Reebok 2012 Annual Report Download - page 223

Download and view the complete annual report

Please find page 223 of the 2012 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

adidas Group

/

2012 Annual Report

Consolidated Financial Statements

201

2012

Notes

/

04.8

/

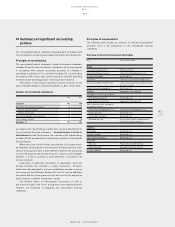

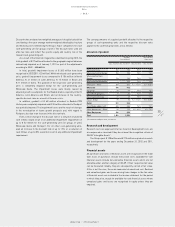

Discount rates are based on a weighted average cost of capital calculation

considering a five-year average market-weighted debt/equity structure

and financing costs referencing the Group’s major competitors for each

cash-generating unit (or groups of units). The discount rates used are

after-tax rates and reflect the specific equity and country risk of the

relevant cash-generating unit.

As a result of the financial irregularities identified in spring 2012, the

total goodwill of € 27 million allocated to the geographic region India was

retroactively impaired as of January 1, 2011 as part of the adjustments

according to IAS 8

/

SEE NOTE 03.

In total, goodwill impairment losses of € 265 million have been

recognised in 2012 (2011: € 0 million). Within wholesale cash-generating

units, goodwill impairment losses amounted to € 106 million in North

America, € 41 million in Latin America, € 15 million in Brazil and

€ 11 million in Iberia. The goodwill of the respective cash-generating

units is completely impaired except for the cash-generating unit

Wholesale Iberia. The impairment losses were mainly caused by

adjusted growth assumptions for the Reebok brand, especially in North

America, Latin America and Brazil, and an increase in the country-

specific discount rates as a result of the euro crisis.

In addition, goodwill of € 68 million allocated to Reebok-CCM

Hockey was completely impaired and € 24 million allocated to Rockport

was partially impaired. The impairment losses are the result of changes

in the re-evaluation of future growth prospects and, with regard to

Rockport, also due to an increase in the discount rate.

Even a small change in the discount rate or a reduction of planned

cash inflows would result in an additional impairment requirement of

up to € 52 million for the cash-generating units (or groups of units)

Wholesale Iberia and Rockport. For all other cash-generating units,

even an increase in the discount rate of up to 1.5% or a reduction of

cash inflows of up to 20% would not result in any additional impairment

requirement.

