ...Interest credited to policyholder account balances ...Policyholder dividends... -

Page 7

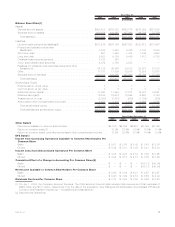

... 31, 2007 2006 2005 (In millions) 2004 2003 Balance Sheet Data(1) Assets: General account assets ...Separate account assets ...Total assets(2) ...Liabilities: Life and health policyholder liabilities(4) ...Property and casualty policyholder liabilities(4) ...Short-term debt ...Long-term debt... -

Page 8

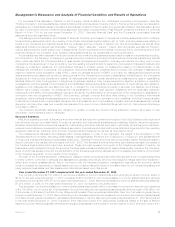

... for Deferred Acquisition Costs in Connection with Modifications or Exchanges of Insurance Contracts, and $37 million related to the adoption of Financial Accounting Standards Board Interpretation No. 48, Accounting for Uncertainty in Income Taxes - An Interpretation of FASB Statement No. 109... -

Page 9

... tax, on the sale of the Peter Cooper Village and Stuyvesant Town properties in Manhattan, New York, that was recognized during the year ended December 31, 2006. Also contributing to the decrease was lower net investment income and net investment gains (losses) from discontinued operations related... -

Page 10

... ventures, cash, cash equivalents and short-term investments, hedge funds and mortgage loans. Management anticipates that investment income and the related yields on other limited partnership interests may decline during 2008 due to increased volatility in the equity and credit markets during 2007... -

Page 11

...the Company increased significantly the size and scale of the Company's core insurance and annuity products and expanded the Company's presence in both the retirement & savings' domestic and international markets. The distribution agreements executed with Citigroup as part of the acquisition provide... -

Page 12

...' rapidly increasing need for savings tools and for income protection. The Company believes that, among life insurers, those with strong brands, high financial strength ratings and broad distribution, are best positioned to capitalize on the opportunity to offer income protection products to Baby... -

Page 13

... and equity securities, mortgage and consumer loans, policy loans, real estate, real estate joint ventures and other limited partnerships, short-term investments, and other invested assets. The Company's investments are exposed to three primary sources of risk: credit, interest rate and market... -

Page 14

...policy issue expenses. VOBA is an intangible asset that reflects the estimated fair value of in-force contracts in a life insurance company acquisition and represents the portion of the purchase price that is allocated to the value of the right to receive future cash flows from the business in-force... -

Page 15

... earnings, comparative market multiples and the discount rate. Liability for Future Policy Benefits The Company establishes liabilities for amounts payable under insurance policies, including traditional life insurance, traditional annuities and non-medical health insurance. Generally, amounts are... -

Page 16

... life and property and casualty insurance products. Accounting for reinsurance requires extensive use of assumptions and estimates, particularly related to the future performance of the underlying business and the potential impact of counterparty credit risks. The Company periodically reviews actual... -

Page 17

... such as the discount rate, expected rate of return on plan assets, rate of future compensation increases, healthcare cost trend rates, as well as assumptions regarding participant demographics such as rate and age of retirements, withdrawal rates and mortality. Management, in consultation with... -

Page 18

... the Company for the years indicated: Years Ended December 31, 2007 2006 (In millions) 2005 Revenues Premiums ...Universal life and investment-type product policy fees ...Net investment income ...Other revenues ...Net investment gains (losses) ...Total revenues ...Expenses Policyholder benefits and... -

Page 19

... years, the write-off of a receivable in the current year, an increase in the closed block-related policyholder dividend obligation, higher annuity benefits, an increase in policyholder dividends and an increase in interest credited to policyholder account balances. The Auto & Home segment's income... -

Page 20

... deposit liability-type contracts in the current year, partially offset by growth in the business. The group life business increased primarily due to business growth in term life and increases in corporate-owned life insurance and life insurance sold to postretirement benefit plans. These increases... -

Page 21

..., cash, cash equivalents and short-term investments, hedge funds and mortgage loans. Management anticipates that investment income and the related yields on other limited partnership interests may decline during 2008 due to increased volatility in the equity and credit markets during 2007. Interest... -

Page 22

...accounts in the current year, the impact of a charge of non-deferrable LTC commissions expense, a charge associated with costs related to the sale of certain small market record keeping businesses and a regulatory settlement, all in the prior year. Corporate & Other contributed to the year over year... -

Page 23

...and claims related to an increase in future policyholder benefit liabilities on specific blocks of business and an increase in litigation liabilities, as well as adverse claim experience in the current year. • The home office recorded higher infrastructure expenditures in support of segment growth... -

Page 24

...investment-type products and an increase in premiums from other life products, partially offset by a decrease in immediate annuity premiums and a decline in premiums associated with the Company's closed block business as this business continues to run-off. Net Investment Income Net investment income... -

Page 25

... the sale of certain small market recordkeeping businesses, a charge associated with non-deferrable LTC commissions expense and a charge associated with costs related to a previously announced regulatory settlement, all within the current year, partially offset by the reduction in Travelers-related... -

Page 26

... gain of $3 billion, net of income tax, on the sale of the Peter Cooper Village and Stuyvesant Town properties in Manhattan, New York, as well as a gain of $32 million, net of income tax, related to the sale of SSRM during the year ended December 31, 2006. This increase was partially offset by gains... -

Page 27

...2005 Revenues Premiums ...Universal life and investment-type product policy fees ...Net investment income ...Other revenues ...Net investment gains (losses) ...Total revenues ...Expenses Policyholder benefits and claims ...Interest credited to policyholder account balances ...Policyholder dividends... -

Page 28

...-type contracts in the current year. Excluding this shift, LTC premiums would have increased due to growth in the business. Group life increased $345 million, which management primarily attributes to a $262 million increase in term life, primarily due to growth in the business from new sales... -

