Reebok 2012 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2012 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275 -

276

276 -

277

277 -

278

278 -

279

279 -

280

280 -

281

281 -

282

282

|

|

adidas Group

/

2012 Annual Report

To Our Shareholders

64

2012

/

01.8

/

Our Share

07

/

Recommendation split 1)

1) At year-end 2012. Source: Bloomberg.

2012 1

/

60% Buy

2

/

30% Hold

3

/

10% Sell

1

2

3

06

/

Shareholder structure 1)

1) As of February 2013.

2012

1

/

36% North America

2

/

35% Rest of Europe

3

/

12% Germany

4

/

11% Other, undisclosed holdings

5

/

4% Rest of the world

6

/

2% Management

6

5

1

2

3

4

Dividend proposal of € 1.35 per share

The adidas AG Executive and Supervisory Boards will recommend

paying a dividend of € 1.35 to shareholders at the Annual General

Meeting (AGM) on May 8, 2013 (2011: € 1.00). Subject to the meeting’s

approval, the dividend will be paid on May 9, 2013. This represents an

increase of 35% compared to an increase of net income attributable to

shareholders, excluding goodwill impairment losses, of 29%. The total

payout of € 282 million (2011: € 209 million) reflects a payout ratio of

35.7% of net income attributable to shareholders, excluding goodwill

impairment losses, versus 34.1% in the prior year

/

TABLE 08. This is in

line with our dividend policy, where we intend to pay out between 20%

and 40% of net income attributable to shareholders.

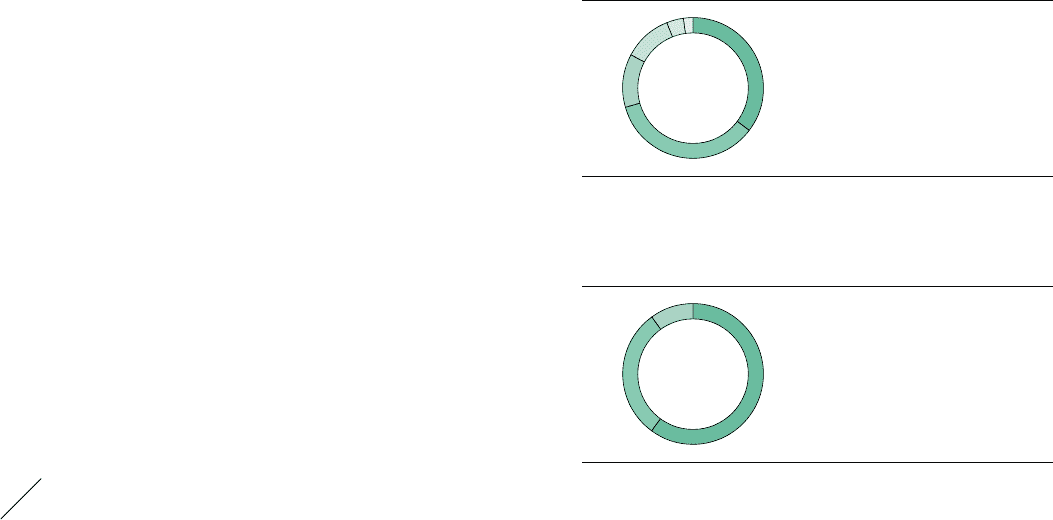

Strong international investor base

Based on our share register, we estimate that adidas AG currently

has around 52,000 shareholders. In our latest ownership analysis

conducted in February 2013, we identified around 90% of our shares

outstanding. Shareholdings in the North American market account for

36% of our total shares outstanding. Identified German institutional

investors hold 12% of shares outstanding. The shareholdings in the rest

of Europe excluding Germany amount to 35%, while 4% of institutional

shareholders were identified in other regions of the world. adidas Group

Management, which comprises current members of the Executive and

Supervisory Boards, holds 2% in total

/

SEE CORPORATE GOVERNANCE REPORT

INCLUDING THE DECLARATION ON CORPORATE GOVERNANCE, P. 51. Undisclosed

holdings, which also include private investors, account for the remaining

11%

/

DIAGRAM 06.

Voting rights notifications published

In 2012, adidas AG published 23 voting rights notifications in

accordance with §§ 21 section 1, 25 section 1 and 25a of the German

Securities Trading Act (Wertpapierhandelsgesetz – WpHG). All voting

rights notifications received in 2012 and thereafter can be viewed

on our corporate website :

//

WWW.ADIDAS-GROUP.COM/VOTING_RIGHTS_

NOTIFICATIONS. Information on reportable shareholdings that currently

exceed or fall below a certain threshold can also be found in the Notes

section of this Annual Report

/

SEE NOTE 26, P. 221.

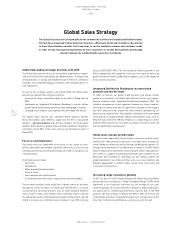

adidas AG share again receives strong analyst support

The adidas Group and the adidas AG share continued to receive strong

analyst support in 2012. Around 40 analysts from investment banks and

brokerage firms regularly published research reports on our Group. The

vast majority of analysts are confident about the medium- and long-term

potential of the Group. This is reflected in the recommendation split for

our share as at December 31, 2012. 60% of analysts recommended

investors to “buy” our share in their last publication during the twelve-

month period (2011: 71%). 30% advised to “hold” our share (2011:

24%). 10% of the analysts recommended to “sell” our share (2011:

5%)

/

DIAGRAM 07.