Reebok 2012 Annual Report Download - page 243

Download and view the complete annual report

Please find page 243 of the 2012 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

adidas Group

/

2012 Annual Report

Consolidated Financial Statements

221

2012

/

04.8

/

Notes

/

Notes to the Consolidated Statement of Financial Position

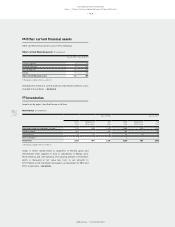

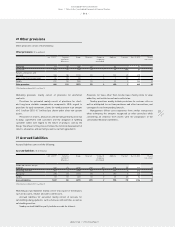

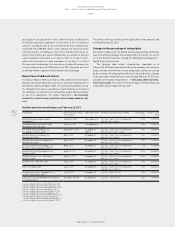

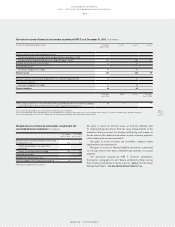

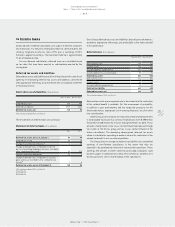

25 Other non-current liabilities

Other non-current liabilities consist of the following:

Other non-current liabilities (€ in millions)

Dec. 31, 2012 Dec. 31, 2011

Liabilities due to personnel 9 11

Deferred income 23 25

Sundry 2 0

Other non-current liabilities 34 36

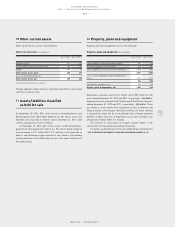

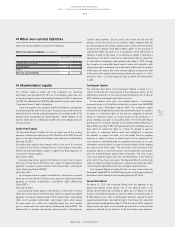

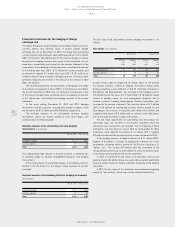

26 Shareholders’ equity

The nominal capital of adidas AG (“the company”) has remained

unchanged since December 31, 2011. As at the balance sheet date, and

in the period beyond, up to and including February 22, 2013, it amounted

to € 209,216,186 divided into 209,216,186 registered no-par-value shares

(“registered shares”) and is fully paid in.

Each share grants one vote and is entitled to dividends starting from

the beginning of the year it was issued. Treasury shares held directly or

indirectly are not entitled to dividend payment in accordance with § 71b

German Stock Corporation Act (Aktiengesetz – AktG). Neither at the

balance sheet date nor at February 22, 2013 does the company hold any

treasury shares.

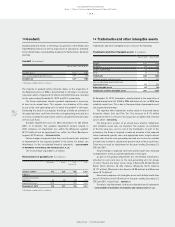

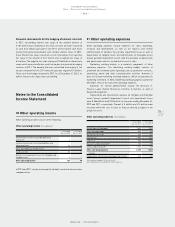

Authorised Capital

The Executive Board of adidas AG did not make use of the existing

amounts of authorised capital of up to € 95 million in the 2012 financial

year or in the period beyond the balance sheet date up to and including

February 22, 2013.

The authorised capital of the company, which is set out in § 4 sections

2, 3 and 4 of the Articles of Association as at the balance sheet date,

entitles the Executive Board, subject to Supervisory Board approval, to

increase the nominal capital

until June 21, 2014

/

by issuing new shares against contributions in cash once or several

times by no more than € 50 million and, subject to Supervisory Board

approval, to exclude residual amounts from shareholders’ subscription

rights (Authorised Capital 2009/I);

until July 4, 2014

/

by issuing new shares against contributions in kind once or several

times by no more than € 25 million and, subject to Supervisory Board

approval, to exclude shareholders’ subscription rights (Authorised

Capital 2011);

until July 12, 2015

/

by issuing new shares against contributions in cash once or several

times by no more than € 20 million and, subject to Supervisory Board

approval, to exclude residual amounts from shareholders’ subscription

rights and to exclude shareholders’ subscription rights when issuing

the new shares at a value not essentially below the stock market

price of shares with the same features (Authorised Capital 2010). The

authorisation to exclude subscription rights pursuant to the previous

sentence may, however, only be used to the extent that the pro-rata

amount of the new shares in the nominal capital together with the

pro-rata amount in the nominal capital of other shares which have been

issued by the company since May 6, 2010, subject to the exclusion of

subscription rights pursuant to or in accordance with § 186 section 3

sentence 4 AktG on the basis of an authorised capital or following a

repurchase, or for which conversion or subscription rights or conversion

or subscription obligations were granted after May 6, 2010, through

the issuance of convertible bonds and/or bonds with warrants, with

subscription rights excluded in accordance with § 186 section 3 sentence

4 AktG, does not exceed 10% of the nominal capital existing on the date

of the entry of this authorisation into the commercial register or – if this

amount is lower – as of the respective date on which the authorisation

is used.

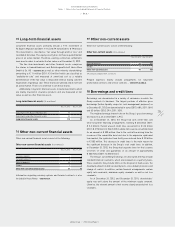

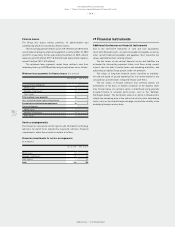

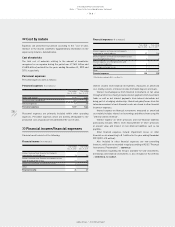

Contingent Capital

The following description of the Contingent Capital is based on § 4

section 5 of the Articles of Association of the company as well as on the

underlying resolutions of the Annual General Meeting held on May 6,

2010. Additional contingent capital does not exist.

At the balance sheet date, the nominal capital is conditionally

increased by up to € 36 million divided into no more than 36,000,000

registered shares (Contingent Capital 2010). The contingent capital

increase will be implemented only to the extent that holders or creditors

of option or conversion rights or the persons obligated to exercise

option or conversion duties on bonds issued by the company or a

group company, pursuant to the authorisation of the Executive Board

granted by the resolution adopted by the Annual General Meeting of

May 6, 2010, up to May 5, 2015 and guaranteed by the company, exercise

their option or conversion rights or, if they are obliged to exercise

the option or conversion duties, meet their obligations to exercise

the warrant or convert the bond, or to the extent that the company

exercises its rights to choose to deliver shares in the company for the

total amount or partially instead of a payment and insofar as no cash

settlement, treasury shares or shares of another public-listed company

are used to serve these rights. The new shares shall be issued at the

respective option or conversion price to be established in accordance

with the aforementioned authorisation resolution. The new shares

shall carry dividend rights from the commencement of the financial

year in which the shares are issued. The Executive Board is authorised,

subject to Supervisory Board approval, to stipulate any additional details

concerning the implementation of the contingent capital increase.

The Executive Board of adidas AG did not issue shares from the

Contingent Capital 2010 in the 2012 financial year or in the period beyond

the balance sheet date up to and including February 22, 2013.

Convertible Bond

On March 14, 2012, the Executive Board, with the approval of the

Supervisory Board, made partial use of the authorisation of the

Annual General Meeting from May 6, 2010, and on March 21, 2012

issued a convertible bond due on June 14, 2019 in a nominal value of

€ 500 million via an offer to institutional investors outside the USA

excluding shareholders’ subscription rights. In principle, the conversion

rights are exercisable between May 21, 2012 and June 5, 2019, subject to

lapsed conversion rights as set out under § 6 section 3 or to the excluded

periods as defined by § 6 section 4 of the bond terms and conditions,