Page 29

... in policyholder benefits and claims, and the amount credited to policyholder account balances for investment-type products, recorded in interest credited to policyholder account balances. Interest credited on insurance products reflects the current period impact of the interest rate assumptions... -

Page 30

... in the current year. The year over year variance in disability also includes the impact of an $18 million loss related to Hurricane Katrina in the prior year. Group life's policyholder benefits and claims increased by $238 million, largely due to the aforementioned growth in the business, partially... -

Page 31

...2005 Revenues Premiums ...Universal life and investment-type product policy fees ...Net investment income ...Other revenues ...Net investment gains (losses) ...Total revenues ...Expenses Policyholder benefits and claims ...Interest credited to policyholder account balances ...Policyholder dividends... -

Page 32

...driven by increased sales of term life business. Universal life and investment-type product policy fees combined with other revenues increased by $384 million due to a combination of growth in the business and improved overall market performance, as well as revisions to management's assumptions used... -

Page 33

... of growth in the business and improved overall market performance. Policy fees from variable life and annuity and investment-type products are typically calculated as a percentage of the average assets in policyholder accounts. The value of these assets can fluctuate depending on equity performance... -

Page 34

... consolidated financial information for the Auto & Home segment for the years indicated: Years Ended December 31, 2007 2006 (In millions) 2005 Revenues Premiums ...Net investment income ...Other revenues ...Net investment gains (losses) ...Total revenues ...Expenses Policyholder benefits and claims... -

Page 35

... increased exposures, mostly offset by lower average premium per policy. In addition, other revenues decreased by $7 million, net of income tax, due to slower than anticipated claims payments resulting in slower recognition of deferred income related to a reinsurance contract. Net investment income... -

Page 36

...2005 Revenues Premiums ...Universal life and investment-type product policy fees ...Net investment income ...Other revenues ...Net investment gains (losses) ...Total revenues ...Expenses Policyholder benefits and claims ...Interest credited to policyholder account balances ...Policyholder dividends... -

Page 37

...income tax, due to changes in foreign currency exchange rates offset by higher claims and business growth. Partially offsetting these increases, income from continuing operations decreased in: • The home office by $9 million, net of income tax, due to higher economic capital charges and investment... -

Page 38

...business growth and changes in foreign currency exchange rates. • India by $4 million due to higher claims and business growth, partially offset by management's update of assumptions used to determine estimated gross profits. Partially offsetting these increases in policyholder benefits and claims... -

Page 39

...employment matters in that year and which were eliminated in the current year as well as overall business growth. • Brazil by $7 million, net of income tax, primarily due to a $10 million, net of income tax, increase in policyholder benefits and claims related to an increase in future policyholder... -

Page 40

...foreign currency exchange rates of $14 million, as well as an increase in institutional premiums through its bank distribution channel, partially offset by lower annuity sales due in part from management's decision not to match aggressive pricing in the marketplace. • The United Kingdom, Argentina... -

Page 41

... on the invested assets supporting those liabilities, a $10 million benefit from a decrease in policyholder benefits associated with a large group policy that was not renewed by the policyholder, and a $6 million benefit in the current year from the elimination of liabilities for pending claims that... -

Page 42

... operating cash flows and additional policyholder account balances contributed to the growth in the invested asset base. The increase in other revenues added $7 million to net income, net of income tax, and was primarily related to an increase in investment product fees on asset-intensive business... -

Page 43

...-force of $245 billion, and a $34 million increase in interest credited due to growth in policyholder account balances associated with the coinsurance of annuity products, which is generally offset by a corresponding increase in net investment income. The increase in policyholder benefits and claims... -

Page 44

...-related expenses associated with RGA's international expansion and general growth in operations, including equity compensation expense. Additionally, a component of the increase in total expenses was a $33 million increase associated with foreign currency exchange rate movements. 40 MetLife... -

Page 45

... the years indicated: Years Ended December 31, 2007 2006 (In millions) 2005 Revenues Premiums ...Universal life and investment-type product policy fees ...Net investment income ...Other revenues ...Net investment gains (losses) ...Total revenues ...Expenses Policyholder benefits and claims ...Other... -

Page 46

... rates, interest credited to bankholder deposits increased by $85 million at MetLife Bank. Policyholder benefits and claims increased $47 million from a 2005 period benefit associated with a reduction of a previously established liability for settlement death benefits related to the Company's sales... -

Page 47

...cash, cash equivalents, short-term investments, and marketable fixed maturity and equity securities. Liquid assets exclude assets relating to securities lending activities. At December 31, 2007 and 2006, the Company had $188.4 billion and $186.5 billion in liquid assets, respectively. Global Funding... -

Page 48

...under which the Holding Company is entitled to the return on the investment portfolio held by the trust established in connection with this collateral financing arrangement in exchange for the payment of a stated rate of return to the unaffiliated financial institution of 3-month LIBOR plus 70 basis... -

Page 49

... Company held assets in trust of $899 million associated with the transaction. In addition the Company held $50 million in custody as of December 31, 2007. MetLife Bank has entered into several repurchase agreements with the Federal Home Loan Bank of New York (the "FHLB of NY") whereby MetLife Bank... -

Page 50

...- 344 44 $2,056 Total ... (1) In June 2007, the Holding Company and MetLife Funding entered into a $3.0 billion credit agreement with various financial institutions, the proceeds of which are available to be used for general corporate purposes, to support their commercial paper programs and for the... -

Page 51

... policyholder benefits include liabilities related to traditional whole life policies, term life policies, closeout and other group annuity contracts, structured settlements, MTF agreements, single premium immediate annuities, long-term disability policies, individual disability income policies, LTC... -

