Reebok 2012 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2012 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

8

adidas Group

/

2012 Annual Report

To Our Shareholders

60

2012

/

01.8

/

Our Share

Our Share

In 2012, international stock markets and the adidas AG share increased considerably. Further

progress in resolving the sovereign debt crisis in the euro area as well as robust US economic data

and expansionary Fed policies were major catalysts for strong market developments throughout

the year. However, disappointing economic data in the euro area, slowing economic growth rates in

Greater China as well as the looming fiscal cliff in the USA temporarily weighed on financial markets.

The DAX-30 and the MSCI World Textiles, Apparel & Luxury Goods Index increased 29% and 26%,

respectively, in 2012. Due to consistently strong financial results throughout the year and market

participants’ rising confidence in the adidas Group’s Route 2015 strategic business plan, the adidas AG

share outperformed both indices, gaining 34% in the period. With further balance sheet improvements

and the strong increase in the Group’s net income attributable to shareholders excluding goodwill

impairment losses in 2012, we intend to propose a 35% higher dividend compared to the prior year at

our 2013 Annual General Meeting.

International stock markets maintain positive momentum

In 2012, international stock markets maintained the positive momentum

from the end of the prior year, driven in particular by European and

Asian indices. At the beginning of 2012, international stock markets

improved significantly, mainly due to measures from European

policymakers to resolve the sovereign debt crisis in the euro area. In

addition, investor confidence was also strengthened following a series

of solid US economic indicators. However, in the second quarter of

2012, international stock markets reversed the positive trend and

suffered considerable losses. This was mainly due to a worsening

of the sovereign debt crisis in the euro area, fuelled by persistently

negative economic data reported in the region. The emergence of more

and more indicators signalling a slowdown of growth of the US and, in

particular, the Chinese economy also contributed to negative investor

sentiment. In the third quarter, global stock markets recovered, posting

considerable gains. This development mainly reflected the reiteration of

central bank commitments, in particular by the ECB, to provide further

economic stimuli. This more than offset the negative impact from

subdued macroeconomic indicators worldwide. Despite the looming

fiscal cliff issues in the USA, most international indices continued to gain

momentum in the fourth quarter. This was attributable to the ongoing

relief in the euro debt crisis, which included a new rescue package for

Greece as well as a recovery of leading indicators in China and Germany.

Furthermore, robust US economic data as well as an expansionary Fed

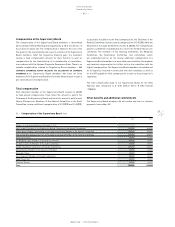

policy provided additional support. As a result, the DAX-30 and the MSCI

World Textiles, Apparel & Luxury Goods Index increased 29% and 26%,

respectively

/

TABLE 01. The Dow Jones Index gained 7% during the

period.

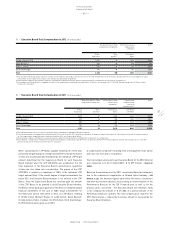

01

/

Historical performance of the adidas AG share and

important indices at year-end 2012 (in %)w

1 year 3 years 5 years 10 years Since IPO

adidas AG 34 78 31 227 596

DAX-30 29 28 (6) 163 247

MSCI World Textiles,

Apparel & Luxury Goods 26 73 53 313 312

Source: Bloomberg.

adidas AG share price outperforms market

At the beginning of the year, our share traded positively, supported

by several analyst recommendation and target price upgrades,

reflecting confidence in the positioning of the adidas Group’s brands

and the Group’s ability to benefit from the underlying strength of the

sporting goods market. On March 7, the publication of the Group’s 2011

financial results as well as the confirmation of our 2012 outlook was

well received. Nevertheless, given the strong share price appreciation

up to that date, some investors took profits, resulting in a share price

correction on the day of the results release. Towards the end of the first

quarter, these losses were more than offset, supported by favourable

market trends as well as successful investor relations marketing

activity. At the beginning of the second quarter, the adidas AG share

traded sideways, outperforming the general market weakness. The

announcement of better than expected first quarter results and an

improved outlook for the full year 2012 provided positive impetus,

1)

1) This section is part of the audited Group Management Report.