Reebok 2012 Annual Report Download - page 191

Download and view the complete annual report

Please find page 191 of the 2012 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

adidas Group

/

2012 Annual Report

Group Management Report – Financial Review

169

2012

/

03.5

/

Risk and Opportunity Report

/

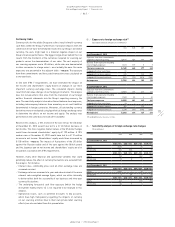

Strategic risks

Risks related to media and stakeholder activities

The adidas Group faces considerable risk if we are unable to uphold high

levels of consumer awareness, affiliation and purchase intent for our

brands. Negative media coverage on our products or business practices,

unfavourable stakeholder activism as well as speed and influence of

social media discussion may significantly hurt the Group’s reputation and

brand image and eventually lead to a sales slowdown. To mitigate these

risks, we pursue pro-active, open communication with key stakeholders

(e.g. consumers, media, non-governmental organisations, the financial

community, etc.) on a continuous basis. We have also defined clear

mission statements, values and goals for all our brands

/

SEE GLOBAL

BRANDS STRATEGY, P. 78

/

SEE OTHER BUSINESSES STRATEGY, P. 92. These form

the foundation of our product and brand communication strategies.

Furthermore, we continue to invest significant marketing resources to

build brand equity and foster consumer awareness.

Nevertheless, we continue to believe that unsubstantiated negative

media coverage, uncontrolled social media activities and stakeholder

activism could have a significant impact on our Group. Despite the

fast-moving and hardly controllable nature of social media as well as

ever-increasing media and other stakeholder activities worldwide, we

now regard the likelihood of being affected to such an extent as likely.

This is as a result of our pro-active communication approach and

continuous improvements of our communication processes.

Customer consolidation/private label risks

The adidas Group is exposed to risks from consolidation amongst

retailers as well as the expansion of retailers’ own private label

businesses. This can result in a reduction of our bargaining power or

reduced shelf space allocation from retailers.

To mitigate this risk, we maintain a regionally balanced sales mix,

focusing on cementing strong relationships with retailers and adapting

the Group’s distribution strategy with a particular focus on controlled

space initiatives

/

SEE GLOBAL SALES STRATEGY, P. 72. In addition, we are

constantly investing in strengthening brand equity to increase the

attractiveness and consumer appeal of our products

/

SEE GLOBAL BRANDS

STRATEGY, P. 78. We assess the potential impact of customer consolidation

and the expansion of private label offerings as significant. Although we

expect the consolidation trend amongst retailers and the expansion of

their own private label business to continue, we regard the likelihood

of these risks materialising as possible due to our brand strength and

excellent relationships with key retailers worldwide.

Competition risks

Strategic alliances amongst competitors and/or retailers and

intense competition for consumers and promotion partnerships from

well-established industry peers and new market entrants (e.g. new

brands, vertical retailers) pose a substantial risk to the adidas Group.

This could lead to harmful competitive behaviour, such as price wars in

the marketplace or bidding wars for promotion partnerships. Sustained

pricing pressure in one of the Group’s key markets could threaten the

Group’s sales and profitability development. Aggressive competitive

practices could also drive increases in marketing costs, thus hurting the

Group’s profitability.

To moderate competition risks, we continuously monitor competitive

and market information in order to be able to anticipate unfavourable

changes in the competitive environment rather than reacting to such

changes. This enables us to pro-actively adjust our marketing activities

when needed. We also pursue a strategy of entering into long-term

agreements with key promotion partners such as Real Madrid,

Chelsea FC or Derrick Rose. As we expect competition in our industry to

remain intense, we evaluate the potential impact for the Group as major.

However, given our leading position in the global sporting goods market

and our brand and marketing strength, we assess the likelihood of an

impact of such magnitude as only possible.

Risks related to risk and control environment

Failure to identify and actively manage substantial risks and to

implement and maintain adequate internal controls across the Group

could result in improper decisions, higher costs, compliance violation

and fraud and also cause reputational damage. Furthermore, a lack of

documentation of processes and procedures could result in a lack of

risk awareness among the Group’s employees and facilitates fraud and

compliance violations.

In order to adequately manage these risks, we maintain a Global

Policy Manual that illustrates all relevant Group policies and is freely

accessible to all employees via the Group’s intranet. In addition, we

document key business processes to create transparency and enable

the implementation of proper control mechanisms. By operating a

Group-wide risk management system, compliance management

system and internal control network, we further mitigate these risks.

Nonetheless, we believe the potential impact of these risks could be

major, but we consider the likelihood of being affected to such a degree

as possible.