Page 52

... contracts, guaranteed investment contracts associated with formal offering programs, funding agreements, individual and group annuities, total control accounts, bank deposits, individual and group universal life, variable universal life and company-owned life insurance. Included within policyholder... -

Page 53

... course of business; however, these purchase obligations are not material to its consolidated results of operations or financial position as of December 31, 2007. Additionally, the Company has agreements in place for services it conducts, generally at cost, between subsidiaries relating to insurance... -

Page 54

...equity securities of $1.4 billion and other limited partnership interests of $0.8 billion. Also, there was a decrease in cash provided by short-term investments of $0.5 billion. In addition, the 2007 period includes the sale of MetLife Australia's annuities and pension businesses and the acquisition... -

Page 55

...invested assets, and short-term investments, as well as increase the origination of mortgage and consumer loans and decrease net sales of real estate and real estate joint ventures and equity securities. The Holding Company Capital Restrictions and Limitations on Bank Holding Companies and Financial... -

Page 56

... a return of capital of $404 million as approved by the applicable insurance department, of which $350 million was paid to the Holding Company. (6) This dividend reflects the proceeds associated with the sale of Peter Cooper Village and Stuyvesant Town properties to be used for general corporate... -

Page 57

...under which the Holding Company is entitled to the return on the investment portfolio held by the trust established in connection with this collateral financing arrangement in exchange for the payment of a stated rate of return to the unaffiliated financial institution of 3-month LIBOR plus 70 basis... -

Page 58

... paid or provided for. The Holding Company is prohibited from declaring dividends on the Preferred Shares if it fails to meet specified capital adequacy, net income and shareholders' equity levels. In addition, under Federal Reserve Board policy, the Holding Company may not be able to pay dividends... -

Page 59

... and long-term earnings, financial condition, regulatory capital position, and applicable governmental regulations and policies. Furthermore, the payment of dividends and other distributions to the Holding Company by its insurance subsidiaries is regulated by insurance laws and regulations. MetLife... -

Page 60

... 2007 program. (See "- Subsequent Events"). Under these authorizations, the Holding Company may purchase its common stock from the MetLife Policyholder Trust, in the open market (including pursuant to the terms of a pre-set trading plan meeting the requirements of Rule 10b5-1 under the Exchange... -

Page 61

... the Company's capital position, its financial strength and credit ratings, general market conditions and the price of MetLife, Inc.'s common stock. See "- Subsequent Events" for further information relating to common stock repurchases subsequent to December 31, 2007. Support Agreements. The... -

Page 62

....2 million shares of the Company's outstanding common stock that the bank borrowed from third parties. Final settlement of the agreement is scheduled to take place during the first half of 2008. The final number of shares the Company is repurchasing under the terms of the agreement and the timing of... -

Page 63

... Insurance Company of Connecticut ("MICC") is a member of the Federal Home Loan Bank of Boston (the "FHLB of Boston") and holds $70 million of common stock of the FHLB of Boston at both December 31, 2007 and 2006, which is included in equity securities. MICC has also entered into funding agreements... -

Page 64

... benefits attributed to employee services rendered through a particular date. The APBO is recorded in the financial statements and is set forth below. As described more fully in "- Adoption of New Accounting Pronouncements", the Company adopted SFAS No. 158, Employers' Accounting for Defined Benefit... -

Page 65

... of plan assets for the pension plans were as follows: December 31, Qualified Plans 2007 2006 Non-Qualified Plans 2007 2006 (In millions) 2007 Total 2006 Aggregate fair value of plan assets (principally Company contracts) ...$6,550 Aggregate projected benefit obligation ...5,174 Over (under) funded... -

Page 66

... under the other postretirement benefit plans. At the end of 2007, the average remaining service period of active employees was 8.3 years for the other postretirement benefit plans. In 2004, the Company adopted the guidance in FSP 106-2 Accounting and Disclosure Requirements Related to the Medicare... -

Page 67

... on plan assets is the assumed return earned by the accumulated pension fund assets in a particular year. iv) Amortization of Prior Service Cost - This cost relates to the increase or decrease to pension benefit cost for service provided in prior years due to amendments in plans or initiation of new... -

Page 68

..., less withdrawals, distributions, allocable expenses relating to the purchase, sale and maintenance of the assets and an allocable part of such separate accounts' investment expenses. Separate account investments in fixed income and equity securities are generally carried at published market value... -

Page 69

... actual and target weighted-average allocations of other postretirement benefit plan assets within the separate accounts: December 31, Weighted Weighted Average Average Actual Target Allocation Allocation 2007 2006 2008 Asset Category Equity securities ...Fixed maturities ...Other (Real Estate and... -

Page 70

...the Company adopted SOP 05-1, Accounting by Insurance Enterprises for Deferred Acquisition Costs in Connection with Modifications or Exchanges of Insurance Contracts . SOP 05-1 which provides guidance on accounting by insurance enterprises for DAC on internal replacements of insurance and investment... -

Page 71

... end of the year of adoption; (iii) recognition of subsequent changes in funded status as a component of other comprehensive income; (iv) measurement of benefit plan assets and obligations as of the date of the statement of financial position; and (v) disclosure of additional information about the... -

Page 72

... 00-19-2 did not have an impact on the Company's consolidated financial statements. Effective January 1, 2007, the Company adopted FSP No. FAS 13-2, Accounting for a Change or Projected Change in the Timing of Cash Flows Relating to Income Taxes Generated by a Leveraged Lease Transaction ("FSP 13... -

Page 73

... as of January 1, 2008. In June 2007, the AICPA issued SOP 07-1, Clarification of the Scope of the Audit and Accounting Guide Investment Companies and Accounting by Parent Companies and Equity Method Investors for Investments in Investment Companies ("SOP 07-1") . Upon adoption of SOP 07-1, the... -

