Reebok 2012 Annual Report Download - page 219

Download and view the complete annual report

Please find page 219 of the 2012 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

adidas Group

/

2012 Annual Report

Consolidated Financial Statements

197

2012

Notes

/

04.8

/

02 Summary of significant accounting

policies

The consolidated financial statements are prepared in accordance with

the consolidation, accounting and valuation principles described below.

Principles of consolidation

The consolidated financial statements include the financial statements

of adidas AG and its direct and indirect subsidiaries, which are prepared

in accordance with uniform accounting principles. A company is

considered a subsidiary if it is controlled by adidas AG, e.g. by holding

the majority of the voting rights and/or directly or indirectly governing

the financial and operating policies of the respective enterprise.

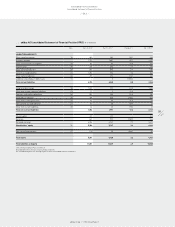

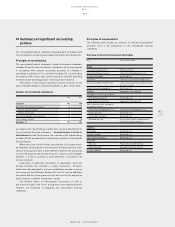

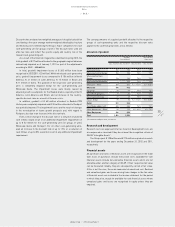

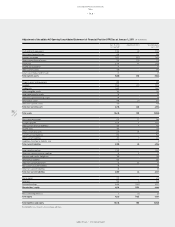

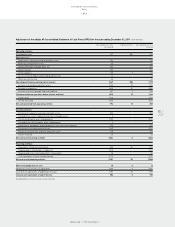

The number of consolidated subsidiaries evolved as follows for the

years ending December 31, 2012 and December 31, 2011, respectively:

Number of consolidated subsidiaries

2012 2011

January 1 173 169

First-time consolidated companies: 13 6

Thereof: newly founded 4 4

Thereof: purchased 9 2

Deconsolidated/divested companies (9) –

Intercompany mergers – (2)

December 31 177 173

A schedule of the shareholdings of adidas AG is shown in Attachment II to

the consolidated financial statements

/

SEE SHAREHOLDINGS OF ADIDAS AG,

HERZOGENAURACH, P. 240. Furthermore, the schedule of the shareholdings

of adidas AG will be published on the electronic platform of the German

Federal Gazette.

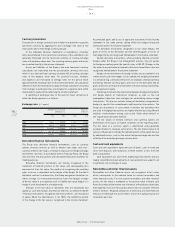

Within the scope of the first-time consolidation, all acquired assets

and liabilities are recognised in the statement of financial position at fair

value at the acquisition date. A debit difference between the acquisition

cost and the proportionate fair value of assets, liabilities and contingent

liabilities is shown as goodwill. A credit difference is recorded in the

income statement.

Acquisitions of additional investments in subsidiaries which are

already controlled are recorded as equity transactions. Therefore,

neither fair value adjustments of assets and liabilities nor gains or losses

are recognised. Any difference between the cost for such an additional

investment and the carrying amount of the net assets at the acquisition

date is directly recorded in shareholders’ equity.

The financial effects of intercompany transactions, as well as

any unrealised gains and losses arising from intercompany business

relations are eliminated in preparing the consolidated financial

statements.

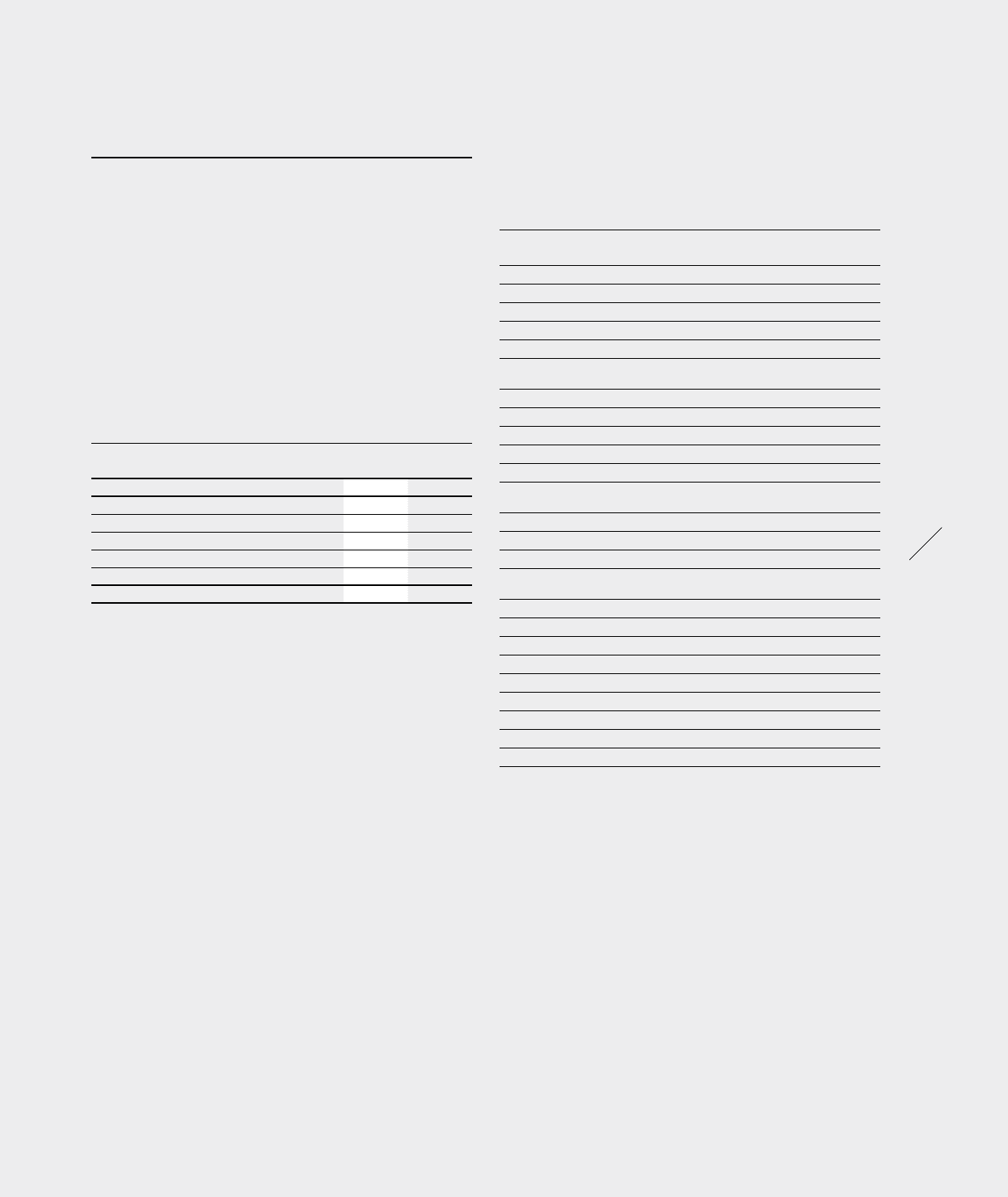

Principles of measurement

The following table includes an overview of selected measurement

principles used in the preparation of the consolidated financial

statements.

Overview of selected measurement principles

Item Measurement principle

Assets

Cash and cash equivalents Nominal amount

Short-term financial assets At fair value through profit or loss

Accounts receivable Amortised cost

Inventories Lower of cost or net realisable value

Assets classified as held for sale Lower of carrying amount and fair value

less costs to sell

Property, plant and equipment Amortised cost

Goodwill Impairment-only approach

Intangible assets (except goodwill):

With definite useful life Amortised cost

With indefinite useful life Impairment-only approach

Other financial assets (categories

according to IAS 39):

At fair value through profit or loss At fair value through profit or loss

Held to maturity Amortised cost

Loans and receivables Amortised cost

Available-for-sale At fair value in other comprehensive

income or at amortised cost

Liabilities

Borrowings Amortised cost

Accounts payable Amortised cost

Other financial liabilities Amortised cost

Provisions:

Pensions Projected unit credit method

Other provisions Expected settlement amount

Accrued liabilities Amortised cost