Reebok 2012 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2012 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

adidas Group

/

2012 Annual Report

To Our Shareholders

48

2012

/

01.5

/

Supervisory Board Report

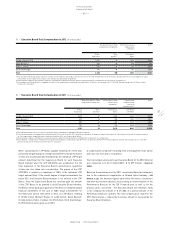

the 2011 financial year, we also discussed and approved the General Committee’s proposal to set up a new compensation plan with

long-term incentive effect covering the three-year period from 2012 to 2014 (“LTIP 2012/2014”). When determining the two variable

compensation components, we took into account that the compensation incentive of the 2012 Performance Bonus Plan shall not exceed

the compensation incentive resulting from the sustainability-oriented variable compensation component, the LTIP 2012/2014. The

Annual General Meeting approved the changed compensation system on May 10, 2012.

At our meeting on November 7, 2012, following detailed discussion of the proposal submitted by the General Committee, we resolved

upon an appropriate increase in the Chief Executive Officer’s fixed annual salary, which had remained unchanged for the past three

years, to become effective from spring 2013. We took this decision in particular in light of his outstanding personal performance and

the excellent position of the Group.

Key topics at our meeting in February 2013 as well as of our circular resolution were the Performance Bonuses for the 2012

financial year and for the previous years. We dealt with the impact on the degree of target achievement for the Performance

Bonuses as determined in the previous years, resulting from adjustments made to the 2011 consolidated financial statements in

the context of the 2012 consolidated financial statements

/

SEE NOTE 03, P. 203. We discussed in-depth the proposal prepared by the

General Committee, based on the adjusted figures, and subsequently resolved upon a redetermination of the Performance Bonuses

for the 2011 financial year and the previous years, including a corresponding obligation for repayment by the Executive Board, while

upholding the LTIP Bonus 2009/2011, the latter requiring no redetermination. The Executive Board members and the Chairman of

the General Committee were already in agreement prior to the meeting that the Performance Bonuses should be partially repaid.

We further resolved upon the proposal submitted by the General Committee with regard to the 2012 Performance Bonus.

Further information on compensation for the 2012 financial year can be found in the Compensation Report

/

SEE COMPENSATION

REPORT, P. 56.

Corporate governance

The Supervisory Board regularly monitors the application and further development of the corporate governance regulations within

the company, in particular the implementation of the recommendations of the German Corporate Governance Code (the “Code”). In

addition to our February meetings, at which corporate governance is usually the focal point, at our August meeting, we dealt with

the implementation of the efficiency examinations scheduled for the year under review and resolved to conduct these examinations

by means of a questionnaire and the involvement of an external consultant. Another topic of this meeting was the amendments to

the Code which were adopted by the Government Commission on the German Corporate Governance Code on May 15, 2012. The

Code now recommends, inter alia, that in the objectives the Supervisory Board resolves upon with regard to its composition, it shall

specify the number of independent Supervisory Board members it considers adequate. At our meeting on February 12, 2013, we

reviewed the objective we had resolved upon in February 2011, which also covers this topic, with the result that, taking into account

the employment contracts of the employee representatives, we continue to uphold our objective that all Supervisory Board members

shall be independent as defined by the Code. Our other key objectives relating to the composition of the Supervisory Board also

continue to apply. At this meeting, following in-depth consultation and the recommendation of the Audit Committee, which is also

responsible for corporate governance topics, we then resolved upon the 2013 Declaration of Compliance. The deviation from the

Code contained in the 2012 Declaration of Compliance – Supervisory Board compensation does not have any performance-related

component – which we had resolved upon at our meeting on February 8, 2012, is no longer included in the 2013 Declaration of

Compliance as the new version of the Code no longer contains the recommendation to include a performance-related component

for Supervisory Board members. The Declarations of Compliance were made permanently available to shareholders on the

corporate website at :

//

WWW.ADIDAS-GROUP.COM/CORPORATE_GOVERNANCE.

There was no indication of any conflicts of interest on the part of the members of the Executive and Supervisory Boards which would

require immediate disclosure to the Supervisory Board and would also require reporting to the Annual General Meeting.

There are no direct advisory or other service relationships between the company and a member of the Supervisory Board.

Further information on corporate governance at the adidas Group can be found in the Corporate Governance Report including the

Declaration on Corporate Governance

/

SEE CORPORATE GOVERNANCE REPORT INCLUDING THE DECLARATION ON CORPORATE GOVERNANCE, P. 51.

Efficient committee work

In order to perform our tasks in an efficient manner, we have five Supervisory Board standing committees

/

SEE SUPERVISORY

BOARD, P. 44 and also four project-related ad hoc committees, which were established in 2009 and 2012. These committees have

the task of preparing topics and resolutions of the Supervisory Board. In appropriate cases, and within the legal framework,