Reebok 2012 Annual Report Download - page 181

Download and view the complete annual report

Please find page 181 of the 2012 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

adidas Group

/

2012 Annual Report

Group Management Report – Financial Review

159

2012

Subsequent Events and Outlook

/

03.4

/

In the USA, industry growth rates are expected to be ahead of the

economy’s overall growth, with lower fuel prices and a recovery

in property values supporting consumer sentiment and spending

expectations. From a category perspective, the trend towards basketball

styles is set to continue. Training and high-performance technical

footwear and apparel are also predicted to be significant sporting goods

drivers for the year. The US golf market is also expected to see modest

growth in 2013.

In Greater China, strong wage growth and domestic consumption

should propel sporting goods sales in 2013. The trend and market share

shift towards international brands is expected to continue. However,

oversupply and discounting are concerns for the industry, particularly

for local players.

In other Asian markets, the sporting goods industry is forecasted to

record strong growth in 2013, however with regional differences. Japan’s

sporting goods industry is expected to be challenging in 2013, given

that overall consumer confidence and spending are projected to remain

low. Most of the other major Asian emerging markets are expected to

see rapid sporting goods sales growth in 2013, as domestic demand

increases and rising wages continue to drive purchases of discretionary

items.

The sporting goods industry in Latin America is projected to record

robust growth in 2013, with a healthy labour market and wage growth,

as well as increasing access to credit, expected to promote consumer

spending and discretionary purchases. Furthermore, given the

importance of football in this region, the industry is expected to gain

significant momentum from the 2013 FIFA Confederations Cup and the

build-up to the 2014 FIFA World Cup.

adidas Group currency-neutral sales to increase at

a mid-single-digit rate in 2013

We expect adidas Group sales to increase at a mid-single-digit rate on

a currency-neutral basis in 2013. Currency translation is expected to

negatively impact our top-line development in reported terms. Despite

a high degree of uncertainty regarding the global economic outlook

and consumer spending, Group sales development will be favourably

impacted by our high exposure to fast-growing emerging markets

as well as the further expansion of Retail. In addition, our strength in

innovation will lead to major product launches throughout 2013, which

will more than offset the non-recurrence of sales related to the UEFA

EURO 2012 and the London 2012 Olympic Games. In terms of phasing,

sales growth is projected to be weighted towards the second half of the

year. Given these expectations for the year, we expect the adidas Group

to outperform global economic growth in 2013.

Currency-neutral Wholesale revenues expected to

increase at a low-single-digit rate

We project currency-neutral Wholesale segment revenues to increase

at a low-single-digit rate compared to the prior year. Our growth

expectations are supported by order backlog development as well as

positive retailer and trade show feedback. Currency-neutral adidas

Sport Performance sales are forecasted to increase at a low-single-

digit rate, driven by growth in key categories such as running, training

and basketball. adidas Sport Style revenues are projected to increase

at a high-single-digit rate on a currency-neutral basis, as a result of

continued momentum and expansion of adidas Originals and the adidas

NEO label. Currency-neutral Reebok sales are expected to increase at

a mid-single-digit rate, mainly due to growth in fitness training, fitness

running and Classics as well as the introduction of new categories such

as Studio.

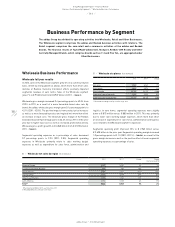

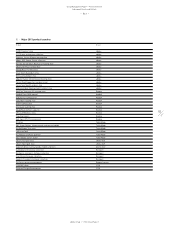

01

/

adidas Group 2013 outlook

Currency-neutral sales development (in %):

adidas Group mid-single-digit rate increase

Wholesale low-single-digit rate increase

Retail high-single- to low-double-digit rate increase

Comparable store sales low- to mid-single-digit rate increase

Other Businesses mid- to high-single-digit rate increase

TaylorMade-adidas Golf mid-single-digit rate increase

Rockport mid- to high-single-digit rate increase

Reebok-CCM Hockey low-double-digit rate increase

Gross margin 48.0% to 48.5%

Operating margin approaching 9.0%

Earnings per share € 4.25 to € 4.40

Average operating working capital as a percentage of sales moderate increase

Capital expenditure € 500 million to € 550 million

Store base net increase by around 100 stores

Gross borrowings decline