Reebok 2012 Annual Report Download - page 220

Download and view the complete annual report

Please find page 220 of the 2012 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

adidas Group

/

2012 Annual Report

Consolidated Financial Statements

198

2012

Notes

/

04.8

/

Currency translation

Transactions in foreign currencies are initially recorded in the respective

functional currency by applying the spot exchange rate valid at the

transaction date to the foreign currency amount.

In the individual financial statements of subsidiaries, monetary

items denominated in non-functional currencies of the subsidiaries are

generally translated into the functional currency at closing exchange

rates at the balance sheet date. The resulting currency gains and losses

are recorded directly in the income statement.

Assets and liabilities of the Group’s non-euro functional currency

subsidiaries are translated into the presentation currency, the euro,

which is also the functional currency of adidas AG, at closing exchange

rates at the balance sheet date. For practical reasons, revenues

and expenses are translated at average rates for the period which

approximate the exchange rates on the transaction dates. All cumulative

differences from the translation of equity of foreign subsidiaries resulting

from changes in exchange rates are included in a separate item within

shareholders’ equity without affecting the income statement.

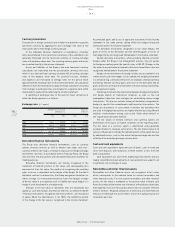

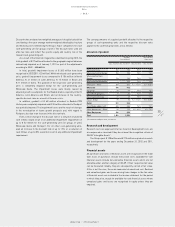

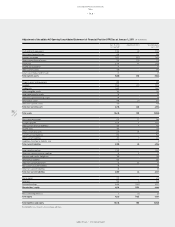

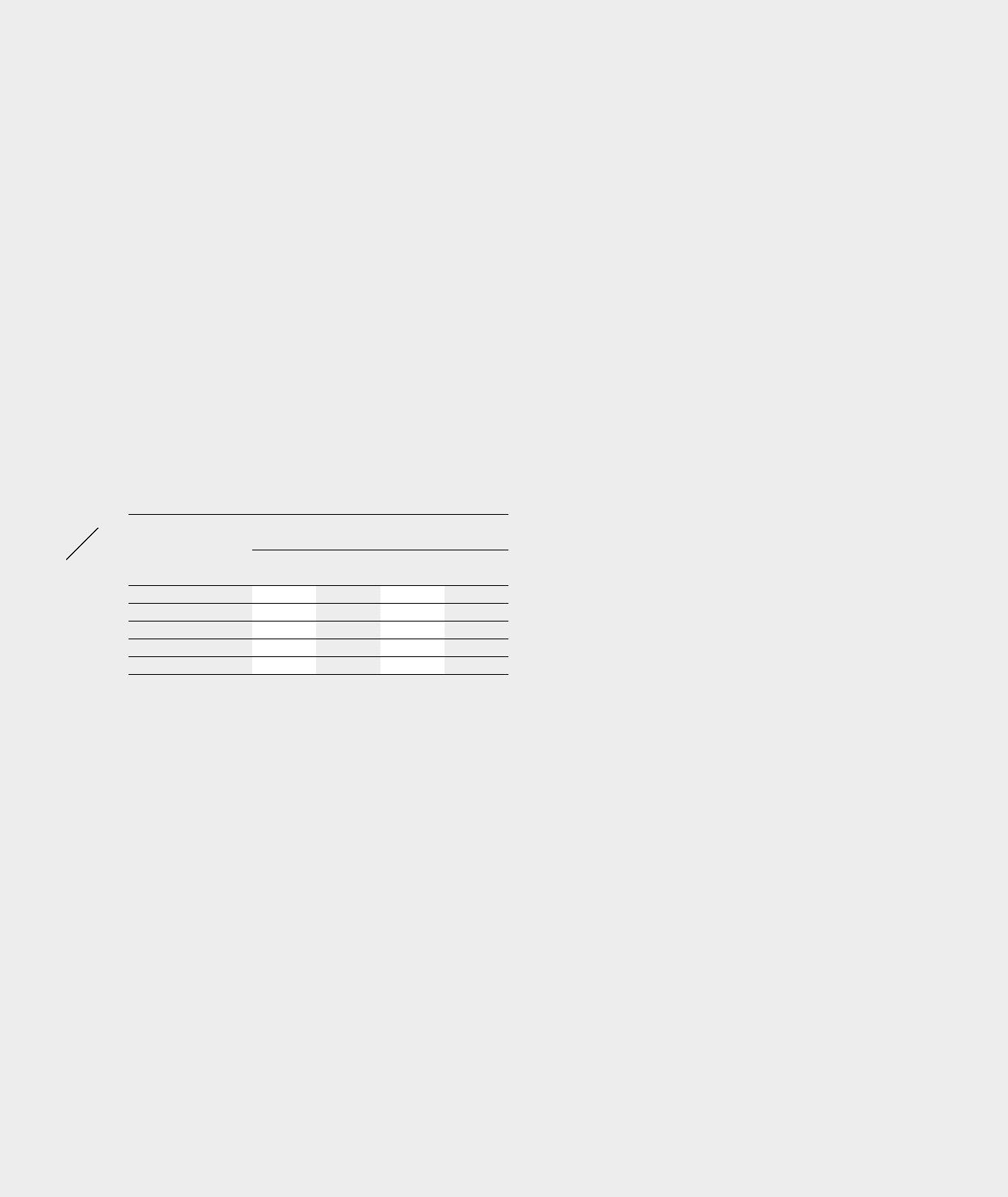

A summary of exchange rates to the euro for major currencies in

which the Group operates is as follows:

Exchange rates (€ 1 equals)

Average rates for the year

ending Dec. 31,

Spot rates

at Dec. 31,

2012 2011 2012 2011

USD 1.2862 1.3922 1.3194 1.2939

GBP 0.8115 0.8678 0.8161 0.8353

JPY 102.6451 111.0420 113.6100 100.2000

CNY 8.1137 9.0000 8.2931 8.1527

RUB 39.9512 40.8709 40.0737 41.4303

Derivative financial instruments

The Group uses derivative financial instruments, such as currency

options, forward contracts as well as interest rate swaps and cross-

currency interest rate swaps, to hedge its exposure to foreign exchange

and interest rate risks. In accordance with its Treasury Policy, the Group

does not enter into transactions with derivative financial instruments for

trading purposes.

Derivative financial instruments are initially recognised in the

statement of financial position at fair value, and subsequently also

measured at their fair value. The method of recognising the resulting

gains or losses is dependent on the nature of the hedge. On the date a

derivative contract is entered into, the Group designates derivatives as

either a hedge of a forecasted transaction (cash flow hedge), a hedge

of the fair value of a recognised asset or liability (fair value hedge) or a

hedge of a net investment in a foreign entity.

Changes in the fair value of derivatives that are designated and

qualify as cash flow hedges, and that are effective, as defined in IAS 39

“Financial instruments: recognition and measurement”, are recognised

in equity. When the effectiveness is not 100%, the ineffective portion