Page 74

... 1, 2008. The Company does not expect the adoption of Issue E23 to have a material impact on its consolidated financial statements. In December 2007, the FASB ratified as final the consensus on EITF Issue No. 07-6, Accounting for the Sale of Real Estate When the Agreement Includes a Buy-Sell Clause... -

Page 75

... risk through geographic, property type and product type diversification and asset allocation. The Company manages interest rate risk as part of its asset and liability management strategies; product design, such as the use of market value adjustment features and surrender charges; and proactive... -

Page 76

...value ...POLICY LOANS Yield(1) ...Investment income ...Ending carrying value ...EQUITY SECURITIES AND OTHER LIMITED PARTNERSHIP INTERESTS Yield(1) ...Investment income ...Investment gains (losses) ...Ending carrying value ...CASH AND SHORT-TERM INVESTMENTS Yield(1) ...Investment income ...Investment... -

Page 77

... credited to policyholders account balances. Fixed Maturity and Equity Securities Available-for-Sale Fixed maturity securities consisted principally of publicly traded and privately placed debt securities, and represented 70% and 73% of total cash and invested assets at December 31, 2007 and 2006... -

Page 78

...due to the exercise of prepayment options. Sales or disposals of fixed maturity and equity securities classified as available-for-sale are as follows: Years Ended December 31, 2007 2006 2005 (In millions) Proceeds ...Gross investment gains ...Gross investment losses ... $80,685 $ 831 $ (1,183) $89... -

Page 79

... securities and asset-backed securities, respectively, and 80% were guaranteed by financial guarantors who remain Aaa rated in 2008. Fixed Maturity and Equity Security Impairment. The Company classifies all of its fixed maturity and equity securities as available-forsale and marks them to market... -

Page 80

...losses related to its fixed maturity and equity securities. These securities are concentrated, calculated as a percentage of gross unrealized loss, as follows: December 31, 2007 2006 Sector: U.S. corporate securities ...Foreign corporate securities ...Asset-backed securities ...Residential mortgage... -

Page 81

... to sell are based on current conditions or the Company's need to shift the portfolio to maintain its portfolio management objectives including liquidity needs or duration targets on asset/liability managed portfolios. The Company attempts to anticipate these types of changes and if a sale decision... -

Page 82

...in Trust and Assets Pledged as Collateral The Company had investment assets on deposit with regulatory agencies with a fair market value of $1.8 billion and $1.3 billion at December 31, 2007 and 2006, respectively, consisting primarily of fixed maturity and equity securities. Company securities held... -

Page 83

... in other limited partnership interests. Net investment income related to the Company's equity method investment in Tribeca was $9 million for the six months ended December 31, 2006. Mortgage and Consumer Loans The Company's mortgage and consumer loans are principally collateralized by commercial... -

Page 84

... or principal payments are past due. The Company defines mortgage loans under foreclosure as loans in which foreclosure proceedings have formally commenced. The Company reviews all mortgage loans on an ongoing basis. These reviews may include an analysis of the property financial statements and rent... -

Page 85

...$149 43 (45) $147 Agricultural Mortgage Loans. The Company diversifies its agricultural mortgage loans by both geographic region and product type. Of the $10.5 billion of agricultural mortgage loans outstanding at December 31, 2007, 58%, were subject to rate resets prior to maturity. A substantial... -

Page 86

... Peter Cooper Village and Stuyvesant Town properties together make up the largest apartment complex in Manhattan, New York totaling over 11,000 units, spread over 80 contiguous acres. The properties were owned by the Holding Company's subsidiary, Metropolitan Tower Life Insurance Company. The sale... -

Page 87

... and 1.4% of cash and invested assets at December 31, 2007 and 2006, respectively. Management anticipates that investment income and the related yields on other limited partnership interests may decline during 2008 due to increased volatility in the equity and credit markets during 2007. Some of the... -

Page 88

... Credit Risk. The Company may be exposed to credit-related losses in the event of nonperformance by counterparties to derivative financial instruments. Generally, the current credit exposure of the Company's derivative contracts is limited to the fair value at the reporting date. The credit exposure... -

Page 89

...in the acquisition, development, management and disposal of real estate investments. (4) Other limited partnership interests include partnerships established for the purpose of investing in public and private debt and equity securities. (5) Trust preferred securities are complex, uniquely structured... -

Page 90

... Annual Report on Form 10-K for the year ended December 31, 2007. Equity Market Prices. The Company's investments in equity securities and equity-based fixed maturity securities expose it to changes in equity prices, as do certain liabilities that involve long-term guarantees on equity performance... -

Page 91

...Sensitivity Analysis The Company measures market risk related to its holdings of invested assets and other financial instruments, including certain market risk sensitive insurance contracts, based on changes in interest rates, equity market prices and currency exchange rates, utilizing a sensitivity... -

Page 92

... 31, 2007 by type of asset or liability: December 31, 2007 Assuming a 10% increase in the yield curve Notional Amount Estimated Fair Value (In millions) Assets Fixed maturity securities ...Equity securities ...Mortgage and consumer loans ...Policy loans ...Short-term investments ...Cash and cash... -

Page 93

... internal control over financial reporting as of December 31, 2007. Deloitte & Touche LLP, an independent registered public accounting firm, has audited the consolidated financial statements and consolidated financial statement schedules included in the Annual Report on Form 10-K for the year... -

Page 94

... internal control over financial reporting is a process designed by, or under the supervision of, the company's principal executive and principal financial officers, or persons performing similar functions, and effected by the company's board of directors, management, and other personnel to provide... -

Page 95

... STATEMENTS Page Report of Independent Registered Public Accounting Firm ...Financial Statements at December 31, 2007 and 2006 and for the Years Consolidated Balance Sheets ...Consolidated Statements of Income ...Consolidated Statements of Stockholders' Equity ...Consolidated Statements of Cash... -

