Reebok 2012 Annual Report Download - page 224

Download and view the complete annual report

Please find page 224 of the 2012 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

adidas Group

/

2012 Annual Report

Consolidated Financial Statements

202

2012

Notes

/

04.8

/

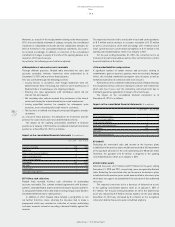

Borrowings and other liabilities

Borrowings and other liabilities are recognised at fair value using

the “effective interest method”, net of transaction costs incurred. In

subsequent periods, long-term borrowings are stated at amortised cost

using the “effective interest method”. Any difference between proceeds

(net of transaction costs) and the redemption value is recognised in the

income statement over the term of the borrowing.

adidas AG has issued a compound financial instrument in the form

of a convertible bond which grants the holder the right to convert the

bond into adidas AG shares. The number of underlying shares is fixed

and does not vary subject to the fair value of the shares.

Compound financial instruments (e.g. convertible bonds) are divided

into a liability component shown under borrowings and into an equity

component resulting from conversion rights. The equity component is

included in the capital reserve. The fair value of the liability component

is determined by discounting the interest and principal payments of a

comparable liability without conversion rights, applying risk-adjusted

interest rates. The liability component is subsequently measured

at amortised cost using the “effective interest method”. The equity

component is determined as the difference between the fair value of the

total compound financial instrument and the fair value of the liability

component and is reported within equity. There is no subsequent

measurement of the equity component. At initial recognition, directly

attributable transaction costs are assigned to the equity and liability

component pro rata on the basis of the respective carrying amounts.

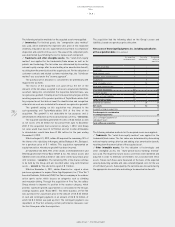

Other provisions and accrued liabilities

Other provisions are recognised where a present obligation (legal or

constructive) to third parties has been incurred as a result of a past

event which can be estimated reliably and is likely to lead to an outflow

of resources, and where the timing or amount is uncertain. Other

non-current provisions are discounted if the effect of discounting is

material.

Accrued liabilities are liabilities to pay for goods or services that

have been received or supplied but have not been paid, invoiced or

formally agreed with the supplier, including amounts due to employees.

Here, however, the timing and amount of an outflow of resources is not

uncertain.

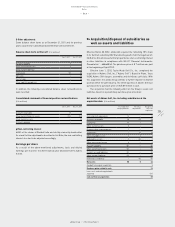

Pensions and similar obligations

Provisions and expenses for pensions and similar obligations relate

to the Group’s obligations for defined benefit and defined contribution

plans. Obligations under defined benefit plans are determined

separately for each plan by valuing the employee benefits accrued in

return for their service during the current and prior periods. These

benefit accruals are discounted to determine their present value, and

the fair value of any plan assets is deducted in order to determine the

net liability. The discount rate is set on the basis of yields at the balance

sheet date for high-quality corporate bonds provided there is a deep

market for high-quality corporate bonds in a given currency. Otherwise,

government bond yields are used as a reference. Calculations are

performed by qualified actuaries using the “projected unit credit

method” in accordance with IAS 19 “Employee Benefits”. Obligations for

contributions to defined contribution plans are recognised as an expense

in the income statement as incurred.

In addition to recognising actuarial gains and losses in the income

statement according to the “corridor method”, IAS 19 grants the option

to immediately recognise actuarial gains and losses within equity.

The Group utilises this option in order to avoid earnings volatility and

recognises actuarial gains or losses for defined benefit plans arising

during the financial year immediately within other comprehensive

income.

Recognition of revenues

Sales are recognised at the fair value of the consideration received or

receivable, net of returns, trade discounts and volume rebates, when the

significant risks and rewards of ownership of the goods are transferred to

the buyer, and when it is probable that the economic benefits associated

with the transaction will flow to the Group.

Royalty and commission income is recognised based on the contract

terms on an accrual basis.

Advertising and promotional expenditures

Production costs for media campaigns are included in prepaid expenses

(other current and non-current assets) until the services are received,

and upon receipt expensed in full. Significant media buying costs are

expensed over the intended duration of the broadcast.

Promotional expenses that involve payments, including one-time

up-front payments for promotional contracts, are expensed on a

straight-line basis over the term of the agreement.