Reebok 2012 Annual Report Download - page 166

Download and view the complete annual report

Please find page 166 of the 2012 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

adidas Group

/

2012 Annual Report

Group Management Report – Financial Review

144

2012

/

03.2

/

Group Business Performance

/

Treasur y

52

/

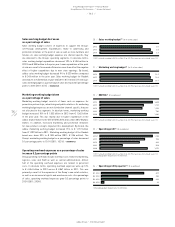

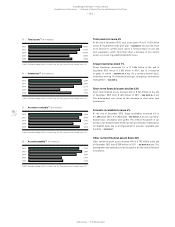

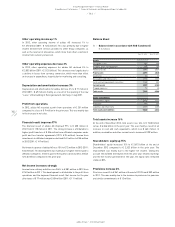

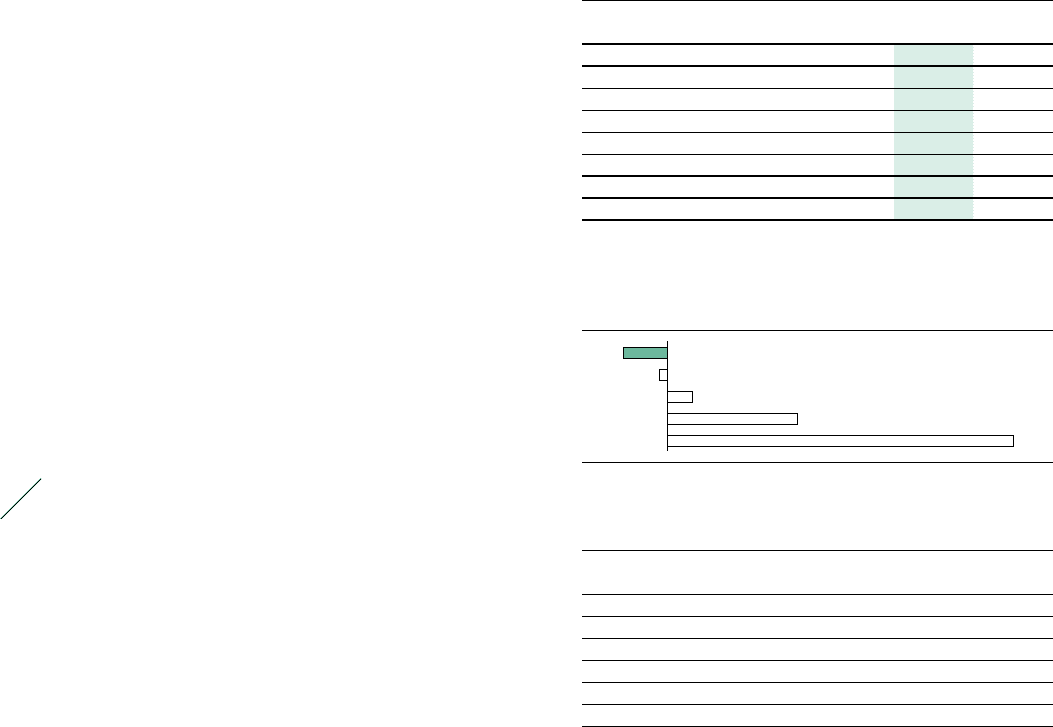

Financial leverage (in %)

2012 (8.5)

2011 (1.7)

2010 4.8

2009 24.3

2008 64.6

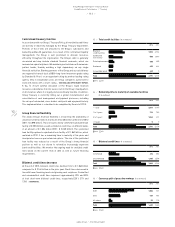

53

/

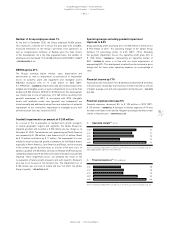

Issued bonds at a glance (in millions)

Issued bonds Volume Coupon Maturity

US private placement USD 292 fixed 2013

Eurobond EUR 500 fixed 2014

German private placement EUR 56 fixed 2014

US private placement USD 115 fixed 2015

US private placement USD 150 fixed 2016

Convertible bond EUR 500 fixed 2019

51

/

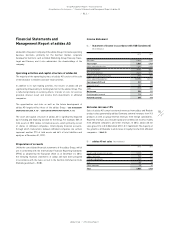

Financing structure 1) (€ in millions)

2012 2011

Cash and short-term financial assets 1,935 1,370

Bank borrowings 59 126

Commercial paper 0 0

Private placements 480 655

Eurobond 499 499

Convertible bond 449 0

Gross total borrowings 1,487 1,280

Net cash 448 90

1) Rounding differences may arise in totals.

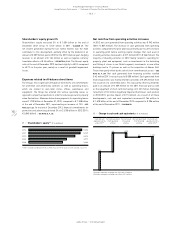

Interest rate improves

The weighted average interest rate on the Group’s gross borrowings

decreased to 4.4% in 2012 (2011: 4.9%)

/

DIAGRAM 50. The positive effect

from lower interest rates on short-term borrowings was partly offset

by the negative effect from local borrowings in currencies which carry

a higher average interest rate. Fixed-rate financing amounted to 96%

of the Group’s total gross borrowings at the end of 2012 (2011: 77%).

Variable-rate financing amounted to 4% of total gross borrowings at the

end of the year (2011: 23%).

Net cash position increases by € 358 million

The Group ended the year with a net cash position of € 448 million,

compared to a net cash position of € 90 million at the end of the

prior year, reflecting an improvement of € 358 million

/

DIAGRAM 48.

Strong cash flow from operating activities significantly influenced this

development. Currency effects had a positive impact of € 3 million on net

cash development. The Group’s financial leverage declined to –8.5% at

the end of 2012 versus –1.7% in the prior year

/

DIAGRAM 52. At the end of

2012, the ratio of net borrowings over EBITDA was –0.3 (2011: –0.1) and

was thus well within the Group’s medium-term guideline of less than

two times. Efficient management of our capital structure continues to

be a top priority for the Group

/

SEE SUBSEQUENT EVENTS AND OUTLOOK, P. 157.

Effective currency management a key priority

As a globally operating company, the Group is exposed to currency

risks. Therefore, effective currency management is a key focus of Group

Treasury, with the aim of reducing the impact of currency fluctuations on

non-euro-denominated net future cashflows. In this regard, hedging US

dollars is a central part of our programme. This is a direct result of the

Group’s Asian-dominated sourcing, which is largely denominated in US

dollars

/

SEE GLOBAL OPERATIONS, P. 100 In 2012, Group Treasury managed

a net deficit of around US $ 2.7 billion against the euro, related to

operational activities (2011: US $ 3.0 billion). As governed by the Group’s

Treasury Policy, we have established a rolling 12- to 24-month hedging

system, under which the vast majority of the anticipated seasonal

hedging volume is secured approximately six months prior to the start of

a season. As a result, we have almost completed our anticipated hedging

needs for 2013 as of year-end 2012 and have already started hedging our

exposure for 2014. The rates for 2013 are less favourable compared to

those of 2012. The use or combination of different hedging instruments,

such as forward contracts, currency options and swaps, protects us

against unfavourable currency movements. The use of currency options

allows the Group to benefit from future favourable exchange rate

developments

/

SEE RISK AND OPPORTUNITY REPORT, P. 164.