Reebok 2012 Annual Report Download - page 232

Download and view the complete annual report

Please find page 232 of the 2012 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

adidas Group

/

2012 Annual Report

Consolidated Financial Statements

210

2012

Notes

/

04.8

/

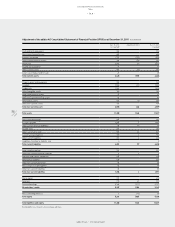

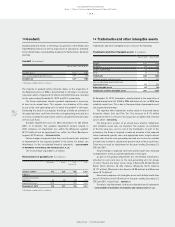

The following valuation methods for the acquired assets were applied:

/

Inventories: For finished goods, the “comparative sales method”

was used, which estimates the expected sales price of the respective

inventory, reduced for all costs expected to be incurred in its completion/

disposition and a profit on those costs. The value of the component parts

was determined by estimating the cost to replace each component.

/

Trademarks and other intangible assets: The “relief-from-royalty

method” was applied for the trademarks/trade names as well as for

patents and technology. The fair value was determined by discounting

notional royalty savings after tax and adding a tax amortisation benefit,

resulting from the amortisation of the acquired asset. For the valuation of

customer contracts and related customer relationships, the “distributor

method” was used under the “income approach”.

The purchase price allocation is considered to be preliminary with

regard to the tax items.

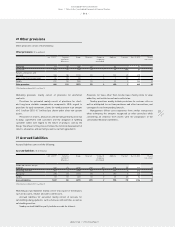

The excess of the acquisition cost paid versus the net of the

amounts of the fair values assigned to all assets acquired and liabilities

assumed, taking into consideration the respective deferred taxes, was

recognised as goodwill. It mainly arises from expected synergies and the

resulting expansion of the product portfolio of TaylorMade-adidas Golf.

Any acquired asset that did not meet the identification and recognition

criteria for an asset was included in the amount recognised as goodwill.

The goodwill arising on this acquisition was allocated to the

cash-generating unit TaylorMade-adidas Golf at the time of the

acquisition. The goodwill is not deductible for tax purposes and is

denominated in US dollars as the local functional currency

/

SEE NOTE 02.

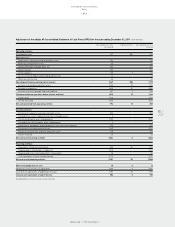

The acquired subsidiary generated net sales of € 33 million as well

as net losses of € 22 million for the period from June to December

2012. If this acquisition had occurred on January 1, 2012, total Group

net sales would have been € 14.9 billion and net income attributable

to shareholders would have been € 534 million for the year ending

December 31, 2012.

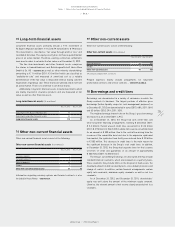

Effective August 31, 2012, adidas AG acquired the remaining 15% of

the shares of its subsidiary in Hungary, adidas Budapest Kft., Budapest,

for a purchase price of € 1 million. This acquisition represented an

equity transaction, whereby no goodwill has been incurred.

At September 30, 2012, 90% of the shares in Immobilieninvest und

Betriebsgesellschaft Herzo-Base GmbH & Co. KG, whose assets and

liabilities were classified as held for sale, were sold for a purchase price

of € 14 million

/

SEE NOTE 11. The remaining 10% of the shares continue

to be held by the Group and are recorded under long-term financial

assets

/

SEE NOTE 15. The sale led to a gain of € 1 million.

Effective November 4, 2011, adidas America Inc. signed a share

purchase agreement to acquire Stone Age Equipment, Inc. (“Five Ten”)

based in Redlands, California (USA). Five Ten is a company in the outdoor

action sports sector, which focuses on categories such as climbing

and mountain biking. Through the acquisition of Five Ten, the adidas

Group intends to improve its position in the outdoor category, which

provides significant growth opportunities as articulated in the Group’s

strategic business plan “Route 2015”. The entire business of Five Ten

was purchased for a purchase price in the amount of US $ 25 million

in cash and contingent payments in an amount of US $ 13 million, of

which US $ 3 million was paid up front. The contingent payments are

dependent on Five Ten achieving certain performance measures over

the first three years after the acquisition.

