Reebok 2012 Annual Report Download - page 218

Download and view the complete annual report

Please find page 218 of the 2012 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

8

adidas Group

/

2012 Annual Report

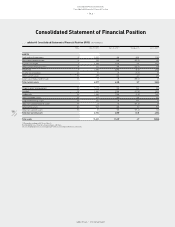

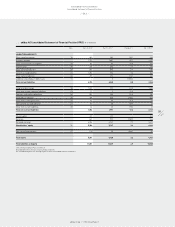

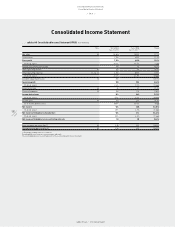

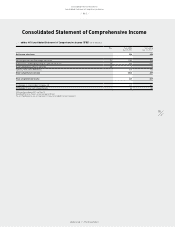

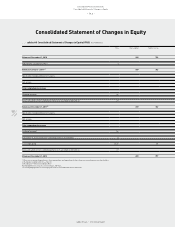

Consolidated Financial Statements

196

2012

Notes

/

04.8

/

01 General

The consolidated financial statements of adidas AG as at December 31,

2012 comprise adidas AG and its subsidiaries and are prepared in

compliance with International Financial Reporting Standards (IFRS),

as adopted by the European Union (EU) as at December 31, 2012, and

the additional requirements pursuant to § 315a section 1 German

Commercial Code (Handelsgesetzbuch – HGB).

The following new standards and interpretations and amendments

to existing standards and interpretations are applicable for the first time

for financial years beginning on January 1, 2012:

/

IAS 12 Amendment – Deferred Tax: Recovery of Underlying Assets

(effective date: January 1, 2012): This amendment had no impact on the

Group’s financial statements.

/

IFRS 7 Amendment – Disclosures – Transfers of Financial Assets

(effective date: July 1, 2011): This amendment had no impact on the

Group’s financial statements.

New standards and interpretations and amendments to existing

standards and interpretations that will be effective for financial years

beginning after January 1, 2012, and which have not been applied in

preparing these consolidated financial statements are:

/

IFRS 7 Amendment – Disclosures – Offsetting Financial Assets and

Financial Liabilities (effective date: January 1, 2013): This amendment

is not expected to have any impact on the Group’s financial statements.

/

IFRS 10 Consolidated Financial Statements (effective date:

January 1, 2014): This new standard is not expected to have any material

impact on the Group’s financial statements.

/

IFRS 11 Joint Arrangements (effective date: January 1, 2014): This

new standard is not expected to have any material impact on the Group’s

financial statements.

/

IFRS 12 Disclosure of Interests in Other Entities (effective date:

January 1, 2014): This new standard is not expected to have any material

impact on the Group’s financial statements.

/

IFRS 13 Fair Value Measurement (effective date: January 1, 2013):

This new standard is not expected to have any material impact on the

Group’s financial statements.

/

IAS 1 Amendment – Presentation of Items of Other Comprehensive

Income (effective date: July 1, 2012): This amendment is not expected to

have any impact on the Group’s financial statements.

/

IAS 19 Employee Benefits – Revised (2011) (effective date: January 1,

2013): This amendment is not expected to have any material impact on

the Group’s financial statements.

/

IAS 27 Separate Financial Statements – Revised (2011) (effective

date: January 1, 2014): This amendment is not expected to have any

impact on the Group’s financial statements.

/

IAS 28 Investments in Associates and Joint Ventures – Revised

(2011) (effective date: January 1, 2014): This amendment is not expected

to have any impact on the Group’s financial statements.

/

IAS 32 Amendment – Offsetting Financial Assets and Financial

Liabilities (effective date: January 1, 2014): This amendment is not

expected to have any impact on the Group’s financial statements.

/

IFRIC 20 Stripping Costs in the Production Phase of a Surface Mine

(effective date: January 1, 2013): This interpretation will not have any

impact on the Group’s financial statements.

/

Improvements to IFRSs (2011) (effective date: January 1, 2013):

These improvements are not expected to have any material impact on

the Group’s financial statements.

New standards and interpretations as well as amendments to existing

standards and interpretations are usually not applied by the Group

before the effective date.

The consolidated financial statements have in principle been

prepared on the historical cost basis with the exception of certain items

in the statement of financial position such as financial instruments

valued at fair value through profit or loss, available-for-sale financial

assets, derivative financial instruments, plan assets and receivables,

which are measured at fair value.

The consolidated financial statements are presented in euros (€)

and all values are rounded to the nearest million (€ in millions).