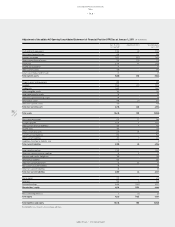

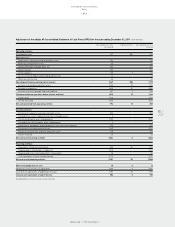

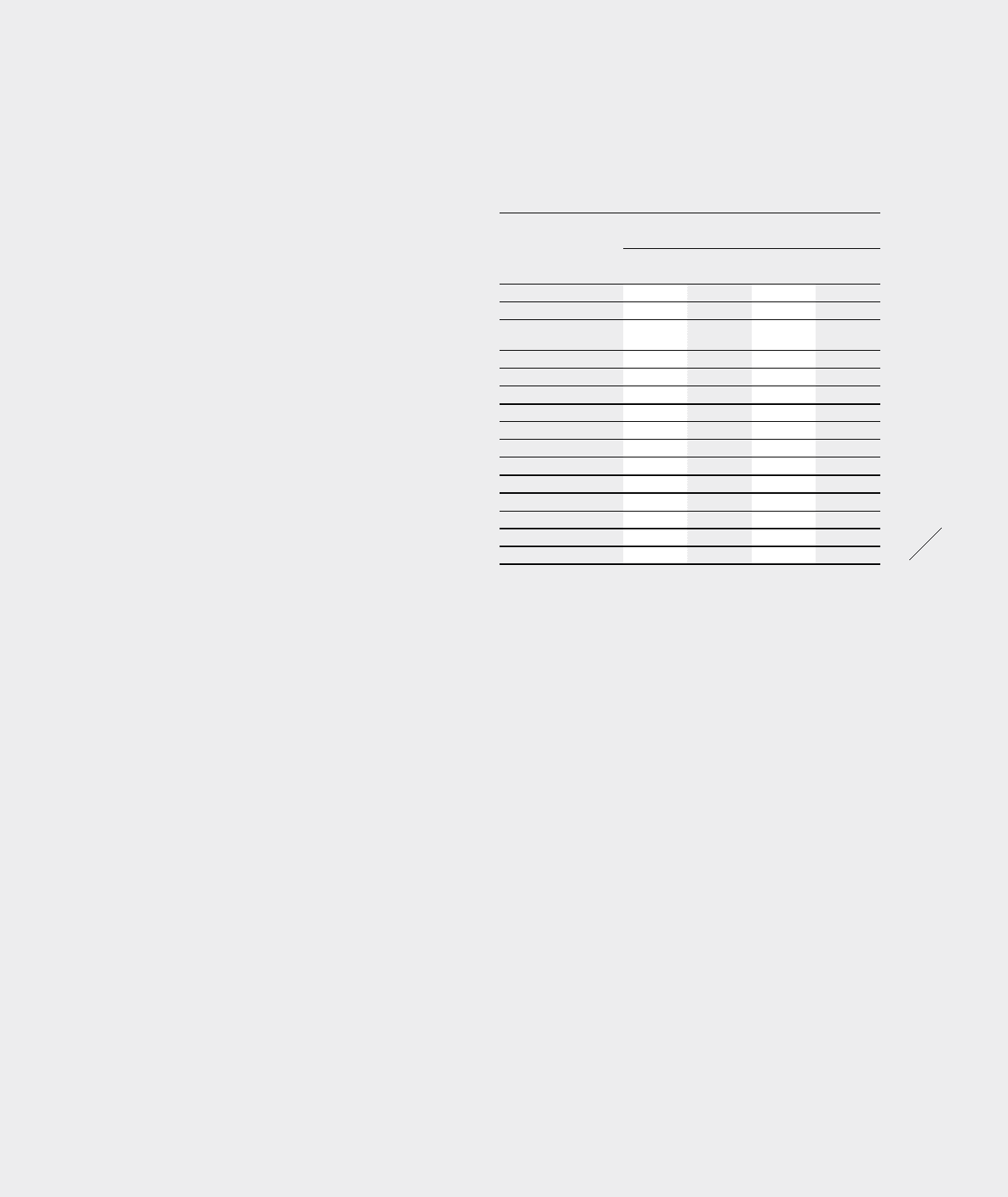

The carrying amounts of acquired goodwill allocated to the respective

groups of cash-generating units and the respective discount rates

applied to the cash flow projections are as follows:

Allocation of goodwill

Goodwill

(€ in millions)

Discount rate

(after taxes)

Dec. 31, 2012 Dec. 31, 2011 1) Dec. 31, 2012 Dec. 31, 2011

Wholesale China 160 162 8.1% 7.9%

Wholesale Central Europe 154 155 7.5% 7.3%

Wholesale Northern

Europe 133 134 7.4% 7.2%

Wholesale North America – 105 7.2% 7.0%

Wholesale – Other 287 357 7.2 – 11.3% 7.0 – 10.5%

Wholesale 734 913

Retail CIS 78 79 9.6% 9.5%

Retail North America 29 30 7.2% 7.0%

Retail Central Europe 29 29 7.5% 7.3%

Retail - Other 95 96 7.2 – 11.3% 7.0 – 10.5%

Retail 231 234

TaylorMade-adidas Golf 288 284 7.6% 7.3%

Other Businesses - Other 28 122 6.5 – 8.0% 6.5 – 7.5%

Other Businesses 316 406

Total 1,281 1,553

1) Restated according to IAS 8, see Note 03.

Research and development

Research costs are expensed in full as incurred. Development costs are

also expensed as incurred if they do not meet the recognition criteria of

IAS 38 “Intangible Assets”.

The Group spent € 128 million and € 115 million on product research

and development for the years ending December 31, 2012 and 2011,

respectively.

Financial assets

All purchases and sales of financial assets are recognised on the trade

date. Costs of purchases include transaction costs. Available-for-sale

financial assets include non-derivative financial assets which are not

allocable under another category of IAS 39. If their respective fair value

can be measured reliably, they are subsequently carried at fair value.

If this is not the case, these are measured at amortised cost. Realised

and unrealised gains and losses arising from changes in the fair value

of financial assets are included in the income statement for the period

in which they arise, except for available-for-sale financial assets where

unrealised gains and losses are recognised in equity unless they are

impaired.