Page 96

[This Page Intentionally Left Blank.] -

Page 97

... generally accepted in the United States of America. As discussed in Note 1, the Company changed its method of accounting for deferred acquisition costs and for income taxes as required by accounting guidance adopted on January 1, 2007, and changed its method of accounting for defined benefit... -

Page 98

...held-for-sale ...Other limited partnership interests ...Short-term investments ...Other invested assets ...Total investments ...Cash and cash equivalents ...Accrued investment income ...Premiums and other receivables ...Deferred policy acquisition costs and Current income tax recoverable ...Goodwill... -

Page 99

...except per share data) 2007 2006 2005 Revenues Premiums ...Universal life and investment-type product policy fees Net investment income ...Other revenues ...Net investment gains (losses) ...Expenses Policyholder benefits and claims ...Interest credited to policyholder account Policyholder dividends... -

Page 100

... Stock Stock Total Balance at January 1, 2005 ...Treasury stock transactions, net ...Common stock issued in connection with acquisition ...Issuance of preferred stock ...Issuance of stock purchase contracts related to common equity units ...Dividends on preferred stock ...Dividends on common stock... -

Page 101

... ...Purchases of: Fixed maturity securities ...Equity securities ...Mortgage and consumer loans ...Real estate and real estate joint ventures ...Other limited partnership interests ...Net change in short-term investments ...Additional consideration related to purchases of businesses ...Purchases of... -

Page 102

... disposed ...Net assets disposed ...Plus: equity securities received ...Less: cash disposed ...Business disposition, net of cash disposed ...Contribution of equity securities to MetLife Foundation ...Accrual for stock purchase contracts related to common equity units ...Real estate acquired... -

Page 103

... equity securities, mortgage and consumer loans, policy loans, real estate, real estate joint ventures and other limited partnerships, short-term investments, and other invested assets. The accounting policies related to each are as follows: Fixed Maturity and Equity Securities. The Company's fixed... -

Page 104

...'s total return on its investment portfolio principally by providing equity-based returns on debt securities. These investments are generally made through structured notes and similar instruments (collectively, "Structured Investment Transactions"). The Company has not guaranteed the performance... -

Page 105

... life of the asset (typically 20 to 55 years). Rental income is recognized on a straight-line basis over the term of the respective leases. The Company classifies a property as held-for-sale if it commits to a plan to sell a property within one year and actively markets the property in its current... -

Page 106

... not qualify for hedge accounting, changes in the fair value of the derivative are generally reported in net investment gains (losses) except for those (i) in policyholder benefits and claims for economic hedges of liabilities embedded in certain variable annuity products offered by the Company, and... -

Page 107

... financial statements and that their related changes in fair value could materially affect reported net income. Cash and Cash Equivalents The Company considers all highly liquid investments purchased with an original or remaining maturity of three months or less at the date of purchase to be cash... -

Page 108

...policy issue expenses. VOBA is an intangible asset that reflects the estimated fair value of in-force contracts in a life insurance company acquisition and represents the portion of the purchase price that is allocated to the value of the right to receive future cash flows from the business in-force... -

Page 109

... and 3% to 10% for international business, and mortality rates guaranteed in calculating the cash surrender values described in such contracts); and (ii) the liability for terminal dividends. Future policy benefits for non-participating traditional life insurance policies are equal to the aggregate... -

Page 110

... changes occur. Policyholder account balances relate to investment-type contracts and universal life-type policies. Investment-type contracts principally include traditional individual fixed annuities in the accumulation phase and non-variable group annuity contracts. Policyholder account balances... -

Page 111

... expected future policy benefit payments. Premiums related to non-medical health and disability contracts are recognized on a pro rata basis over the applicable contract term. Deposits related to universal life-type and investment-type products are credited to policyholder account balances. Revenues... -

Page 112

... and property and casualty insurance products. For each of its reinsurance contracts, the Company determines if the contract provides indemnification against loss or liability relating to insurance risk in accordance with applicable accounting standards. The Company reviews all contractual features... -

Page 113

...expected service years of employees expected to receive benefits under the plans. The obligations and expenses associated with these plans require an extensive use of assumptions such as the discount rate, expected rate of return on plan assets, rate of future compensation increases, healthcare cost... -

Page 114

... of stock-based awards and settlement of the stock purchase contracts underlying common equity units is assumed to occur with the proceeds used to purchase common stock at the average market price for the period. See Notes 13, 18 and 20. Litigation Contingencies The Company is a party to a number of... -

Page 115

... end of the year of adoption; (iii) recognition of subsequent changes in funded status as a component of other comprehensive income; (iv) measurement of benefit plan assets and obligations as of the date of the statement of financial position; and (v) disclosure of additional information about the... -

Page 116

... 00-19-2 did not have an impact on the Company's consolidated financial statements. Effective January 1, 2007, the Company adopted FSP No. FAS 13-2, Accounting for a Change or Projected Change in the Timing of Cash Flows Relating to Income Taxes Generated by a Leveraged Lease Transaction ("FSP 13... -

Page 117

... a discount (or premium) associated with the debt, and an increase (or decrease) in additional paid-in capital. The adoption of EITF 05-7 did not have a material impact on the Company's consolidated financial statements. Effective January 1, 2006, the Company adopted EITF Issue No. 05-8, Income Tax... -

Page 118

... as of January 1, 2008. In June 2007, the AICPA issued SOP 07-1, Clarification of the Scope of the Audit and Accounting Guide Investment Companies and Accounting by Parent Companies and Equity Method Investors for Investments in Investment Companies ("SOP 07-1") . Upon adoption of SOP 07-1, the... -