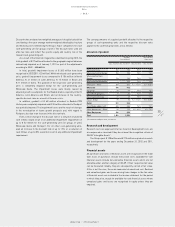

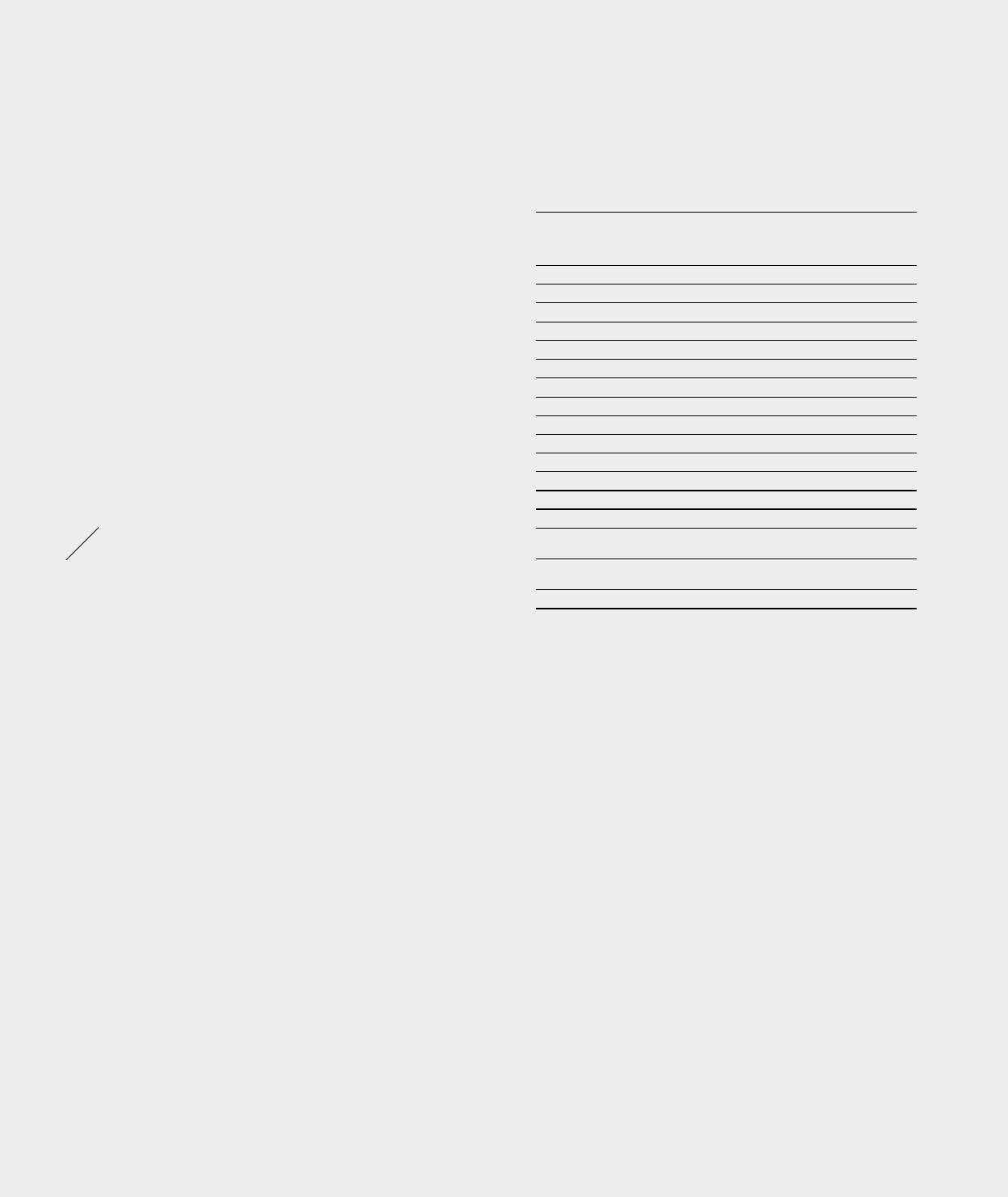

The acquisition had the following effect on the Group’s assets and

liabilities, based on a purchase price allocation:

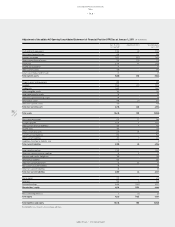

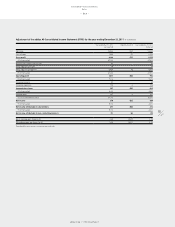

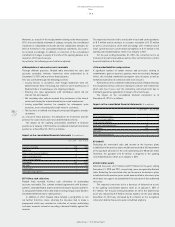

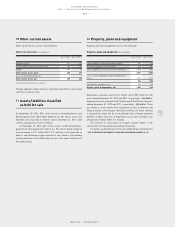

Net assets of Stone Age Equipment, Inc. including subsidiaries

at the acquisition date (€ in millions)

Pre-acquisition

carrying amounts

Fair value

adjustments

Recognised

values on

acquisition

Accounts receivable 2 – 2

Inventories 4 – 4

Other current assets 1 0 1

Property, plant and equipment 0 – 0

Trademarks – 8 8

Other intangible assets – 14 14

Other non-current assets 0 – 0

Short-term borrowings (0) – (0)

Accounts payable (3) – (3)

Current accrued liabilities (0) – (0)

Long-term borrowings (1) – (1)

Deferred tax liabilities – (9) (9)

Net assets 3 13 16

Goodwill arising on acquisition 11

Purchase price in consideration

of contingent payments 27

Less: contingent payments in

subsequent years (7)

Cash outflow on acquisition 20

The following valuation methods for the acquired assets were applied:

/

Trademark: The “relief-from-royalty method” was applied for the

trademark/trade name. The fair value was determined by discounting

notional royalty savings after tax and adding a tax amortisation benefit,

resulting from the amortisation of the acquired asset.

/

Other intangible assets: For the valuation of technologies and

other intangible assets, the “multi-period-excess-earnings method”

was used. The respective future excess cash flows were identified and

adjusted in order to eliminate all elements not associated with these

assets. Future cash flows were measured on the basis of the expected

sales by deducting variable and sales-related imputed costs for the use

of contributory assets. Subsequently, the outcome was discounted using

the appropriate discount rate and adding a tax amortisation benefit.