Reebok 2012 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2012 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

adidas Group

/

2012 Annual Report

Group Management Report – Our Group

74

2012

/

02.2

/

Global Sales Strategy

/

Retail Strategy

In 2013, we will roll out several new RSM concepts. In the USA, the

adidas brand will further roll out its “Home Court” shop-in-shop concept

aimed at the sporting goods retail channel. In addition, we will also see

an increasing focus on Reebok as the brand rolls out its Fit Hub concepts

to present its expanded fitness offering more comprehensively

/

SEE

GLOBAL BRANDS STRATEGY, P. 78.

Harmonisation and standardisation of processes

to leverage best practices

Wholesale is constantly working on reducing complexity by imple-

menting best operational practices across our entire wholesale activ-

ities. A key area of focus in this respect is rolling out a trade terms policy

globally that rewards customer performance either by higher efficiency

(e.g. in logistics), cost savings or better sell-out support. As part of this

effort, we have established regular reporting, delivering meaningful

benchmarks that allow us to better control our third-party retail support

activities.

Customer and range segmentation to exploit market

potential

Rolling out standardised product range packages around the globe is an

important part of the Group’s Wholesale strategy. The initiative involves

a customer segmentation strategy that facilitates the systematic

allocation of differentiated product packages to groups of comparable

customers. With 40,000 different partners around the world that operate

more than 100,000 points of sale, this segmentation is broadly based

on a distinction between sports and lifestyle retailers that either have

an up-market brand-driven positioning or a value-oriented commercial

positioning. By best suiting their specific needs, this provides a platform

to better exploit market potential. In addition, Wholesale continues to

partner with retailers on increasing the level and quality of sell-through

information the Group receives on a regular basis. This creates a

mutually beneficial understanding of their needs. At the same time, this

helps us to drive incremental business opportunities and ensure globally

consistent distribution logic.

Build strong relationships with leading and most dynamic

retailers

To win in the sporting goods industry, we need to develop collaborative

and fact-based strategic plans with our leading customers. In order to

ensure success, we work together with our leading customers to jointly

identify and quantify the opportunities to improve our business in the

future. To gain full customer understanding and to maximise customer

profitability, we have been investing considerable resources to support

the tracking and analysing of sell-out and sell-through information. This

will enable us to reach binding strategic partnership agreements to

realise joint business opportunities.

PEAK people development programme to build the

best sales team

In order to activate our sales force and enable them to reach higher

levels of performance, a people development and training framework

for Wholesale has been created called PEAK (Performance, Excellence,

Activation and Knowledge). The PEAK performance framework sets the

expectations for individual excellence in Wholesale. In addition, PEAK

also offers a guideline for desired behaviour and actions that support our

employees to become successful leaders in order to deliver on the Route

2015 strategic business plan.

Retail Strategy

Our vision for Retail is to become a top retailer by delivering healthy,

sustainable growth with outstanding return on investment. Retail plays

an increasingly important role for the future of our Group and our brands,

and is a key driver on our Route 2015 journey. The reasons are manifold:

/

To showcase the breadth of our brands (e.g. brand centres).

/

To create distribution in markets which do not have traditional

wholesale structures.

/

To grow another profitable distribution channel.

/

To leverage our learnings from own retail for the entire organisation.

/

To provide a clearance channel (i.e. factory outlets).

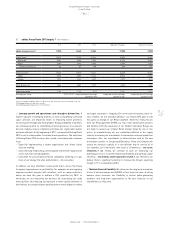

Over the past five to ten years, the adidas Group has evolved into a

signifi cant retailer, operating 2,446 stores for the adidas and Reebok

brands worldwide

/

SEE RETAIL BUSINESS PERFORMANCE, P. 152.

In order to simplify the shape of our store chain, we have clustered it into

three different types, namely brand centres, concept stores and factory

outlets.

/

Brand centres are large stores carrying the full range of each of our

adidas sub-brands under one roof. They are the bold and powerful

statements about the adidas brand’s strength, breadth and depth.

This format will be kept to a limited number and only in exclusive

locations such as New York, Paris or Shanghai.

/

Concept stores are the commercial engine for sales and profit

across the Group’s retail organisation, upholding and accentuating

each brand’s reputation. There are adidas concept stores, Originals

concept stores and Reebok concept stores.

/

Factory outlets facilitate the controlled sale of excess stock returned

from our wholesale key and field accounts, franchise partners,

own-retail stores as well as eCommerce. The stock is complemented

with a portion of planned production which creates a balanced

product offering aimed at maximising profitability.