Reebok 2012 Annual Report Download - page 205

Download and view the complete annual report

Please find page 205 of the 2012 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

adidas Group

/

2012 Annual Report

Group Management Report – Financial Review

183

2012

/

03.5

/

Risk and Opportunity Report

/

Financial opportunities

/

Management assessment of overall risks and opportunities

Financial opportunities

Favourable financial market changes

Favourable exchange and interest rate developments can potentially

have a positive impact on the Group’s financial results. Our Group

Treasury department closely monitors the financial markets to identify

and exploit opportunities

/

SEE TREASURY, P. 141. Translation effects

from the conversion of non-euro-denominated results into our Group’s

functional currency, the euro, might positively impact our Group’s

financial performance. Overall, we believe favourable financial market

changes could have a major potential impact. Given the volatility of

financial markets, and exchange rate movements since the beginning

of 2013, we assess the likelihood of being positively affected to such an

extent as unlikely.

08

/

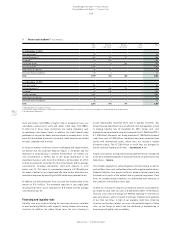

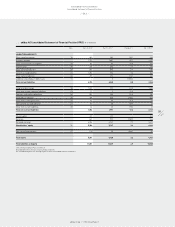

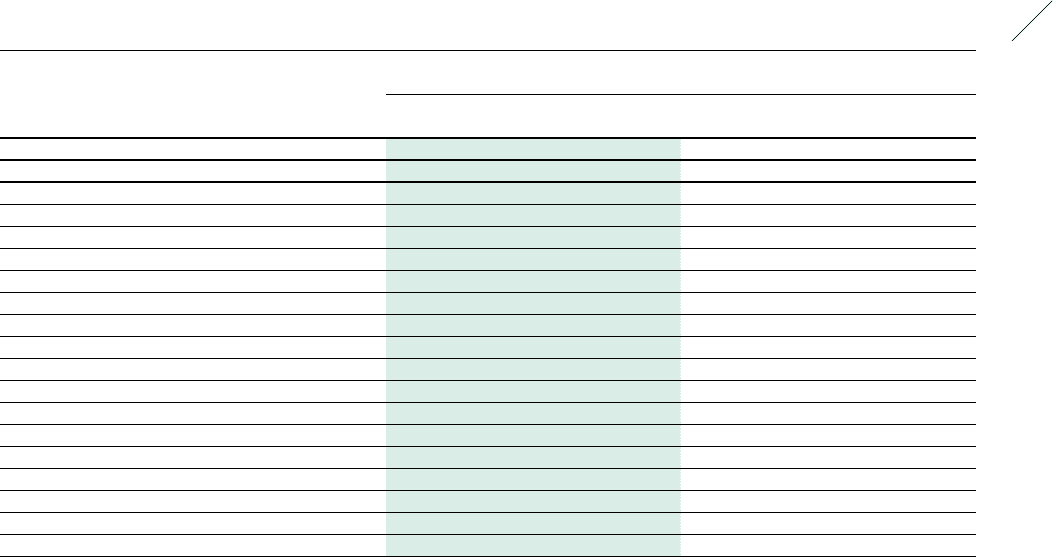

Changes in corporate risk assessment versus prior year

2012 2011

Likelihood Potential impact Likelihood Potential impact

Strategic risks

Consumer demand risks 1) Possible Significant Likely Moderate

Operational risks

Own-retail risks 1) Possible Major Likely Moderate

Supplier risks Unlikely Possible

Inventory risks 1) Possible Significant Probable Moderate

Personnel risks 1) Unlikely Significant Likely Moderate

IT risks Major Significant

Product innovation and development risks Likely Moderate Possible Minor

Risks related to rising input costs Likely Moderate Highly probable Major

Legal & compliance risks

Legal risks 1) Possible Major Likely Significant

Social and environmental risks 1) Possible Major Likely Moderate

Risks related to product counterfeiting and imitation 1) Unlikely Significant Probable Moderate

Product quality risks 1) Possible Significant Likely Moderate

Financial risks

Credit risks 1) Major Moderate

Currency risks Probable Highly probable

Interest rate risks Probable Highly probable

1) Modification of the risk aggregation methodology and further updates of the Risk Universe had an effect on our risk evaluation, contributing to changes in the assessment of likelihood and potential

impact. However, the general risk rating remains virtually unchanged versus the prior year.

Management assessment of overall

risks and opportunities

Management aggregates all risks and opportunities reported by

different business units and functions through the quarterly risk and

opportunity assessment process. Taking into account the occurrence

likelihood and the potential financial impact of the risks explained within

this report, the strong balance sheet as well as the current business

outlook, Management does not foresee any material jeopardy to the

viability of the Group as a going concern. This assessment is also

supported by the historical response to our financing demands

/

SEE

TREASURY, P. 141. The adidas Group therefore has not sought an official

rating by any of the leading rating agencies. Management remains

confident that the Group’s earnings strength forms a solid basis for our

future business development and provides the necessary resource to

pursue the opportunities available to the Group. Compared to the prior

year, our assessment of certain risks has changed in terms of likelihood

of occurrence and/or potential financial impact. These changes are

reflected in the table below

/

TABLE 08. The changes in individual risks

have no substantial impact on the overall adidas Group risk profile,

which we believe remains unchanged compared to the prior year.