Page 119

...the Company increased significantly the size and scale of the Company's core insurance and annuity products and expanded the Company's presence in both the retirement & savings' domestic and international markets. The distribution agreements executed with Citigroup as part of the acquisition provide... -

Page 120

... to provide retirement plans and financial services to the same markets. Further information on goodwill and VOCRA is described in Note 6 and Note 7, respectively. See Note 23 for information on the disposition of the annuities and pension businesses of MetLife Insurance Limited ("MetLife Australia... -

Page 121

MetLife, Inc. Notes to Consolidated Financial Statements - (Continued) 3. Investments Fixed Maturity and Equity Securities Available-for-Sale The following tables present the cost or amortized cost, gross unrealized gain and loss, and estimated fair value of the Company's fixed maturity and equity ... -

Page 122

MetLife, Inc. Notes to Consolidated Financial Statements - (Continued) The amortized cost and estimated fair value of fixed maturity securities, by contractual maturity date (excluding scheduled sinking funds), are as follows: December 31, 2007 Amortized Cost Estimated Fair Value Amortized Cost 2006... -

Page 123

... such unrealized losses of $24 million, $12 million related to securities that were in an unrealized loss position for a period of less than six months. The Company held 30 fixed maturity and equity securities, each with a gross unrealized loss at December 31, 2007 of greater than $10 million. These... -

Page 124

...in Trust and Assets Pledged as Collateral The Company had investment assets on deposit with regulatory agencies with a fair market value of $1.8 billion and $1.3 billion at December 31, 2007 and 2006, respectively, consisting primarily of fixed maturity and equity securities. Company securities held... -

Page 125

... by properties primarily located in the United States. At December 31, 2007, 21%, 7% and 7% of the value of the Company's mortgage and consumer loans were located in California, Florida and Texas, respectively. Generally, the Company, as the lender, only loans up to 75% of the purchase price of... -

Page 126

... Investment in leveraged leases ...$ 2,059 The Company's deferred income tax liability related to leveraged leases was $1.0 billion and $670 million at December 31, 2007 and 2006, respectively. The rental receivables set forth above are generally due in periodic installments. The payment periods... -

Page 127

...: Years Ended December 31, 2007 2006 (In millions) 2005 Fixed maturity securities ...Equity securities ...Mortgage and consumer loans ...Policy loans ...Real estate and real estate joint ventures ...Other limited partnership interests ...Cash, cash equivalents and short-term investments Other... -

Page 128

... securities and short sale agreement liabilities, are changes in fair value of ($4) million, $26 million and less than $1 million for the years ended December 31, 2007, 2006 and 2005, respectively. As part of the acquisition of Travelers on July 1, 2005, the Company acquired Travelers' investment... -

Page 129

...in the acquisition, development, management and disposal of real estate investments. (4) Other limited partnership interests include partnerships established for the purpose of investing in public and private debt and equity securities. (5) Trust preferred securities are complex, uniquely structured... -

Page 130

...due date. The Company also enters into basis swaps to better match the cash flows from assets and related liabilities. In a basis swap, both legs of the swap are floating with each based on a different index. Generally, no cash is exchanged at the outset of the contract and no principal payments are... -

Page 131

... hedge minimum guarantees embedded in certain variable annuity products offered by the Company. To hedge against adverse changes in equity indices, the Company enters into contracts to sell the equity index within a limited time at a contracted price. The contracts will be net settled in cash based... -

Page 132

... and equity variance swaps to economically hedge liabilities embedded in certain variable annuity products; (vi) swap spread locks to economically hedge invested assets against the risk of changes in credit spreads; (vii) financial forwards to buy and sell securities; (viii) synthetic guaranteed... -

Page 133

... presents changes in fair value related to derivatives that do not qualify for hedge accounting: Years Ended December 31, 2007 2006 2005 (In millions) Net investment gains (losses), excluding embedded derivatives ...$(232) Policyholder benefits and claims ...$ 7 Net investment income(1) ...$ 31... -

Page 134

... Statements - (Continued) 5. Deferred Policy Acquisition Costs and Value of Business Acquired Information regarding DAC and VOBA is as follows: DAC VOBA (In millions) Total Balance at January 1, 2005 ...Capitalizations ...Acquisitions ...Subtotal ...Less: Amortization related to: Net investment... -

Page 135

...: Future Policy Benefits 2007 2006 December 31, Policyholder Account Balances 2007 2006 (In millions) Other Policyholder Funds 2007 2006 Institutional Group life ...Retirement & savings Non-medical health & Individual Traditional life ...Universal variable life Annuities ...Other ...Auto & Home... -

Page 136

... Under Funding Agreements MetLife Insurance Company of Connecticut ("MICC") is a member of the Federal Home Loan Bank of Boston (the "FHLB of Boston") and holds $70 million of common stock of the FHLB of Boston at both December 31, 2007 and 2006, which is included in equity securities. MICC... -

Page 137

... the liabilities for unpaid claims and claim expenses relating to property and casualty, group accident and nonmedical health policies and contracts, which are reported in future policy benefits and other policyholder funds, is as follows: Years Ended December 31, 2007 2006 2005 (In millions... -

Page 138

...$29 10 - 39 1 - 40 6 - $46 $ 78 52 (6) 124 54 (6) 172 125 (8) $289 Account balances of contracts with insurance guarantees are invested in separate account asset classes as follows: December 31, 2007 2006 (In millions) Mutual Fund Groupings Equity ...Bond ...Balanced ...Money Market ...Specialty... -

Page 139

... guaranteed policy benefit payments, such payments will be made from assets outside of the closed block. The closed block will continue in effect as long as any policy in the closed block remains in-force. The expected life of the closed block is over 100 years. The Company uses the same accounting... -

