Reebok 2012 Annual Report Download - page 225

Download and view the complete annual report

Please find page 225 of the 2012 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

adidas Group

/

2012 Annual Report

Consolidated Financial Statements

203

2012

Notes

/

04.8

/

Interest

Interest is recognised as income or expense as incurred using the

“effective interest method” with the exception of interest that is directly

attributable to the acquisition, construction or production of a qualifying

asset. This interest is capitalised as part of the cost of the qualifying

asset.

Income taxes

Current income taxes are computed in accordance with the applicable

taxation rules established in the countries in which the Group operates.

The Group computes deferred taxes for all temporary differences

between the carrying amount and the tax base of its assets and liabilities

and tax loss carry-forwards. As it is not permitted to recognise a deferred

tax liability for goodwill, the Group does not compute any deferred taxes

thereon.

Deferred tax assets arising from deductible temporary differences

and tax loss carry-forwards which exceed taxable temporary differences

are only recognised to the extent that it is probable that the company

concerned will generate sufficient taxable income to realise the

associated benefit.

Income tax is recognised in the income statement except to the

extent that it relates to items recognised directly in equity, in which case

it is recognised in equity.

Estimation uncertainties and judgements

The preparation of financial statements in conformity with IFRS

requires the use of assumptions and estimates that affect reported

amounts and related disclosures. Although such estimates are based

on Management’s best knowledge of current events and actions, actual

results may ultimately differ from these estimates.

The key assumptions concerning the future and other key sources of

estimation uncertainty at the balance sheet date which have a significant

risk of causing a material adjustment to the carrying amounts of assets

and liabilities within the next financial year are outlined in the respective

Notes, in particular goodwill

/

SEE NOTE 13, trademarks

/

SEE NOTE 14,

other provisions

/

SEE NOTE 20, pensions

/

SEE NOTE 24, derivatives

/

SEE

NOTE 29 as well as deferred taxes

/

SEE NOTE 34.

Judgements have, for instance, been used in classifying leasing

arrangements as well as in determining valuation methods for intangible

assets.

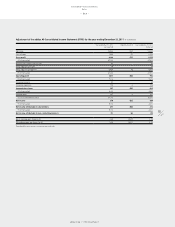

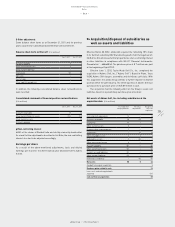

03 Adjustments according to IAS 8

At Reebok India Company (hereinafter “Reebok India”), numerous

financial irregularities were identified in March 2012. As a result, the

services of the then Managing Director (MD) and Chief Operating Officer

were terminated, and a new MD was instated. Immediately on becoming

aware of the aforesaid financial irregularities, Reebok India carried

out an externally assisted internal investigation and filed a criminal

complaint with the police. This resulted in an investigation which is

being carried out by the Special Economic Wing of the Gurgaon Police.

Additionally, various other regulatory agencies are conducting specific

investigations into various aspects of the case.

Key findings from the internal investigation include inappropriate

recognition of sales due to sales cut-off irregularities, a failure to book

sales returns and a failure to correctly post credit notes to accounts

receivable. This also resulted in a significant overstatement of the

accounts receivable balances as well as materially incorrect accounting

for inventories and provisions. During the investigation process, the new

management also discovered four secret warehouses not disclosed in

the official accounting records. The investigations also revealed that

Reebok India had adopted inappropriate procedures to artificially reduce

the accounts receivable balance. The findings of the investigations

suggest that the practice of inflating sales and profits had been going

on for several years.

The discovery of these activities resulted in the identification of

material errors in the prior period financial statements of Reebok

India. As a consequence of these errors, material misstatements are

also included in the consolidated financial statements of adidas AG for

the 2011 financial year and previous financial years, which have to be

corrected in accordance with IAS 8.41 et seqq. These corrections are

reflected in the consolidated financial statements as at December 31,

2012, in which the comparative figures for the year 2011 are restated and

the opening balance sheet for 2011 is corrected to the extent that earlier

periods are affected.

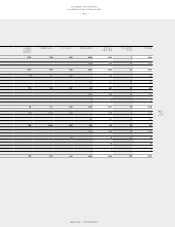

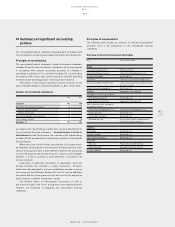

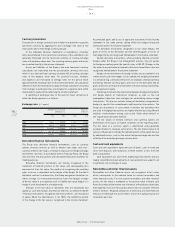

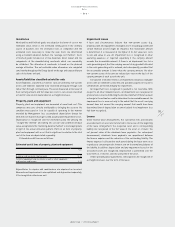

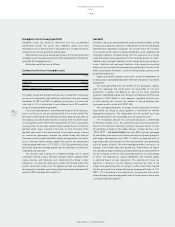

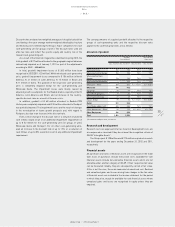

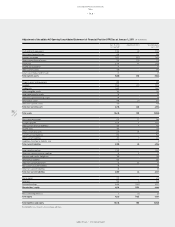

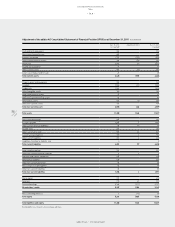

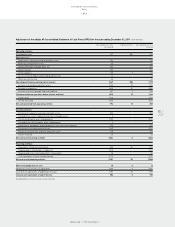

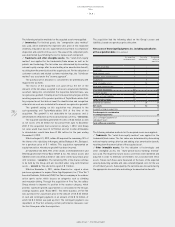

The following tables provide an overview of the impact of all

corrections: