Reebok 2012 Annual Report Download - page 183

Download and view the complete annual report

Please find page 183 of the 2012 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

adidas Group

/

2012 Annual Report

Group Management Report – Financial Review

161

2012

Subsequent Events and Outlook

/

03.4

/

Average operating working capital as a percentage

of sales to increase moderately

In 2013, average operating working capital as a percentage of sales is

expected to increase moderately compared to the prior year level (2012:

20.0%). This is mainly due to working capital increases to support the

growth of our business as well as the build-up to the 2014 FIFA World

Cup.

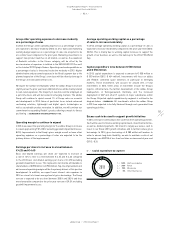

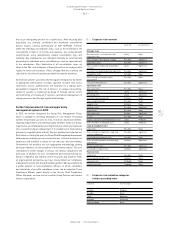

Capital expenditure to be between € 500 million

and € 550 million

In 2013, capital expenditure is expected to amount to € 500 million to

€ 550 million (2012: € 434 million). Investments will focus on adidas

and Reebok controlled space initiatives, in particular in emerging

markets. These investments will account for around 35% of total

investments in 2013. Other areas of investment include the Group’s

logistics infrastructure, the further development of the adidas Group

headquarters in Herzogenaurach, Germany, and the increased

deployment of SAP and other IT systems in major subsidiaries within

the Group. Projected capital expenditure by segment is outlined in the

diagram below

/

DIAGRAM 02. All investments within the adidas Group

in 2013 are expected to be fully financed through cash generated from

operating activities.

Excess cash to be used to support growth initiatives

In 2013, we expect continued positive cash flow from operating activities.

Cash will be used to finance working capital needs, investment activities,

as well as dividend payments. We intend to largely use excess cash to

invest in our Route 2015 growth initiatives and to further reduce gross

borrowings. In 2013, gross borrowings of € 280 million will mature. In

order to ensure long-term flexibility, we aim to maintain a ratio of net

borrowings over EBITDA of less than two times as measured at year-end

(2012: –0.3).

Group other operating expenses to decrease modestly

as a percentage of sales

In 2013, the Group’s other operating expenses as a percentage of sales

are expected to decrease modestly (2012: 41.3%). Sales and marketing

working budget expenses as a percentage of sales are projected to be

at a similar level compared to the prior year. Marketing investments to

support new product launches at all brands, as well as the expansion

of Reebok’s activities in the fitness category, will be offset by the

non-recurrence of expenses in relation to the UEFA EURO 2012 as well

as the London 2012 Olympic Games. Operating overhead expenditure as

a percentage of sales is forecasted to decline modestly in 2013. Higher

administrative and personnel expenses in the Retail segment due to the

planned expansion of the Group’s store base will be offset by leverage in

the Group’s non-allocated central costs.

We expect the number of employees within the adidas Group to increase

slightly versus the prior year level. Additional hires will be mainly related

to own-retail expansion. The majority of new hires will be employed on

a part-time basis and will be located in emerging markets. The adidas

Group will continue to spend around 1% of Group sales on research

and development in 2013. Areas of particular focus include advanced

cushioning solutions, lightweight and digital sports technologies as

well as sustainable product innovation. In addition, we will continue our

commitment to expanding Reebok’s product offering to match its fitness

positioning

/

SEE RESEARCH AND DEVELOPMENT, P. 105.

Operating margin to continue to expand

In 2013, we expect the operating margin for the adidas Group to increase

to a level approaching 9.0% (2012 excluding goodwill impairment losses:

8.0%). Improvements in the Group’s gross margin as well as lower other

operating expenses as a percentage of sales are expected to be the

primary drivers of the improvement.

Earnings per share to increase to a level between

€ 4.25 and € 4.40

Basic and diluted earnings per share are expected to increase at

a rate of 12% to 16% to a level between € 4.25 and € 4.40 compared

to the 2012 basic and diluted earnings per share of € 3.78 excluding

goodwill impairment losses. This represents net income attributable to

shareholders of € 890 million to € 920 million. Top-line improvement and

an increased operating margin will be the primary drivers of this positive

development. In addition, we expect lower interest rate expenses in

2013 as a result of a lower average level of gross borrowings. The Group

tax rate is expected to be at a level between 28.0% and 28.5% and thus

more favourable compared to the prior year tax rate of 29.3% excluding

goodwill impairment losses.

02

/

Capital expenditure by segment

2013

1

/

50% HQ/Consolidation

2

/

30% Retail

3

/

15% Wholesale

4

/

5% Other Businesses

1

2

3 4