Page 140

... ...Equity securities available-for-sale, at estimated fair value (cost: $1,555 and $1,184, respectively) ...Mortgage loans on real estate ...Policy loans ...Real estate and real estate joint ventures held-for-investment ...Short-term investments ...Other invested assets ...Total investments ...Cash... -

Page 141

... closed block revenues and expenses is as follows: Years Ended December 31, 2007 2006 (In millions) 2005 Revenues Premiums ...Net investment income and other revenues ...Net investment gains (losses) ...Total revenues ...Expenses Policyholder benefits and claims ...Policyholder dividends ...Change... -

Page 142

... related senior notes. Repurchase Agreements with Federal Home Loan Bank MetLife Bank, National Association ("MetLife Bank") is a member of the FHLB of NY and holds $64 million and $54 million of common stock of the FHLB of NY at December 31, 2007 and 2006, respectively, which is included in equity... -

Page 143

...344 44 $2,056 Total ... (1) In June 2007, the Holding Company and MetLife Funding, Inc. entered into a $3.0 billion credit agreement with various financial institutions, the proceeds of which are available to be used for general corporate purposes, to support their commercial paper programs and for... -

Page 144

... regulatory approval and the performance of specified term life insurance policies with guaranteed level premiums retroceded by RGA's subsidiary, RGA Reinsurance Company ("RGA Reinsurance"), to Timberlake Re. Proceeds from the offering of the notes, along with a $113 million direct investment... -

Page 145

... Holding Company must use reasonable commercial efforts to raise replacement capital through the issuance of certain qualifying capital securities. Issuance costs associated with the offering of the Trust Securities of $10 million have been capitalized, are included in other assets, and are MetLife... -

Page 146

... in a registered public offering on June 21, 2005. As described below, the common equity units consist of interests in trust preferred securities issued by MetLife Capital Trusts II and III, and stock purchase contracts issued by the Holding Company. The only assets of MetLife Capital Trusts II and... -

Page 147

... annual rate of 4.82% and 4.91% on the Series A and Series B trust preferred securities, respectively, in payment of any accrued and unpaid distributions. Stock Purchase Contracts Each stock purchase contract requires the holder of the common equity unit to purchase, and the Holding Company to sell... -

Page 148

... for income tax as reported for continuing operations is as follows: Years Ended December 31, 2007 2006 (In millions) 2005 Tax provision at U.S. statutory rate ...Tax effect of: Tax-exempt investment income ...State and local income tax ...Prior year tax ...Foreign tax rate differential and change... -

Page 149

... reclassified to current and deferred income taxes, as applicable, and a payment of $156 million was made in December of 2007 with the remaining $21 million to be paid in future years. In addition, the Company's liability for unrecognized tax benefits may change significantly in MetLife, Inc. F-53 -

Page 150

...income, transfer pricing and tax credits. Management is working to resolve the remaining audit items directly with IRS auditors as well as through available accelerated IRS resolution programs and may protest any unresolved issues through the IRS appeals process and, possibly, litigation, the timing... -

Page 151

...7312 of the New York Insurance Law, but denying plaintiffs' motion to certify a litigation class with respect to a common law fraud claim. Plaintiffs and defendants have filed notices of appeal from this order. The court has directed various forms of class notice. In re MetLife Demutualization Litig... -

Page 152

...") and MetLife Securities, Inc. ("MSI") have faced numerous claims, including class action lawsuits, alleging improper marketing or sales of individual life insurance policies, annuities, mutual funds or other products. As of December 31, 2007, there were approximately 130 sales practices litigation... -

Page 153

... class action relating to the payment of medical providers, Innovative Physical Therapy, Inc. v. MetLife Auto & Home, et ano (D. N.J., filed November 12, 2007) has been filed against Metropolitan Property and Casualty Insurance Company in federal court in New Jersey. The Company is vigorously... -

Page 154

...the Company's consolidated financial statements, have arisen in the course of the Company's business, including, but not limited to, in connection with its activities as an insurer, employer, investor, investment advisor and taxpayer. Further, state insurance regulatory authorities and other federal... -

Page 155

... at an aggregate price of $76 million under an accelerated share repurchase agreement with a major bank. The bank borrowed the stock sold to RGA from third parties and purchased the shares in the open market over the subsequent few months to return to the lenders. RGA would either pay or receive an... -

Page 156

... the applicable plans. Virtually all retirees, or their beneficiaries, contribute a portion of the total cost of postretirement medical benefits. Employees hired after 2003 are not eligible for any employer subsidy for postretirement medical benefits. In connection with the acquisition of Travelers... -

Page 157

... - 2 (27) 1,172 $ (901) $ - (901) Benefit obligation at end of year ...Change in plan assets: Fair value of plan assets at beginning of year Actual return on plan assets ...Divestitures ...Employer contribution ...Benefits paid ... Fair value of plan assets at end of year ...Funded status at end of... -

Page 158

... of plan assets for the pension plans were as follows: December 31, Qualified Plans 2007 2006 Non-Qualified Plans 2007 2006 (In millions) 2007 Total 2006 Aggregate fair value of plan assets (principally Company contracts) . . Aggregate projected benefit obligation ...Over (under) funded ... $6,550... -

Page 159

... on long-term historical returns of the plan assets by sector, adjusted for the Subsidiaries' long-term expectations on the performance of the markets. While the precise expected return derived using this approach will fluctuate from year to year, the Subsidiaries' policy is to hold this long-term... -

Page 160

...: One Percent Increase One Percent Decrease (In millions) Effect on total of service and interest cost components ...Effect of accumulated postretirement benefit obligation ... $ 7 $63 $ (6) $(62) Plan Assets The Subsidiaries have issued group annuity and life insurance contracts supporting... -

Page 161

... paid or provided for. The Holding Company is prohibited from declaring dividends on the Preferred Shares if it fails to meet specified capital adequacy, net income and shareholders' equity levels. In addition, under Federal Reserve Board policy, the Holding Company may not be able to pay dividends... -

