Reebok 2012 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2012 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

adidas Group

/

2012 Annual Report

To Our Shareholders

37

2012

/

01.2

/

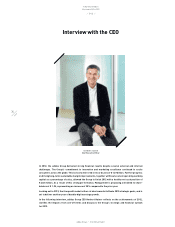

Interview with the CEO

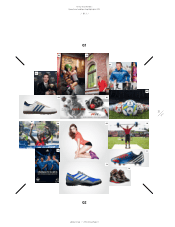

Speaking of China, many sporting goods companies had a

difficult 2012, whereas the adidas Group grew by 15%. What is

the reason behind this and what can we expect in 2013?

/

For many players in our industry, China was indeed a challenge

in 2012. However, this was mainly the result of certain specific

competitor issues and not due to any lack of interest in sporting goods

on the part of the consumer. In fact, Chinese consumers have seen their

real income continue to grow strongly, and this is supporting spending

power and consumption for our industry. What is our recipe for success?

Well, it comes back to one of the guiding principles of our Route 2015

strategic plan – focus on the consumer. As part of a rising middle

class, our consumer target group in China is maturing at a rapid pace,

becoming increasingly discerning and sophisticated. They are looking for

innovative global brands with functional, stylish and fashionable products

which they can identify with. adidas fits perfectly to this consumer and,

on top of our global appeal, we also infuse our brand messages and

products with local flair and understanding to ensure we are always top

of mind. This approach spans the entire offering, and this strength is

underpinned through the fact that we saw double-digit growth in adidas

Sport Performance, adidas Originals and the adidas NEO label in 2012.

Additionally, we have deepened our already very close relationship with

our retail partners, who now operate more than 7,500 points of sale

across Greater China. By ensuring that our business remains constantly

in tune with theirs, in particular through our industry leadership in

terms of keeping our inventories under control, we have been able to

keep our product offerings fresh and new at the point of sale. This is a

clear edge we are enjoying and will continue to enjoy. Looking forward,

from our market research, we can see that adidas’ brand appeal has the

most momentum in the Chinese market right now. I fully expect this to

continue in 2013, and I am confident we will take more market share and

grow faster than our major competitors in this critical market.

Taking all the negative impacts for Reebok into account, what

was the underlying business trend, and what do you expect for

the brand in 2013?

/

Reebok sales declined 18% currency-neutral in 2012. Excluding

the impacts from the discontinuation of the NFL business and the

transfer of NHL-related sales to Reebok-CCM Hockey, sales declined

8%. The brand’s gross margin was essentially flat at 35.9%, which is

not a bad performance, given we had quite some promotional activity

to move old toning products during the year. While we are obviously

disappointed with the result, we have seen the underlying business

further stabilise. In the fourth quarter, Reebok sales excluding licence

revenues were up 3% currency-neutral. To ensure this now continues,

we will commence a major brand and category offensive in fitness in

2013. Our new category approach, which we call “The House of Fitness”,

allows Reebok to engage with consumers, regardless of how they

choose to stay fit. It focuses on five key areas: Fitness Training, Fitness

Running, Studio categories including Yoga, Dance and Aerobics, Walking

as well as Classics. Several new footwear and apparel collections will

be launched throughout the year to create a broad-based foundation

for long-term, sustainable success. For example, in Fitness Training,

Reebok will introduce the Reebok Delta collection, which takes design

inspiration from the CrossFit community. This collection is redefining

the fitness apparel aesthetic, with every piece designed and developed

for the freedom of movement for any fitness activity. In addition to new

products, we will activate new exciting partnerships to authenticate and

give credibility to Reebok in each category. Renowned yoga instructor

Tara Stiles, the Spartan Race series of obstacle races and the Red Bull

X-Alps adventure race are just a taste of what’s to come over the next

couple of years. Bringing it all together, in 2013, the Reebok brand will

speak to the consumer with one voice by launching a global campaign.

The campaign, which is called “Live with Fire”, will be the brand’s first

concerted effort to inspire the fitness consumer to live a life of passion,

intent and purpose. Everything I see so far confirms we are gaining

traction again with retailers and consumers, and I fully expect a return

to growth for Reebok once we anniversary the last of the NFL-related

comparisons in the first quarter.