Reebok 2012 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2012 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

adidas Group

/

2012 Annual Report

To Our Shareholders

47

2012

/

01.5

/

Supervisory Board Report

they did not deal with Executive Board matters. KPMG attended all meetings of the Audit Committee. The employee representatives

held separate meetings to prepare agenda items for the meetings of the entire Supervisory Board.

In the periods between meetings, the Supervisory Board Chairman and the Audit Committee Chairman maintained regular contact

with the Chief Executive Officer and the Chief Financial Officer with respect to matters such as corporate strategy, business

development and planning, the risk situation and risk management as well as compliance and major business transactions.

The consultations and examinations of the entire Supervisory Board focused on the following topics:

Business development

The development of sales and earnings, the employment situation as well as the financial position of the Group and the

business development of individual markets were presented to us in detail by the Executive Board at every Supervisory Board

meeting following the close of the respective quarter and were subsequently discussed together. At each meeting, we placed

considerable focus on the possible impact of global economic developments and the development of individual brands. We dealt

intensively with the business development of the Reebok brand and its future strategic orientation. The Executive Board informed

us that Reebok’s sales were forecasted to be below original expectations and explained the main reasons for the decline, pointing

out that this was expected to be offset by the very positive sales development of the other brands. At our meeting in November,

we discussed the future strategic positioning of one of the smaller business segments, for which we established the ad hoc

committee “Project 99”.

The KPMG-certified 2011 annual financial statements and consolidated financial statements, including the combined management

report for adidas AG and the Group, as well as the Executive Board’s proposal regarding the appropriation of retained earnings, were

discussed and examined in the presence of the Executive Board and the auditor on March 6, 2012.

At our meeting in August, the Executive Board provided us with detailed information on the compliance case that had arisen in

connection with Reebok India Company. We discussed this matter in detail under the aspects of compliance, risk management and

the potential impact on the previous year’s consolidated financial statements as well as on the business development for the year

under review.

Transactions requiring Supervisory Board approval

In accordance with statutory regulations and the Rules of Procedure of the Supervisory Board, certain transactions and measures

require a formal resolution or the prior approval of the Supervisory Board.

At our meeting on March 6, 2012, we discussed and resolved upon the resolutions to be proposed to the 2012 Annual General

Meeting, including the proposal regarding the appropriation of retained earnings for the 2011 financial year. At this meeting,

following in-depth discussion, we also approved the sale of land belonging to GEV Grundstücksgesellschaft Herzogenaurach mbH

& Co. KG (“GEV KG”) to the town of Herzogenaurach (“the Town”) and the purchase of the remaining share in GEV KG held by

the Town. At the same meeting, we dealt intensively with the possible issuance of a convertible bond by adidas AG in an amount

of up to € 500 million. We delegated granting approval of the issuance of the convertible bond and determination of the terms

and conditions, within the framework approved by the Supervisory Board, to the ad hoc committee “Convertible Bond/Bond with

Warrants”, which was established at this meeting. Furthermore, following a detailed presentation by the Executive Board relating

to the planned expansion of the Group’s golf segment, we discussed the possibility of acquiring Adams Golf, Inc., the market leader

in the hybrid sector. In order to pursue this project efficiently, we formed the “Apple” committee, which was responsible for final

approval of the acquisition that was subsequently completed in June 2012.

At our meetings in August and November, respectively, we also discussed in detail and approved a capital injection for Reebok

India Company in an amount of up to € 300 million and for adidas Canada Limited in an amount of CAD 50 million (approximately

€ 39 million).

Matters relating to the Executive Board

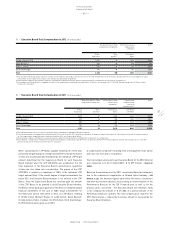

A key topic of our meeting on February 8, 2012, was the variable compensation components payable to the Executive Board.

Following in-depth discussion, we resolved upon the General Committee’s proposals for the amount of the 2011 Performance

Bonus to be granted to each member of the Executive Board and the LTIP Bonus 2009/2011 to be granted for the three-year period

from 2009 to 2011. Furthermore, following in-depth consultation, we resolved upon the key performance criteria for granting

the 2012 Performance Bonus, together with the individual short-term targets, as well as the Performance Bonus target amount

relevant for each Executive Board member, as proposed by the General Committee. As the LTIP 2009/2011 had expired at the end of