Page 162

... of the September 2007 program. (See Note 25). Under these authorizations, the Company may purchase its common stock from the MetLife Policyholder Trust, in the open market (including pursuant to the terms of a pre-set trading plan meeting the requirements of Rule 10b5-1 under the Exchange Act) and... -

Page 163

..., its financial strength and credit ratings, general market conditions and the price of the Company's common stock. Stock Purchase Contracts See Note 13 regarding stock purchase contracts issued by the Company on June 21, 2005 in connection with the issuance of the common equity units. Dividends The... -

Page 164

... All Stock Options granted had an exercise price equal to the closing price of the Company's common stock as reported on the New York Stock Exchange on the date of grant, and have a maximum term of ten years. Certain Stock Options granted under the Stock Incentive Plan and the 2005 Stock Plan have... -

Page 165

... 31, 2007 2006 2005 Dividend yield ...Risk-free rate of return ...Expected volatility ...Exercise multiple ...Post-vesting termination rate ...Contractual term (years) ...Expected life (years) ...Weighted average exercise price of stock options granted . Weighted average fair value of stock options... -

Page 166

... 31, 2007, there were $57 million of total unrecognized compensation costs related to Performance Share awards. It is expected that these costs will be recognized over a weighted average period of 1.72 years. Long-Term Performance Compensation Plan Prior to January 1, 2005, the Company granted stock... -

Page 167

... date of purchase, for the six month period ended December 31, 2005. Statutory capital and surplus, as filed with the Connecticut Insurance Department, was $4.2 billion and $4.1 billion at December 31, 2007 and 2006, respectively. Due to the merger of MetLife Life and Annuity Company of Connecticut... -

Page 168

... stock property and casualty insurance company would support the payment of such dividends to its shareholders. Because MPC's net income for the year ended December 31, 2007 excluding net realized capital gains and dividends paid, was negative, MPC cannot pay any dividends in 2008 without regulatory... -

Page 169

... 31, 2006 2007 2005 (In millions, except share and per share data) Weighted average common stock outstanding for basic earnings common share ...Incremental common shares from assumed: Stock purchase contracts underlying common equity units(1) . Exercise or issuance of stock-based awards ... per... -

Page 170

...-term disability, long-term care, and dental insurance, and other insurance products and services. Individual offers a wide variety of protection and asset accumulation products, including life insurance, annuities and mutual funds. Auto & Home provides personal lines property and casualty insurance... -

Page 171

... Total Statement of Income: Premiums ...Universal life and investment- type product policy fees ...Net investment income ...Other revenues ...Net investment gains (losses) ...Policyholder benefits and claims ...Interest credited to policyholder account balances ...Policyholder dividends ...Other... -

Page 172

...365 Total Statement of Income: Premiums ...Universal life and investment- type product policy fees ...Net investment income ...Other revenues ...Net investment gains (losses) ...Policyholder benefits and claims ...Interest credited to policyholder account balances ...Policyholder dividends ...Other... -

Page 173

..., New York for $5.4 billion. The Peter Cooper Village and Stuyvesant Town properties together make up the largest apartment complex in Manhattan, New York totaling over 11,000 units, spread over 80 contiguous acres. The properties were owned by the Company's subsidiary, MTL. Net investment income on... -

Page 174

... and growth measures. The purchase price is also subject to reduction over five years, depending on retention of certain MetLife-related business. In the fourth quarter of 2007, the Company accrued a liability for $2 million, net of income tax, related to the termination of certain MetLife-related... -

Page 175

...Equity securities ...Mortgage and consumer loans ...Policy loans ...Short-term investments ...Cash and cash equivalents ...Accrued investment income ...Mortgage loan commitments ...Commitments to fund bank credit facilities, bridge loans and private investments ...Liabilities: Policyholder account... -

Page 176

... Equity securities ...$ 5,094 Mortgage and consumer loans ...$ 42,239 Policy loans ...$ 10,228 Short-term investments ...$ 2,709 Cash and cash equivalents ...$ 7,107 Accrued investment income ...$ 3,347 Mortgage loan commitments ...$4,022 $ - Commitments to fund bank credit facilities, bridge loans... -

Page 177

....2 million shares of the Company's outstanding common stock that the bank borrowed from third parties. Final settlement of the agreement is scheduled to take place during the first half of 2008. The final number of shares the Company is repurchasing under the terms of the agreement and the timing of... -

Page 178

... Chief Executive Officer, Wal-Mart Stores, USA BURTON A. DOLE, JR. Retired Chairman, Dole/Neal, LLC Member, Audit Committee, Finance and Risk Policy Committee and Public Responsibility Committee CHERYL W. GRISÉ General, United States Army (Retired) Co-Founder and Senior Managing Director, Keane... -

Page 179

...the United States (based on life insurance in-force). The MetLife companies offer life insurance, annuities, auto and home insurance, retail banking and other financial services to individuals, as well as group insurance, reinsurance and retirement & savings products and services to corporations and... -

Page 180

... New York Stock Exchange Listed Company Manual was submitted to the NYSE in 2007. MetLife, Inc. has filed the CEO and CFO Certifications required by Sections 302 and 906 of the Sarbanes-Oxley Act of 2002 as exhibits to its Annual Report on Form 10-K for the year ended December 31, 2007. 94 MetLife... -

Page 181

[This Page Intentionally Left Blank.] -

Page 182

[This Page Intentionally Left Blank.] -

Page 183

-

Page 184

MetLife, Inc. 200 Park Avenue New York, NY 10166-0188 www.metlife.com 0710-6222 © 2008 METLIFE, INC. MetLife, Inc. PEANUTS © United Feature Syndicate, Inc.