Reebok 2012 Annual Report Download - page 151

Download and view the complete annual report

Please find page 151 of the 2012 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

adidas Group

/

2012 Annual Report

Group Management Report – Financial Review

129

2012

/

03.2

/

Group Business Performance

/

Economic and Sector Development

02

/

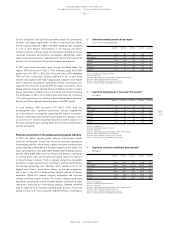

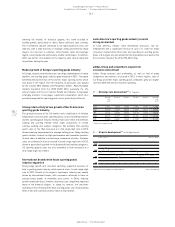

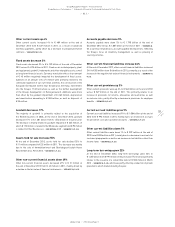

Quarterly unemployment rate by region

(in % of total active population)

Q4 2011 Q1 2012 Q2 2012 Q3 2012 Q4 2012

USA 1) 8.7 8.2 8.2 8.0 7.8

Euro area 2) 10.7 11.0 11.4 11.6 11.7

Japan 3) 4.5 4.5 4.3 4.2 4.2

China 4) 4.1 4.1 4.1 4.1 4.1

Russia 5) 6.1 6.5 5.4 5.2 5.3

Brazil 6) 4.7 6.2 5.9 5.4 4.6

1) Source: US Bureau of Labor Statistics.

2) Source: Eurostat.

3) Source: Japan Ministry of Internal Affairs and Communications.

4) Source: China National Bureau of Statistics.

5) Source: Russia Federal Service of State Statistics.

6) Source: Brazil Institute of Geography and Statistics.

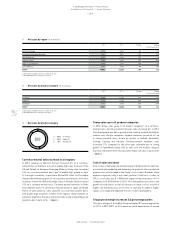

03

/

Quarterly development of Consumer Price Index 1)

(by region)

Q4 2011 Q1 2012 Q2 2012 Q3 2012 Q4 2012

USA 2) 3.0 2.7 1.7 2.0 1.7

Euro area 3) 2.7 2.7 2.4 2.6 2.2

Japan 4) (0.2) 0.5 (0.2) (0.3) (0.1)

China 5) 4.1 3.6 2.2 1.9 2.5

Russia 6) 6.1 3.7 4.3 6.6 6.6

Brazil 7) 6.5 5.2 4.9 5.3 5.8

1) Quarter-end figures.

2) Source: US Bureau of Labor Statistics.

3) Source: Eurostat.

4) Source: Japan Ministry of Internal Affairs and Communications.

5) Source: China National Bureau of Statistics.

6) Source: Russia Federal Service of State Statistics.

7) Source: Brazil Institute of Geography and Statistics.

04

/

Quarterly consumer confidence development 1)

(by region)

Q4 2011 Q1 2012 Q2 2012 Q3 2012 Q4 2012

USA 2) 64.8 69.5 62.7 68.4 66.7

Euro area 3) (21.2) (18.9) (19.6) (25.7) (26.3)

Japan 4) 38.1 40.1 40.8 40.4 39.1

China 5) 100.5 100.0 99.3 100.8 103.7

Russia 6) (7.0) (5.0) (4.0) (6.0) (8.0)

Brazil 7) 113.4 113.2 112.6 113.2 115.2

1) Quarter-end figures.

2) Source: US Bureau of Labor Statistics.

3) Source: Eurostat.

4) Source: Japan Ministry of Internal Affairs and Communications.

5) Source: China National Bureau of Statistics.

6) Source: Russia Federal Service of State Statistics.

7) Source: Brazil Institute of Geography and Statistics.

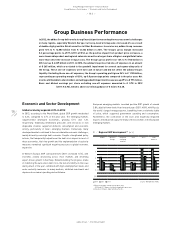

Despite disruptions from political uncertainty around the presidential

elections and budget negotiations, as well as from hurricane Sandy,

the US economy improved in 2012, with GDP expanding 1.8% compared

to 1.7% in 2011. Modest improvements in the housing and labour

markets as well as relatively stable food and fuel prices helped increase

consumer confidence and domestic consumption. Additionally, robust

export and industrial activity, supported by increasing trade with Asian

markets, also contributed to the positive economic development.

In 2012, most Asian economies grew strongly. Excluding Japan, the

region’s GDP increased 6.1% (2011: 7.4%). Including Japan, Asian GDP

growth was 4.4% (2011: 4.0%), with China and India’s GDP expanding

7.8% and 5.3%, respectively. Inflation stabilised or fell in most Asian

markets and, together with robust wage growth, helped to drive higher

levels of domestic consumption, particularly in China. These factors also

supported an increase in trade between the region’s economies, which

helped offset the reduced demand from most mature markets. In Japan,

despite government stimulus and reconstruction investments following

the earthquake in 2011, the economy grew only modestly, increasing

1.9%, with high energy costs, lacklustre global demand and a diplomatic

dispute with China negatively impacting exports and GDP growth.

In Latin America, GDP increased 2.7% (2011: 4.2%), with low

unemployment rates, significant government stimulus programmes

and solid domestic consumption supporting the region’s economies.

However, moderating export demand, particularly from Europe, as well

as an increase in inflation negatively impacted economic expansion of

the region during the year, making 2012 one of the lowest growth years

over the last decade.

Positive momentum in the global sporting goods industry

In 2012, the global sporting goods industry outperformed overall

economic development. Growth was driven by consumer spending in

the emerging markets, which offset subdued consumer confidence and

private spending in many Western European markets and in Japan. Two

major sporting events, the London 2012 Olympic and Paralympic Games

and the UEFA EURO 2012 hosted by Poland and Ukraine, contributed

to sporting goods sales and in particular helped support the industry

in many European markets. From a category perspective, basketball

posted the strongest growth rate in the industry, with both performance

and lifestyle performing well. Running, which remained one of the

biggest sales drivers, faced some softness as the year progressed,

due in part to the shift in demand from lifestyle running to lifestyle

basketball. Within the running category, lightweight and technical

running continued to grow robustly. The outdoor category faced some

headwinds, primarily due to unseasonable weather, resulting in a slight

contraction, especially for snow-related products. Demand remained

high for higher-priced, innovative sporting goods products introduced

during the year with many advanced, high-performance technologies