Reebok 2012 Annual Report Download - page 124

Download and view the complete annual report

Please find page 124 of the 2012 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

adidas Group

/

2012 Annual Report

Group Management Report – Our Group

102

2012

Global Operations

/

02.5

/

02

/

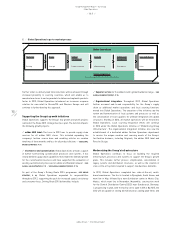

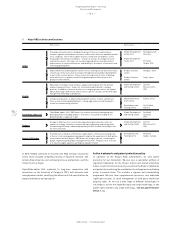

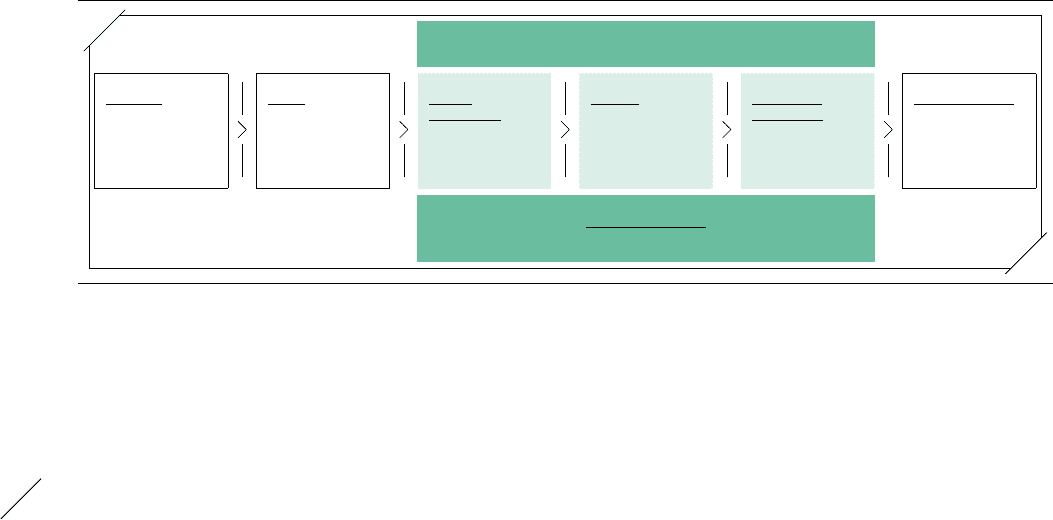

Global Operations in go-to-market process

Global Operations

Marketing

Briefing

Design

Concept

Product

Development

Product creation

Sourcing

Manufacturing

Supply Chain

Management

Distribution

Sales Subsidiaries

Sales

Centre of Excellence

Processes and infrastructure of the future

Further order-to-delivery lead time reductions will be achieved through

increased proximity to sourcing countries, which will enable us to

manufacture closer to our key markets to deliver and replenish products

faster. In 2012, Global Operations introduced an in-season response

solution for own retail in Russia/CIS and Western Europe and will

continue to further develop this approach.

Supporting the Group’s growth initiatives

Global Operations supports the Group’s key growth and profit projects

outlined in the Route 2015 strategic business plan. The function impacts

the following growth projects:

/

adidas NEO label: The focus in 2012 was to provide supply chain

services for all adidas NEO stores. This included expanding the

company’s fashion source base and enabling articles on creation

timelines of three months and less for all product divisions

/

SEE GLOBAL

BRANDS STRATEGY, P. 78.

/

eCommerce and customisation: Global Operations provides support

in further harmonising customisation processes and systems. It has

clearly defined supply chain capabilities that enable the demand growth

for the customisation business and have supported the evaluation of

existing customisation processes for adidas and Reebok footwear

/

SEE

GLOBAL SALES STRATEGY, P. 72

/

SEE GLOBAL BRANDS STRATEGY, P. 78.

As part of the Group’s Driving Route 2015 programme

/

SEE GROUP

STRATEGY, P. 68, Global Operations expanded its responsibilities

throughout 2012, supporting the push for increased speed, consistency

and consumer focus. Driving Route 2015 deliverables include:

/

Superior service for the adidas brand’s global foundation range

/

SEE

GLOBAL BRANDS STRATEGY, P. 78.

/

Organisational integration: Throughout 2012, Global Operations

further assumed end-to-end responsibility for the Group’s supply

chain as additional market operations and local sourcing functions

moved into Global Operations. The execution of the initiative saw the

review and harmonisation of local systems and processes as well as

the consolidation of local suppliers for ultimate integration into global

structures. Starting in 2013, all market operations will be moved into

Global Operations. Local sourcing integration efforts will continue

in 2013 under the Global Operations initiative of “Modernising Group

Infrastructure”. The organisational integration initiative also saw the

establishment of a dedicated adidas Fashion Operations department

to service the unique creation and sourcing needs of the Group’s

fast-fashion business, including Originals, the adidas NEO label and

Porsche Design.

Modernising the Group’s infrastructure

Global Operations continues to focus on building the required

infrastructure, processes and systems to support the Group’s growth

plans. This includes further process simplification, consolidation of

legacy systems and distribution structures, as well as the creation of

state-of-the-art systems required to support new business demands.

In 2012, Global Operations completed two state-of-the-art, multi-

brand warehouses. The first is located in Pyongtaek, South Korea, and

went live in May, followed by a new distribution centre in Mexico City,

Mexico, which went live in November. Meanwhile, construction work

for the Central Distribution Centre (CDC) near Osnabrueck, Germany,

is progressing to plan, with the facility set to open in 2013. By 2015, the

CDC will be capable of storing 35 million pieces during peak times and