of the change in the fair value is recognised in the income statement.

Accumulated gains and losses in equity are transferred to the income

statement in the same periods during which the hedged forecasted

transaction affects the income statement.

For derivative instruments designated as fair value hedges, the

gains or losses on the derivatives and the offsetting gains or losses on

the hedged items are recognised immediately in the income statement.

Certain derivative transactions, while providing effective economic

hedges under the Group’s risk management policies, may not qualify

for hedge accounting under the specific rules of IAS 39. Changes in the

fair value of any derivative instruments that do not meet these rules are

recognised immediately in the income statement.

Hedges of net investments in foreign entities are accounted for in a

similar way to cash flow hedges. If, for example, the hedging instrument

is a derivative (e.g. a forward contract) or, for example, a foreign currency

borrowing, effective currency gains and losses in the derivative and all

gains and losses arising on the translation of the borrowing, respectively,

are recognised in equity.

The Group documents the relationship between hedging instruments

and hedge objects at transaction inception, as well as the risk

management objectives and strategies for undertaking various hedge

transactions. This process includes linking all derivatives designated as

hedges to specific firm commitments and forecasted transactions. The

Group also documents its assessment of whether the derivatives that

are used in hedging transactions are highly effective by using different

methods of effectiveness testing, such as the “dollar offset method” or

the “hypothetical derivative method”.

The fair values of forward contracts and currency options are

determined on the basis of market conditions on the reporting dates.

The fair value of a currency option is determined using generally

accepted models to calculate option prices. The fair market value of an

option is influenced not only by the remaining term of the option but also

by additional factors, such as the actual foreign exchange rate and the

volatility of the underlying foreign currency base.

Cash and cash equivalents

Cash and cash equivalents represent cash at banks, cash on hand and

short-term deposits with maturities of three months or less from the

date of acquisition.

Cash equivalents are short-term, highly liquid investments that are

readily convertible to known amounts of cash and which are subject to an

insignificant risk of changes in value.

Receivables and other financial assets

Receivables and other financial assets are recognised at fair value,

which corresponds to the nominal value for current receivables and

other financial assets. For non-current receivables and other financial

assets, the fair value is estimated as the present value of future cash

flows discounted at the market rate of interest at the balance sheet date.

Subsequently, these are measured at amortised cost using the “effective

interest method”. Required allowances, if necessary, are determined on

the basis of individual risk assessments, and on the ageing structure of

receivables past due.